Crypto Market Liquidations Hit $870 Million as EU Escalates Trump Tariff War

Bitcoin BTC $92 939 24h volatility: 2.4% Market cap: $1.86 T Vol. 24h: $41.52 B and the broader cryptocurrency market faced another selling pressure soon after the EU-US trade war escalated further. The crypto market liquidations have soared to $870 million, with the EU preparing for another $100 billion in tariffs, dubbed as trade bazooka, amid Trump’s rising threats to annex Greenland.

Crypto Market Faces Strong Selling Pressure Again

The broader crypto market has once again come under strong selling pressure as Bitcoin failed to cross the $100K resistance last week. In the last 24 hours, BTC has crashed another 2.6%, moving to $92,550, thereby triggering a broader market-wide sell-off.

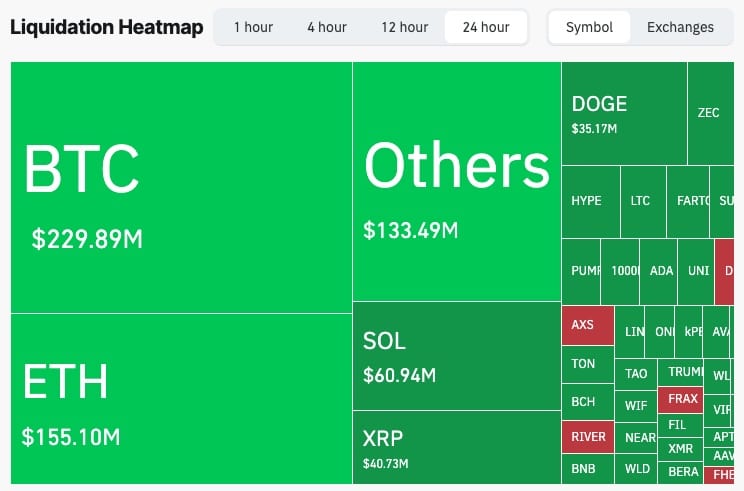

According to CoinGlass data, the overall crypto market liquidations have soared to $870 million. Of this, $788 million is in long liquidations, suggesting a bearish trader sentiment in the market.

Crypto Market Liquidation Heatmap | Source: CoinGlass

Furthermore, the postponement of the crypto market structure bill to the end of January has led to the sentiment turning bearish overall.

Whale Entities Sell Bitcoin in Coordinated Dump

Large Bitcoin outflows and selling activity were spotted across several major market participants. According to the on-chain data shared by popular market analyst Tracer, insiders sold 22,918 BTC, while Coinbase sold 2,417 BTC, Bybit 3,339 BTC, Binance 2,301 BTC, and Wintermute 4,191 BTC. In total, the claim suggests whales and exchanges sold more than $4 billion worth of BTC over the last hour.

With the EU looking to escalate the Trump tariff war over the US President’s bid to take over Greenland, global markets remain shaky. The European Union is reportedly preparing a retaliatory package of up to roughly $100 billion in tariffs, which will particularly target US companies.

This is the latest escalation from the European joint bloc after Trump threatened with an additional 10% tariff on European countries, starting Feb. 1, unless there’s a deal on purchasing Greenland. The Trump administration has made a $700 billion offer for this purchase.

Market participants noted that large-scale trade measures typically weigh on risk assets first, as investors price in weaker growth and rising uncertainty. As a result, Bitcoin and the overall crypto market are seeing some volatility today.

On the other hand, safe-haven assets like gold are gaining strength. Gold futures climbed to a fresh record high of $4,660 per ounce. At the same time, grey metal Silver soared past $94 per ounce.

nextThe post Crypto Market Liquidations Hit $870 Million as EU Escalates Trump Tariff War appeared first on Coinspeaker.

You May Also Like

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy

Ondo Finance launches USDY yieldcoin on Stellar network