Why Is XRP Price Falling Today?

- XRP faces decline as net outflows and market volatility continue.

- Technical indicators show XRP might be oversold, hinting at recovery.

- XRP’s price drop signals cautious market sentiment, raising investor concerns.

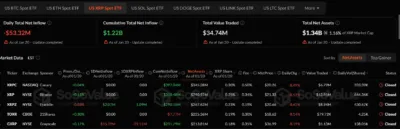

XRP’s price is facing a significant decline today, leading to a wave of concern among investors. As of January 20, the XRP spot ETF market saw a $53.32 million net outflow, signaling reduced investor confidence in the short term.

This daily drop contrasts sharply with its cumulative total net inflow of $1.22 billion, which highlights the strong overall interest in XRP, despite the daily setbacks. The total value traded today was recorded at $34.74 million, indicating active market participation despite current losses.

Several exchanges, including NASDAQ (Canary) and NYSE (Bitwise), have shown notable drops in XRP’s market performance. XRP on Bitwise saw a 8.53% decrease, closing at $21.33, while XRP on Canary also dropped 8.49%, ending at $20.26. These figures suggest that investor sentiment toward XRP is currently negative, which has contributed to the downturn in its price.

Source: Sosovalue

Also Read: U.S. Faces Urgency to Pass Crypto Market Structure Bill, Warns White House Advisor

What’s Behind XRP’s Struggles?

The technical outlook further highlights why XRP’s price is falling today. Trading at $1.9003, the cryptocurrency experienced a +0.68% uptick recently, but the overall market sentiment remains bearish. XRP’s price is positioned near the lower boundary of the Bollinger Bands, which range from 1.8632 to 2.2996, indicating potential volatility in the coming days.

Additionally, the Relative Strength Index (RSI) stands at 39.62, which places XRP in the oversold zone. This suggests that XRP could be undervalued at the moment, meaning there might be room for a bounce-back, depending on the market’s next move. For many traders, an RSI under 40 signals that the asset is nearing a price floor and could be due for a recovery.

Source: Tradingview

The overall market for XRP today remains in a volatile state, with negative movements seen across both the spot ETFs and trading charts. This sudden price drop could be a reaction to market forces, such as lower investor confidence or broader economic pressures affecting cryptocurrencies.

XRP’s price decline today can be attributed to several factors, from negative ETF inflows to the technical indicators suggesting an oversold condition. While the drop is significant, the long-term outlook for XRP remains uncertain, and only time will tell if it can regain its position or face further declines. Investors will continue to monitor the market closely to determine whether today’s losses are temporary or part of a broader trend.

Also Read: XRP/BTC Markets Set for Major Shift as Compression Tightens, Expert Predicts Bullish Move

The post Why Is XRP Price Falling Today? appeared first on 36Crypto.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise