Bitcoin Pro Traders Buy Dips, Expecting More Downside

Bitcoin has hovered under 91,000 as U.S. growth upholds a risk-on impulse, yet traders remain cautious about raising leveraged bets. Equities staged a rally on stronger-than-expected data, but appetite for aggressive long exposure in Bitcoin appears muted. The macro backdrop — resilient GDP, steady employment progress, and rising yields — complicates the path higher for BTC, with many market participants awaiting clearer signals before committing to sizeable leverage.

-

Bitcoin funding rates sit at 7%, showing bullish traders are still hesitant to increase leveraged positions.

-

The spot Bitcoin ETFs saw $1.58 billion in outflows while gold hit record highs, signaling a shift toward safe assets.

-

Options activity points to volatility-focused strategies, with traders favoring non-directional plays that imply accumulation rather than a sharp downturn.

-

Exchange and on-chain data reveal a mixed but cautiously constructive stance, with some bullish tilt among larger players despite a cautious macro tone.

Tickers mentioned: $BTC, $ETH, $COIN

Sentiment: Neutral

Price impact: Neutral. The current readings suggest limited near-term pressure from ETF flows or leverage shifts, keeping BTC in a narrow trading range.

Trading idea (Not Financial Advice): Hold. Market participants appear to be waiting for clearer signs of institutional inflows and macro catalysts before expanding long exposure.

Market context: A risk-off tilt toward gold and selective equities underscores a broader consolidation in BTC against a backdrop of resilient macro data.

Bitcoin (BTC) has been pinned below 91,000 since Tuesday, even as equity markets rallied on strong US economic growth and employment data. As BTC struggles to find bullish momentum, muted demand for leveraged long positions has led traders to question whether the 88,000 support level can hold much longer.

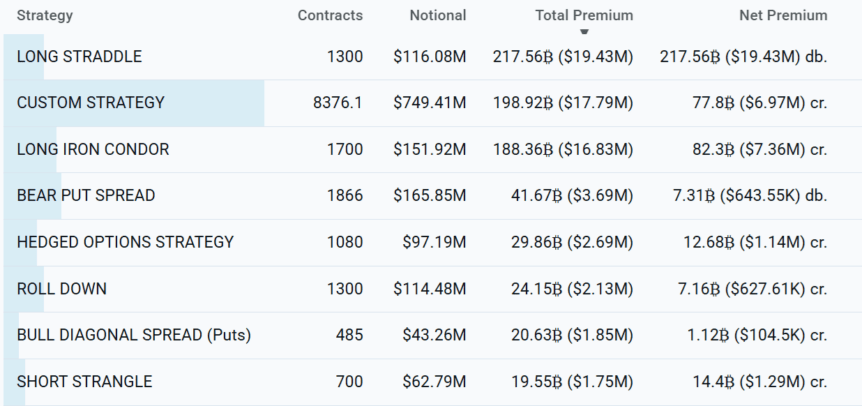

Top BTC option strategies at Deribit, 48h. Source: laevitas.chThe annualized funding rate for Bitcoin perpetual futures stood at 7% on Thursday, a recovery from Monday’s near-zero reading, but significant demand for bullish leverage remains absent from the market.

Bitcoin whales are expected to keep accumulating

The lack of optimism among Bitcoin traders stems partly from robust 4.4% third-quarter US GDP growth. A strong economy typically fuels earnings momentum, providing a tailwind for the stock market. Continuing jobless claims fell by 26,000 to 1.85 million for the week ending Jan. 10. Despite this, there has been no notable surge in demand for downside protection via BTC options.

Top BTC option strategies at Deribit, 48h. Source: laevitas.ch

Top BTC option strategies at Deribit, 48h. Source: laevitas.ch

According to data from Laevitas, the two most active BTC options strategies on Wednesday and Thursday were the long straddle and the long Iron Condor. Both strategies prioritize volatility over directional bets. This suggests that whales and market makers are anticipating a period of price accumulation rather than a deeper correction from the current 89,500 level.

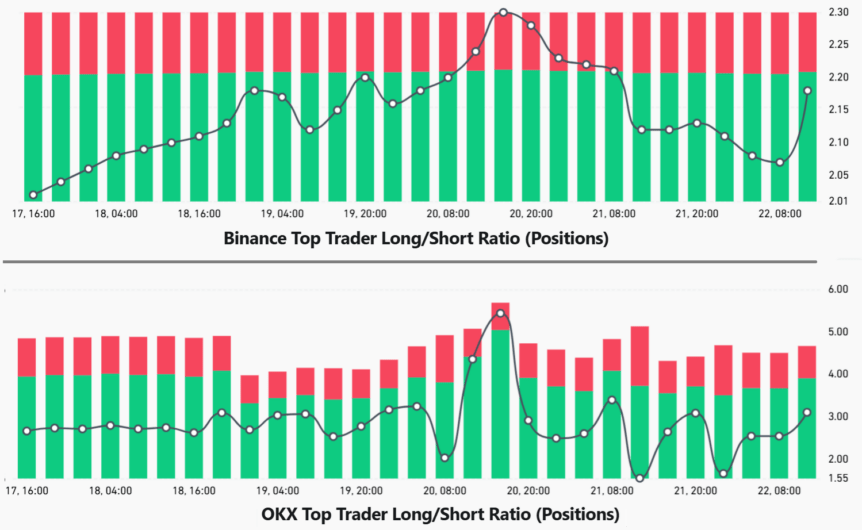

Top traders’ long-to-short ratio at Binance and OKX. Source: CoinGlass

Top traders’ long-to-short ratio at Binance and OKX. Source: CoinGlass

Top traders at Binance increased bullish exposure on Thursday, with the long-to-short ratio rising to 2.18 from 2.08. Similarly, the top 20% of users by margin on OKX boosted long positions on Thursday despite Bitcoin’s failure to reclaim 90,000. This on-chain data reinforces the view that traders remain neutral-to-bullish despite the current lack of appetite for high-leverage plays.

Market attention is now shifting toward corporate earnings. Microsoft (NASDAQ: MSFT), Tesla (NASDAQ: TSLA) are among the biggest names reporting next week, followed by Apple (NASDAQ: AAPL) and Visa (NYSE: V) on the subsequent days. Consumer demand will also be scrutinized as General Motors (NYSE: GM) and Starbucks (NASDAQ: SBUX) prepare their releases. Gold prices climbed to new highs as 10-year Treasury yields pressed higher, a sign of faltering confidence in ongoing fiscal stimulus and rising borrowing costs. The divergence between rising yields and precious metals suggests a growing concern that further stimulus could ignite inflationary pressures, complicating the demand outlook for risk assets like Bitcoin.

The bond market backdrop matters: the 10-year yield climbed to 4.25% on Thursday, up from 4.14% the prior week. Rising yields reduce the attractiveness of risk assets by increasing the opportunity cost of holding non-yielding exposure, yet Bitcoin’s derivatives market has shown resilience after the 88,000 retest. A sustained move toward 95,000 hinges on renewed institutional inflows, a development that has yet to materialize despite $1.58 billion in net outflows from spot Bitcoin ETFs over the past two days. As macro data continues to shape risk appetite, BTC remains in a cautious hold pattern, awaiting a clearer signal that institutions are prepared to re-enter with sizable capital.

This article was originally published as Bitcoin Pro Traders Buy Dips, Expecting More Downside on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

XRP Ledger Unlocks Permissioned Domains With 91% Validator Backing