Cardano $1 Dream vs Remittix $1 Reality: Could PayFi Redefine the 2026 Crypto Landscape?

Cryptocurrency markets are entering another period of close scrutiny as investors consider the long-term value of individual altcoins. Cardano continues to be a known entity in financial news cycles, as conversations arise about periods of volatility and changes in market sentiment.

Yet, emergent cryptocurrencies with working products are beginning to come to the forefront for cryptocurrency investors in the space. This particular element of remittance-focused digital currencies was exemplified by the $0.123 value of a PayFi-focused token, such as Remittix (RTX), which is beginning to make waves through delivery rather than speculation. This trend continues to raise important questions about the space as investors anticipate moves into 2026.

Cardano Price Pressure and Market Position

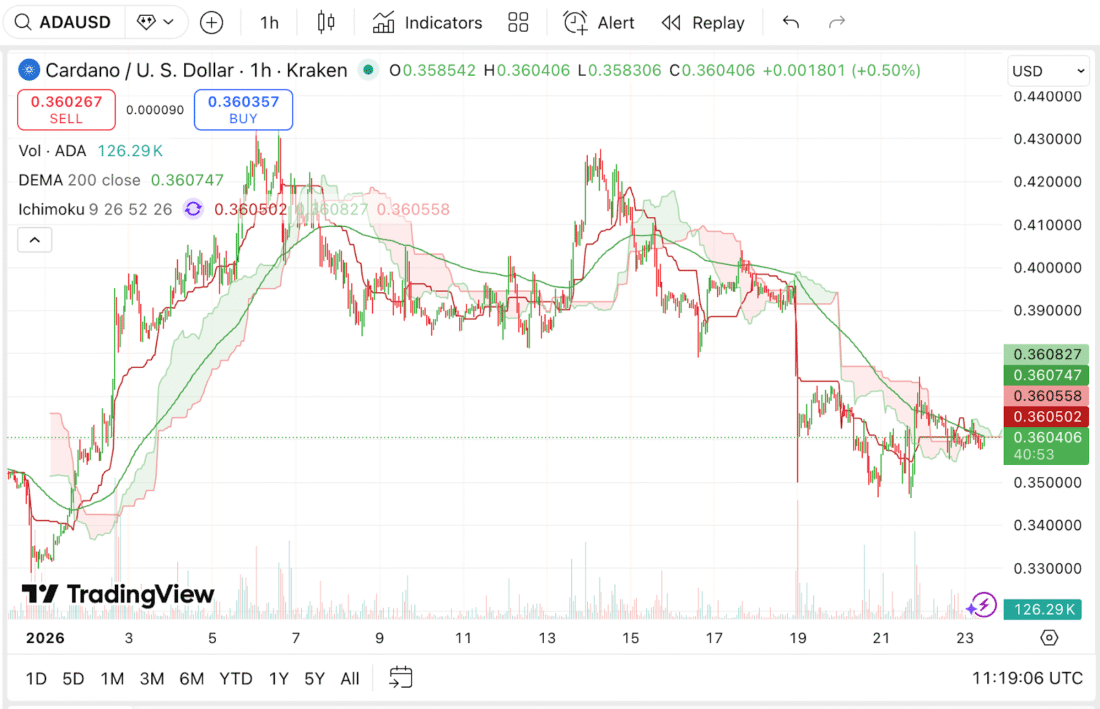

Cardano has been considered a research-driven blockchain technology project with a solid academic foundation. Today, the crypto asset is trading at $0.3597, down 1.47% in a day. The asset’s market capitalization has reached $12.96 billion; however, its trading volume has decreased to $399.97 million, down more than 43%.

From a crypto analysis perspective, Cardano still depends on slow growth in its ecosystem, smart contracts and decentralized applications developed on the Cardano network.

On-chain activity is still growing, yet the broader crypto space has experienced slower growth than other areas, such as the more prominent growth of DeFi and payment-focused platforms. As altcoins compete for attention in a crowded crypto market, Cardano’s $1 narrative remains tied to future development cycles and favorable crypto regulation rather than immediate catalysts.

Shifting Focus Toward Utility-Driven Altcoins

Across the board, crypto trends indicate an increasing orientation towards projects with clearly defined problems. Efficiency of payments, access to crypto-to-fiat conversions and simplified onboarding are now common themes in most crypto updates. It is, however, a factor that influences how investors define the best cryptocurrency to buy now, amid torn market sentiment and uncertainties about a future crypto bull run.

Consequently, capital rotation is increasingly evident toward platforms that combine blockchain technology with actual financial infrastructure. This environment allows newer altcoins to stand shoulder-to-shoulder with established names like Cardano without relying on their longstanding brand recognition.

Remittix PayFi Model and Product Progress

Remittix has positioned itself as a practical PayFi solution within the cryptocurrency sector. The project has raised over $28.8 million in private funding by selling more than 701 million tokens, while maintaining a current token price of $0.123. Unlike many early-stage altcoins, Remittix already operates a live wallet available on the Apple App Store, with a Google Play release in progress.

The platform is preparing for its full PayFi rollout on 9 February 2026, marking the launch of its crypto-to-fiat payment system. A key trust signal comes from Remittix being fully audited and team verified by CertiK, where it currently ranks number one among pre-launch tokens. Future centralized exchange listings have also been revealed, including BitMart and LBank, with additional announcements expected as milestones are reached.

Key factors supporting Remittix adoption include:

- Live wallet product with active community testing

- PayFi platform enabling crypto-to-fiat transfers inside one app

- CertiK audited smart contracts and verified the team

- Clear roadmap toward global payments infrastructure

- Focus on real transactions rather than speculative activity

Within crypto analysis circles, this places Remittix among projects often discussed when evaluating the best altcoin to buy now based on utility.

Cardano vs Real World Payment Demand

When comparing Cardano and Remittix, the difference lies in timelines. Cardano continues to build toward long-term scalability and broader relevance in decentralized finance. Remittix is targeting immediate payment friction, a segment tied directly to everyday crypto adoption. Both approaches matter, yet the market increasingly rewards delivered functionality over future potential.

As the crypto market matures, narratives alone carry less weight. Cardano remains an important blockchain technology project with a loyal base and deep research roots. Remittix represents a newer category of altcoins focused on execution and financial integration.

For investors evaluating digital assets ahead of 2026, the contrast between established ecosystems and PayFi-driven platforms may shape the next cycle of crypto trends.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Frequently Asked Questions

What is the best crypto to buy now for real-world use?

Many crypto investors look for projects with live products, audits and payment utility. Platforms focused on crypto-to-fiat services often stand out during periods of cautious market sentiment.

Can Cardano still reach wider adoption in the crypto market?

Cardano continues to develop its ecosystem and smart contract capabilities. Broader adoption depends on increased dApp usage, liquidity and sustained on-chain activity.

Which altcoins could benefit most from crypto adoption in 2026?

Altcoins tied to payments, DeFi access and simplified user experience are frequently mentioned in crypto news as adoption expands beyond trading alone.

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release

The post Cardano $1 Dream vs Remittix $1 Reality: Could PayFi Redefine the 2026 Crypto Landscape? appeared first on Live Bitcoin News.

You May Also Like

CME Group to launch Solana and XRP futures options in October

BlockchainFX or Based Eggman $GGs Presale: Which 2025 Crypto Presale Is Traders’ Top Pick?