Litecoin and ONDO Dethroned As Best Cryptos To Buy Now As RTX Nears 95% Sell Out

Litecoin and ONDO are both feeling the pressure. After strong runs earlier this month, both assets have slipped into corrective territory, forcing investors to reassess which names still belong in the discussion around the best cryptos to buy now.

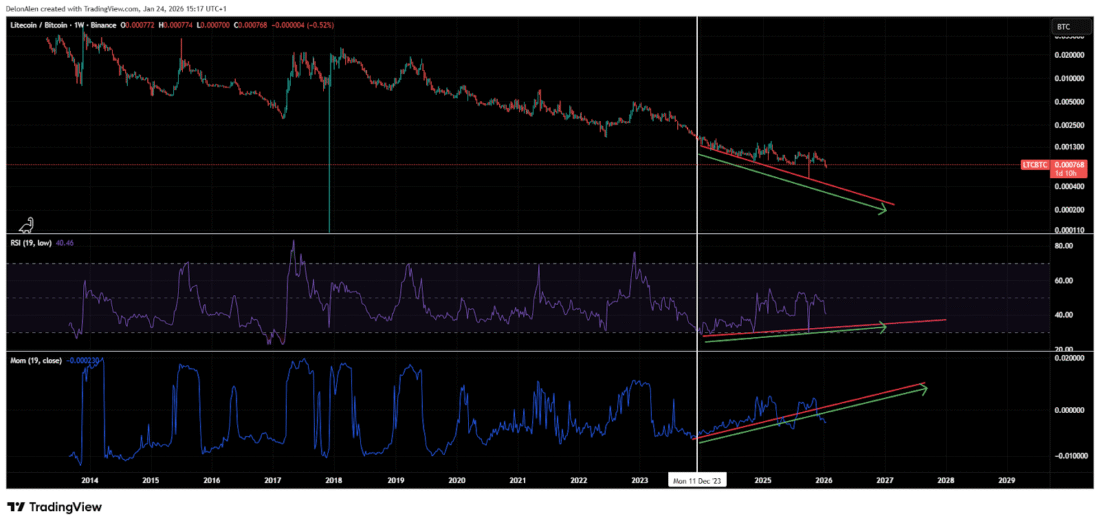

Litecoin Weakens as Key Support Gives Way

From a technical standpoint, Litecoin’s structure has deteriorated. A sequence of lower highs and lower lows since early January has replaced the earlier recovery narrative.

Source: LTCDeepDive

Volume has also dropped sharply, down more than 40% over the past 24 hours. While reduced volume can sometimes signal seller exhaustion, it also reflects fading conviction among buyers. Analysts now point to the $62 and $51 regions as potential areas of interest if downside pressure continues.

For many traders, Litecoin’s appeal has weakened as momentum cools and clearer opportunities emerge elsewhere.

ONDO Price Enters Cooling Phase After Narrative Run

The ONDO price action tells a different but equally familiar story. After benefiting from enthusiasm around tokenized real-world assets, ONDO surged quickly, leaving its price stretched relative to short-term demand.

Source: Finora AI on X

Recent sessions show a clear shift. Buying strength has tapered off, volumes are thinning, and follow-through has been limited. Rather than a sharp reversal, ONDO appears to be settling into a consolidation phase as early momentum traders step back.

From a technical perspective, revisiting prior support levels is not unusual after a strong move.

Remittix Draws Attention as Supply Tightens

As Litecoin and ONDO price actions soften, a different kind of altcoin is gaining ground. Remittix (RTX) has started to feature more prominently in trader conversations, not because of hype cycles, but because of execution and timing.

RTX is built around a straightforward use case: enabling crypto-to-fiat payments for individuals and businesses. Its wallet is already live on the Apple App Store, with Google Play support expected next, moving the project well beyond the planning stage.

What’s adding urgency now is supply. More than 700 million of the 750 million presale tokens have already been sold, putting RTX close to a 95% sell-out. With limited allocation remaining, investors who have been watching from the sidelines are beginning to feel the clock.

The project’s PayFi platform is scheduled to launch on 9 February 2026, providing a fixed milestone the market can anchor expectations around. Combined with a completed CertiK audit and team verification, Remittix is increasingly viewed as a delivery-focused alternative in a market growing tired of promises.

A Changing Definition of “Best Crypto to Buy Now”

The current rotation highlights a broader shift in how traders assess opportunity. Momentum alone is no longer enough. Sustainability, utility, and supply dynamics are playing a larger role in capital allocation.

Litecoin’s breakdown and ONDO price consolidation show how quickly sentiment can change. At the same time, projects like Remittix are benefiting from clear timelines, shrinking supply, and real products already in users’ hands.

As the altcoin market resets, the definition of the best crypto to buy now is evolving.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Frequently Asked Questions

- Why are Litecoin and ONDO losing momentum?

A: Litecoin failed to hold the $70 support, while ONDO is in a natural cooling phase after a rapid price run. Both are facing lower volumes and reduced buyer conviction.

- What makes Remittix stand out now?

A: Remittix has a live wallet, verified team, audited smart contracts, and a PayFi platform launching on 9 February 2026. Its token presale is nearly sold out, creating urgency for investors.

- How much of the Remittix presale has been sold?

Over 700 million of 750 million tokens are already sold (more than 93%) leaving only a limited supply.

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release

The post Litecoin and ONDO Dethroned As Best Cryptos To Buy Now As RTX Nears 95% Sell Out appeared first on Live Bitcoin News.

You May Also Like

Top NYC Book Publishing Companies

Sensorion Announces its Participation in the Association for Research in Otolaryngology ARO 49th Annual Midwinter Meeting