70% of Institutions Say Bitcoin is Undervalued Despite 30% Crash – Bitcoin About to Rally?

Most institutional investors remain bullish on Bitcoin despite brutal fourth-quarter volatility that erased nearly a third of the asset’s value from recent peaks.

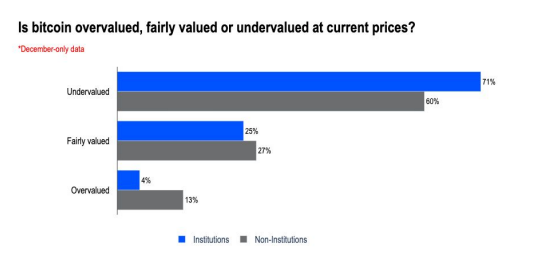

A new Coinbase Institutional and Glassnode survey found 70% of institutions view BTC as undervalued, even after the token dropped from above $125,000 in early October 2025 to trade around $90,000 by year-end, while 60% of non-institutional investors share that conviction.

Source: Coinbase Institutional

Source: Coinbase Institutional

The findings come from a quarterly poll of 148 global investors, split between 75 institutions and 73 non-institutions, conducted between December 10, 2025, and January 12, 2026.

Despite the October liquidation event that shook altcoin markets and compressed leverage across derivatives platforms, most respondents held or added to crypto positions rather than retreating.

Around 62% of institutions and 70% of non-institutions either maintained existing allocations or increased net long exposure since October.

Bearish Sentiment Rises, But Doesn’t Dominate Positioning

Perceptions of the market cycle shifted noticeably during the quarter.

Around 26% of institutions and 21% of non-institutions now believe crypto has entered the bear-market markdown phase, up sharply from just 2% and 7%, respectively, in the prior survey.

That shift exposes the weight of October’s deleveraging event, which saw the Altcoin Season Index plummet and mid-cap tokens struggle to recover their third-quarter gains despite the launch of several spot altcoin ETFs in the US.

Still, the uptick in bearish views did not translate into widespread selling. Most investors stuck with their positions, and sentiment toward Bitcoin specifically remained constructive.

“We have a constructive view for 1Q26,” Coinbase Global Head of Research David Duong wrote in the report. “We believe that crypto markets are entering 2026 in a healthier state, with excess leverage having been flushed from the system in Q4.“

Bitcoin dominance held relatively steady through the turbulence, rising only marginally from 58% to 59% over the quarter, a sign that institutional capital continued to favor the largest digital asset even as smaller tokens faced sustained selling pressure.

Open interest in BTC options overtook perpetual futures as market participants sought downside protection, with the 25-day put-call skew staying positive across 30-day, 90-day, and 180-day expiries.

Coinbase Survey Points to Macro Support and Policy Progress

Several factors underpinned the optimistic outlook. Inflation held steady at 2.7% in December’s Consumer Price Index reading, and the Atlanta Fed’s GDPNow model projected robust 5.3% real GDP growth for the fourth quarter as of January 14.

While the future direction of monetary policy remained uncertain, Duong said the firm still expects the Federal Reserve to deliver two rate cuts totaling 50 basis points currently priced into Fed funds futures, “which should provide a tailwind for risk assets broadly and crypto specifically.“

Questions about comprehensive crypto market structure legislation persist, but confidence in eventual regulatory clarity stayed firm.

“We’re confident that we will eventually see a set of rules that allows the industry to reach its full potential,” the report stated, noting that major policy progress in the US, particularly around the proposed CLARITY Act, could boost investor sentiment further.

Beyond the survey, separate data shows institutional engagement deepening across channels.

A recent Bitwise and VettaFi poll found 32% of financial advisors allocated to crypto in client accounts during 2025, up from 22% in 2024, with registered investment advisors leading at 42%.

Similarly, a separate Coinbase survey found that younger US investors now allocate 25% of their portfolios to non-traditional assets, compared with 8% among older cohorts.

Risks Remain, But Long-Term Trajectory Holds

The Coinbase report acknowledged headwinds. While the economy appears solid, the jobs market cooled in 2025, with the US adding just 584,000 positions, down from 2 million in 2024, partly due to increased AI adoption.

Geopolitical tensions have flared in several regions, and any escalation that disrupts energy markets could dampen investor appetite.

“A meaningful uptick in inflation, a spike in energy prices, or a significant flare up of geopolitical tensions could warrant a more cautious approach to risk assets,” the report warned.

Still, onchain metrics improved after October’s shakeout. Bitcoin supply moved within three months, surged 37% in the fourth quarter, while coins unmoved for over a year fell 2%, indicating short-term distribution that likely cleared weaker hands.

Ethereum’s Net Unrealized Profit/Loss ratio swung sharply through 2025, hitting capitulation in the first quarter, then rising to optimism in the third quarter, and settling back into fear territory by year-end.

Despite recent ETF outflows totaling $1.62 billion over four trading days and Bitcoin slipping below $90,000, institutional conviction appears durable. As Duong put it, “crypto markets are entering 2026 in a healthier state.”

You May Also Like

What Are the Latest Trends in Coinbase Clone Script Development?

Forward Industries Bets Big on Solana With $4B Capital Plan