Senate Postpones Vital Crypto Market Structure Markup Due to Snow – New Date Confirmed

A winter storm in Washington, D.C., has compelled the senators to delay the first markup vote on comprehensive digital asset market structure legislation.

The Senate Agriculture Committee confirmed on Monday that it had postponed its scheduled Tuesday markup of the Digital Commodity Intermediaries Act because of dangerous weather conditions across the capital.

The committee staff cited unsafe travel conditions, noting that much of Washington is covered by snow and ice amid dangerously low temperatures caused by a major winter storm.

Flights Canceled, Roads Icy as Senate Crypto Markup Slips

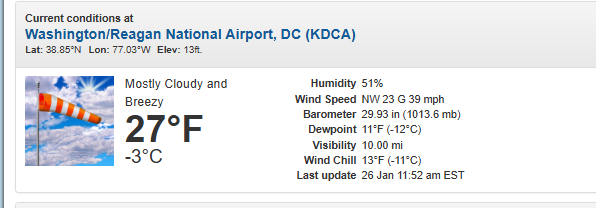

The weekend was topped off by an arctic cold snap and heavy snowfall, with wind chills dropping down to below zero and daytime temperatures struggling to reach the mid-20s Fahrenheit.

Source: National Weather Service

Source: National Weather Service

The snowy sidewalks and the icy roads, along with the high winds, led to the closure of federal offices on Monday, with a snow emergency being declared in the city, which limited the movement of vehicles on major routes.

People were also greatly affected in air travel, with thousands of flights being cancelled across the country and major delays at Reagan National Airport as airlines and airports cleared backlogs.

Schools and universities in the area of Washington, Maryland, and Virginia went to closures or remote education, and legislators had restricted mobility as crews proceeded with snow removal.

The weather scramble created a new obstacle of a long legislative procedure that has already experienced a series of postponements.

The Agriculture Committee markup is paid close attention to, as it is the first occasion that the Senate formally votes on and amends a crypto market structure bill.

The panel oversees the Commodity Futures Trading Commission, and the legislation would expand the agency’s authority over digital commodities such as Bitcoin.

The bill is the product of months of negotiations led by Committee Chair John Boozman, with contributions from Senator Cory Booker, though bipartisan agreement has proven difficult.

Agriculture Committee Emerges as Key Path for Crypto Legislation

The way ahead was unclear even before the weather delay, as the Senate Banking Committee, which has jurisdiction over the Securities and Exchange Commission, has consistently put off its parallel bill, the CLARITY Act.

That effort was derailed earlier this month after Coinbase withdrew its support, citing concerns over restrictions on tokenized equities, stablecoin rewards, and the balance of power between regulators.

Banking Committee leaders have since pivoted to housing legislation following President Donald Trump’s push to prioritize affordability, pushing crypto legislation into late February or March.

The delay in the Banking Committee has increased pressure on the Agriculture Committee’s bill, which now represents the most immediate legislative vehicle for crypto market structure reform.

However, last week, the Senate Agriculture Committee, led by Republicans, released its bill text, but it seemingly lacked Democratic support.

The Agriculture Committee’s bill differs from the Banking Committee’s approach on several key issues, including stablecoins and token classification.

While the CLARITY Act explicitly restricts interest-like rewards for holding payment stablecoins, the Agriculture Committee’s proposal largely sidesteps yield rules by excluding permitted payment stablecoins from CFTC oversight, deferring those questions to other frameworks such as the GENIUS Act.

The bill also explicitly places meme coins under CFTC jurisdiction, a move not mirrored in the Banking Committee’s draft.

The legislation has drawn increasing political attention as President Trump said last week that he expects to sign a crypto market structure bill “very soon,” framing digital assets as a strategic priority for maintaining U.S. competitiveness.

You May Also Like

eurosecurity.net Expands Cryptocurrency Asset Recovery Capabilities Amid Rising Investor Losses

Ethereum to boost scalability and roll out Fusaka upgrade on Dec 3