U.S. Spot AVAX ETF Records Zero Inflows as Investor Caution Grows

This article was first published on The Bit Journal.

The launch of the first U.S. spot AVAX ETF has drawn attention to the fragile state of the crypto market in early 2026. Investor sentiment remains weak across digital assets.

Altcoins have been hit harder than Bitcoin. The AVAX ETF debut reflected this reality, as trading activity and inflows failed to meet expectations.

AVAX ETF Sees Zero Inflows as Risk Aversion Dominates Markets

VanEck’s spot AVAX ETF recorded zero inflows on its first trading day. Total trading volume reached only $330,000. The figures stood out for their weakness.

Other recent altcoin ETFs saw much stronger demand at launch. Market participants viewed the AVAX ETF debut as a clear signal of ongoing risk aversion.

Also Read: AVAX Price Prediction: Can Avalanche Hold $30 and Rally to $50?

The crypto market entered 2026 under heavy pressure. Price volatility remained high. Liquidity stayed thin for many assets. Investors continued to favor caution over speculation.

In this environment, the AVAX ETF struggled to attract interest despite regulatory approval and institutional backing.

AVAX ETF Highlights Market Sentiment

The AVAX ETF launch coincided with extreme fear across the altcoin market. Avalanche’s Fear and Greed Index dropped to 20 during the debut.

This reading signaled deep pessimism. The index later recovered slightly to 29. Sentiment, however, remained firmly negative. The ETF introduction did little to change trader behavior.

Comparison With Other Altcoin ETFs

Recent history shows a sharp contrast. Bitwise’s Solana ETF launched during a market downturn. It still attracted $69 million in inflows and $58 million in trading volume. Canary Capital’s spot XRP ETF recorded $245 million on its first day.

Grayscale’s Chainlink ETF pulled in $41 million. Against these benchmarks, the AVAX ETF debut appeared subdued.

Analyst Views on Altcoin ETFs

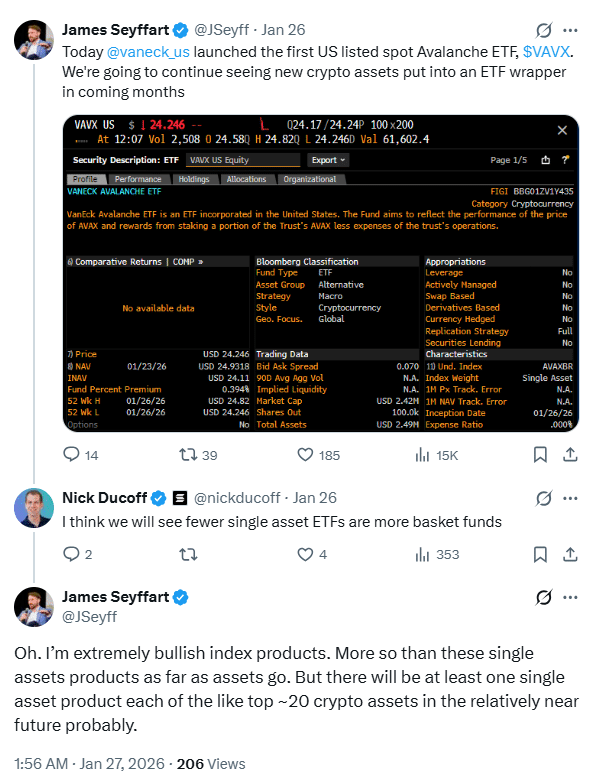

Bloomberg analyst James Seyffart weighed in on the trend. He said that many top crypto assets are likely to see ETF products over time.

He added that index-based ETFs may gain stronger traction than single-asset funds. His comments suggested that the AVAX ETF may face structural demand challenges.

Source: X

Source: X

Futures Market Shows Weak Appetite

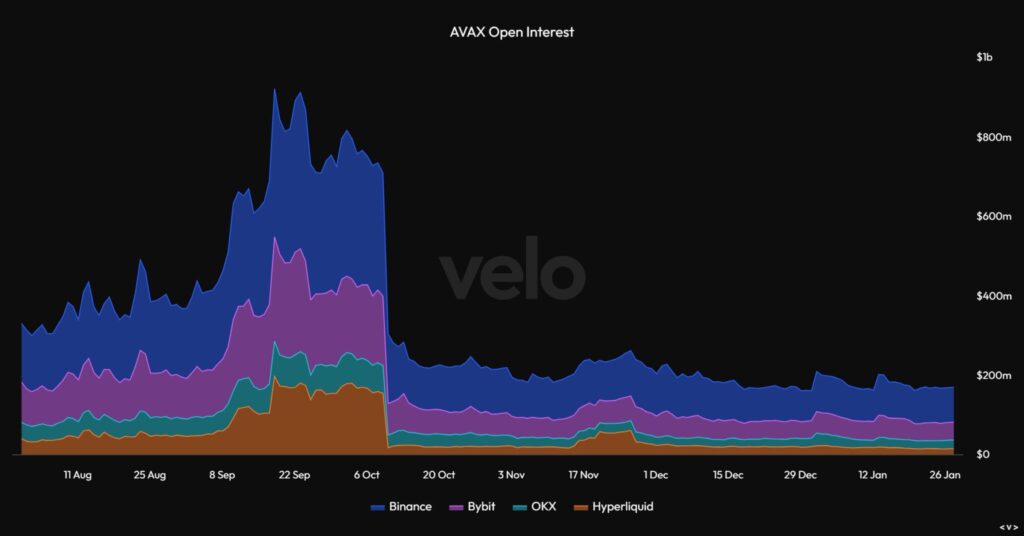

Derivatives data supported the cautious outlook as Avalanche futures’ Open Interest collapsed after the October market crash. It fell from nearly $1 billion to below $200 million.

The figure remained flat for months. This trend showed limited speculative interest. The AVAX ETF launch failed to revive futures activity.

Source: Velo

Source: Velo

Price Action Remains Constrained

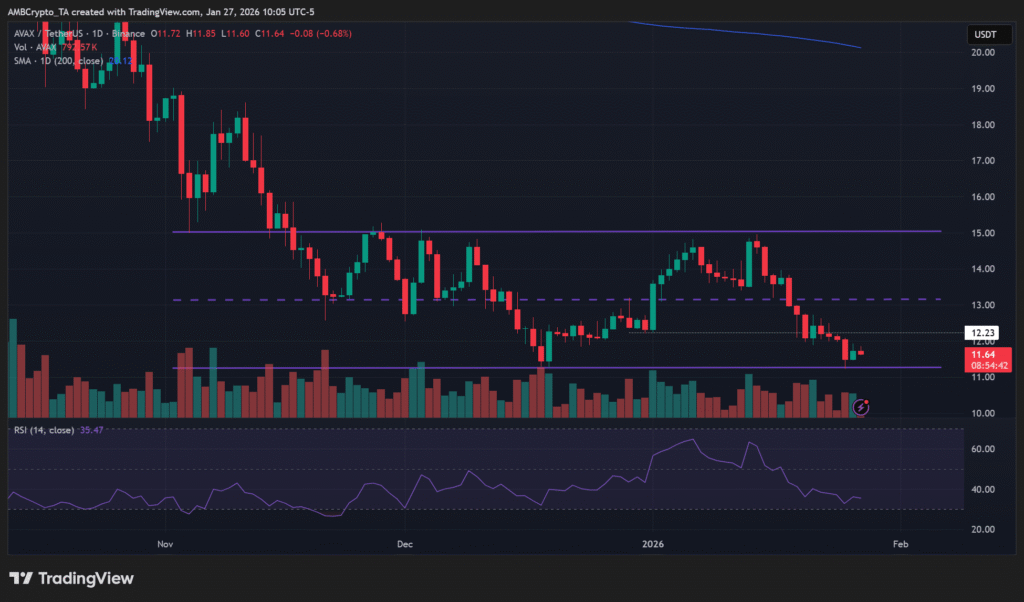

Avalanche’s price response remained muted. AVAX gained about 2% following the ETF news. The move lacked follow-through. Price continued to trade within the $11 to $15 range seen in late 2025.

| Month | Min. Price | Avg. Price | Max. Price | Change |

|---|---|---|---|---|

| Feb 2026 | $ 12.04 | $ 12.44 | $ 13.18 |

9.66%

|

| Mar 2026 | $ 12.35 | $ 13.05 | $ 14.27 |

18.69%

|

| Apr 2026 | $ 12.17 | $ 13.51 | $ 14.83 |

23.36%

|

| May 2026 | $ 15.00 | $ 16.44 | $ 18.97 |

57.82%

|

| Jun 2026 | $ 19.67 | $ 26.03 | $ 29.15 |

142.46%

|

| Jul 2026 | $ 26.48 | $ 27.93 | $ 30.74 |

155.66%

|

| Aug 2026 | $ 32.54 | $ 39.06 | $ 41.73 |

247.10%

|

| Sep 2026 | $ 32.06 | $ 35.92 | $ 41.08 |

241.68%

|

| Oct 2026 | $ 31.70 | $ 35.01 | $ 38.24 |

218.07%

|

| Nov 2026 | $ 33.06 | $ 34.59 | $ 36.60 |

204.40%

|

| Dec 2026 | $ 32.55 | $ 36.72 | $ 41.18 |

242.57%

|

The muted reaction raised concerns among traders. If AVAX breaks below the established range, losses could accelerate.

A sustained move under $11 would increase the risk of a dip below $10. Persistent bearish sentiment could reinforce that outcome. The AVAX ETF did not provide near-term price support.

Source: TradingView

Source: TradingView

Signs of Stabilization Emerge

Not all indicators remained negative. CryptoQuant data pointed to cooling market conditions. Large whale orders appeared on both spot and futures markets.

Buy-side dominance was also observed. These signals suggested accumulation rather than distribution. They hinted at a potential shift beneath the surface.

Derivatives Data Shows Gradual Improvement

CoinGlass data showed a steady rise in futures Open Interest. Avalanche OI reached $494.08 million on Wednesday. It was up from $437.49 million on January 21.

Rising Open Interest often reflects new capital entering the market. This trend may support a short-term recovery despite ETF weakness.

Technical Indicators Support Recovery Case

From a technical perspective, AVAX showed early signs of stabilization. Price retested support near $11.28 and bounced nearly 6%. It later traded around $12.06.

A move toward $13.38 remains possible. That level aligns with the 50-day EMA. A close above it could open the path to $15.06.

The Relative Strength Index stood at 41. It pointed upward toward the neutral level. This suggested fading bearish momentum. The MACD lines also moved closer together. Red histogram bars continued to weaken. These signals supported the recovery thesis.

Source: TradingView

Source: TradingView

Conclusion

The AVAX ETF launch highlighted how altcoins are struggling for stability in a risk-off market. Sheer investors’ wariness was evident in the absence of new inflows and thin volume. Though the regulatory advances continue to matter, they have not been sufficient to create demand.

Yet, enhancing derivatives data and technical signals indicate that Avalanche may be stabilizing. In the weeks ahead, they will determine whether confidence can be restored.

Also Read: $1B AVAX Treasury Planned as AVAT Prepares Nasdaq Listing in 2026

Appendix: Key Terms Glossary

Spot ETF: An ETF that reflects the actual market price of an asset.

Volume: Quantity of a financial instrument that changed hands in a particular period.

Net InflowsIt’s the net amount of money coming into an investment product, after withdrawals.

Risk-Off: Market condition where investors shun high-risk assets.

Open Interest (OI): The total number of futures contracts that exist in the marketplace.

Relative Strength Index (RSI): An indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

Exponential Moving Average (EMA): A moving average that gives more weight to recent price data.

Frequently Asked Questions About AVAX ETF

1- What is the AVAX ETF?

The AVAX ETF is a U.S.-listed spot exchange-traded fund that tracks the price of Avalanche’s native token.

2- Why did the AVAX ETF see low demand?

Negative market sentiment and weak risk appetite for altcoins limited investor participation.

3- How does the AVAX ETF compare to other ETFs?

Unlike the AVAX ETF, recent Solana, XRP, and Chainlink ETFs saw strong inflows at launch.

4- Did the AVAX ETF impact AVAX price?

The AVAX ETF had limited short-term impact, with price remaining range-bound.

References

AMB Crypto

FXStreet

Read More: U.S. Spot AVAX ETF Records Zero Inflows as Investor Caution Grows">U.S. Spot AVAX ETF Records Zero Inflows as Investor Caution Grows

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

SHIB Price Analysis for February 8