XRP Price: Testing $1.50 Support as ETF Outflows Hit Two-Week Streak

TLDR

- XRP briefly dropped to $1.50 on Saturday, its lowest level since November 2024, before recovering above $1.60

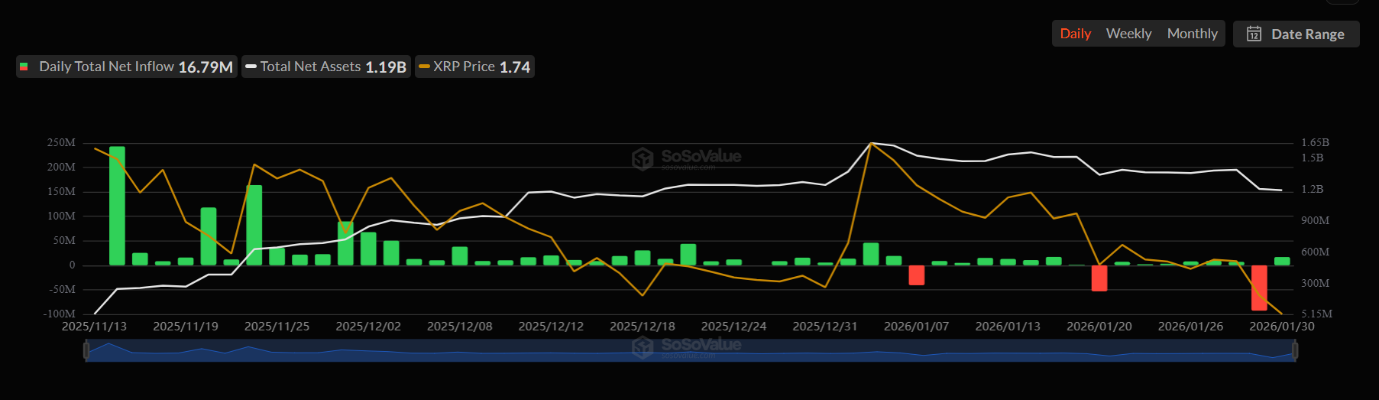

- US XRP-spot ETFs recorded $52.26 million in net outflows for the week ending January 30, driven by Grayscale’s GXRP ETF

- Technical analyst identified potential bullish signal in XRP/BTC pairing despite bearish dollar performance

- Market Structure Bill advanced in Senate Agriculture Committee but faces challenges in Banking Committee over stablecoin yield provisions

- White House scheduled meeting on February 2 between crypto firms and banking representatives to address legislative sticking points

XRP dropped to $1.50 on Saturday, marking its lowest price point since November 2024. The token has since recovered to trade above $1.60.

XRP Price

XRP Price

The decline occurred during a broader cryptocurrency market selloff that affected all major digital assets. XRP faced selling pressure alongside the wider market downturn.

Technical analyst CryptoWZRD noted that while XRP closed bearish against the dollar, the XRP/BTC pairing showed a “dragonfly doji” candlestick pattern. This formation is typically viewed as a bullish indicator.

Analyst EGRAG CRYPTO suggested Saturday’s sharp decline could represent a liquidity grab that might trigger an immediate bounce. The analyst outlined a scenario where historical patterns could lead to a potential rally of up to 1,600% in coming months, similar to price action seen after a comparable structure in the 2017 cycle.

ETF Flows Show Mixed Signals

The US XRP-spot ETF market saw $52.26 million in net outflows for the week ending January 30. This followed the previous week’s $40.64 million in outflows, which had ended a 10-week inflow streak.

Source: SoSoValue

Source: SoSoValue

Grayscale’s XRP ETF (GXRP) accounted for $98.39 million in net outflows on January 29. GXRP has been responsible for two out of three total net outflow days for the US XRP-spot ETF market.

Despite weekly outflows, the US XRP-spot ETF market has recorded total net inflows of $1.18 billion since trading began in November 2025. In January, US XRP-spot ETFs saw net inflows of $15.59 million.

The US BTC-spot ETF market reported total net outflows of $4.3 billion since US XRP-spot ETFs launched. In January alone, the BTC-spot ETF market experienced net outflows of $1.61 billion.

Legislative Developments Create Uncertainty

The US Senate Agriculture Committee advanced its draft text of the Market Structure Bill this week. However, the advancement lacked bipartisan support as no Democratic Committee members voted to advance the markup.

The US Senate Banking Committee must now release an updated draft text and schedule a markup vote. In January, the Banking Committee postponed its markup vote after Coinbase withdrew support for the Market Structure Bill.

Coinbase CEO Brian Armstrong cited the draft text’s stance on stablecoin yields as a key reason for withdrawing support.

US banks oppose stablecoins offering yields while the crypto market pushes for rewards for stablecoin holders. The Banking Committee’s draft text faces hurdles in finding common ground between these positions.

The White House scheduled a meeting for February 2 between crypto firms and banking representatives. The session will include senior policy executives from Coinbase, crypto trade groups, and banking associations. Major bank CEOs and Coinbase CEO Armstrong will not attend.

Crypto journalist Eleanor Terrett stated the meeting is “intentionally not a C-suite meeting” and is meant to be a working session to facilitate dialogue on key issues.

Bank of America CEO Brian Moynihan previously warned that more than $6 trillion in deposits could move from the US banking system to stablecoins if crypto legislation permitted stablecoin rewards.

XRP closed Saturday’s trading session at $1.6454, down 3.98% for the day. The token held its close above $1.60, swept liquidity near $1.64, and opened February at $1.66.

The post XRP Price: Testing $1.50 Support as ETF Outflows Hit Two-Week Streak appeared first on CoinCentral.

You May Also Like

XRP Price Prediction: XRP Risks Drop Toward $0.65 After Support Break, While Long-Term Fundamentals Stay Intact

‘More Orange’: Saylor Sends Buy Signal as Bitcoin Nosedives and Leverage Flushes