$304 Million in Hype Unlocked This Week: 4 Unlocks to Keep an Eye on in February

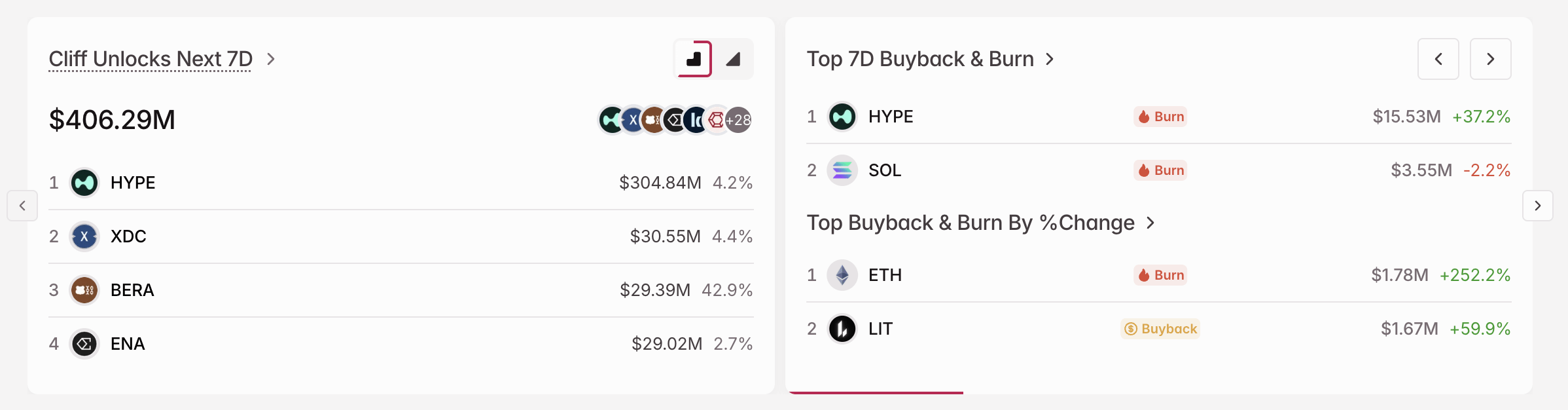

- In the first week of February, over $400 million in new supply will hit the market in token unlocks, with HYPE accounting for over 75% of the new supply.

- Overall, tokens worth $3.17 billion will enter the market this month from both emissions and unlocks, with Bitcoin mining generating $838 million.

It’s a new month, and a new wave of token unlocks is set to hit the market over the next four weeks that could impact prices at a time when the market is tanking.

In February, over $3 billion in new supply will flood the market across linear and cliff unlocks, as well as scheduled emissions. This week will see the biggest release of new tokens, with $992 million entering the market at current prices, data from Tokenomist shows.

The biggest unlock in February will be by leading decentralized exchange Hyperliquid. The perpetual futures trading platform will release 4.2% of the circulating supply of HYPE tokens on February 6, worth $304 million at current prices. While it’s the largest unlock by dollar value, it’s not this month’s largest unlock by share of circulating supply.

Image courtesy of Tokenomist.

Image courtesy of Tokenomist.

It will be the third of 25 token unlocks for the token, which launched in November 2024 and has since then gone on to command a $9.51 billion market cap, the 12th largest on the market. Its token generation event released $1 billion worth of tokens, and last November, its first unlock released 2.66% of the circulating supply, worth $346 million. Last month, another 3.6% ($331 million) hit the market, and on Friday, 2.79% will be released. All the tokens released have gone to the core contributors.

Despite the new supply, HYPE has been one of the best performing tokens at a time of heightened uncertainty in the crypto market. In the past week, the token has surged over 40%, making it the best performer among the top 100 tokens.

At press time, it trades at $31.3, trading sideways in the past day amid a 12% dip in trading volume.

Berachain Unlocks 43% in February as Bitcoin Emits $840 Million

While HYPE’s unlock is the biggest this month by market value, a few other networks will release a higher percentage of the circulating supply. Berachain leads in this category. The layer 1 network, which is anchored on proof-of-liquidity and focuses on decentralized finance, will release 42.9% of its circulating supply in February, worth $29.4 million at current prices.

Berachain’s BERA token has lost 7.8% in the past day, bringing its total dip in the past week to 29.2% for a $66 million market cap. BERA dipped to $0.435 earlier today, its lowest price ever, and the influx in BERA tokens at a time when the price is struggling could wreck its market.

The XDC Network and Ethena are the other notable projects releasing tokens this month. The former will release 4.4% of the XDC circulating supply later this week, worth $30.7 million. XDC currently trades at $0.03514, dipping 11% in the past week.

Ethena will release 2.67% of the circulating supply of its governance token, ENA, worth $29.74 million.

Beyond unlocks, some of the biggest crypto projects will record sizable emissions this month as part of the programmed token release schedule. The largest is Bitcoin, whose miners will generate 0.05% of the token’s circulating supply, worth $837 million. Rainmaker Games will release 11.12% of RAIN tokens, valued at $368 million, while Solana‘s 0.33% unlock will add $185 million in SOL tokens.

BTC continues to dip, trading at $75,390, shedding 4% overnight as the broader market continued to bleed. In the past five days, the crypto market cap has dipped by over $500 billion to settle at $2.55 trillion at press time, with liquidity crunches across the entire global capital market disproportionately affecting risk-on assets like crypto and tech stocks.

]]>You May Also Like

Young Republicans were more proud to be American under Obama than under Trump: data analyst

Vitalik Buterin Outlines Ethereum’s AI Framework, Pushes Back Against Solana’s Acceleration Thesis