A quick look at the AI pet game The Farm: Will AI agents bring new gameplay to blockchain games?

Author: Zen, PANews

Although the blockchain game track has attracted much attention from capital and the market, its gameplay and mode are highly homogenized and lack real innovative breakthroughs. However, with the rise of AI agent technology, the blockchain game industry may have ushered in a new opportunity for change. In this wave, The Farm attempts to create an unprecedented immersive game world through deep integration with AI Agent, and redefine the way players interact with the virtual ecosystem.

In addition to the innovation at the conceptual level, The Farm, which fits the current hot spots in the industry, has also received initial recognition from the market. Its current market value has reached US$75 million, and on January 3 it even rose by nearly 50%.

The Farm: GenAI-powered AI agent game

The Farm is the first GenAI-driven AI agent game based on Hyperliquid, which combines on-chain creature generation (similar to CryptoKitties 2.0), business simulation (such as "Stardew Valley") and battle mechanism (such as "Pokémon Go"), and uses AI to help realize a new experience of player creation and interaction. The game drives the economic ecology through $FARM tokens and gradually unfolds with multi-stage gameplay.

Game Design and Features

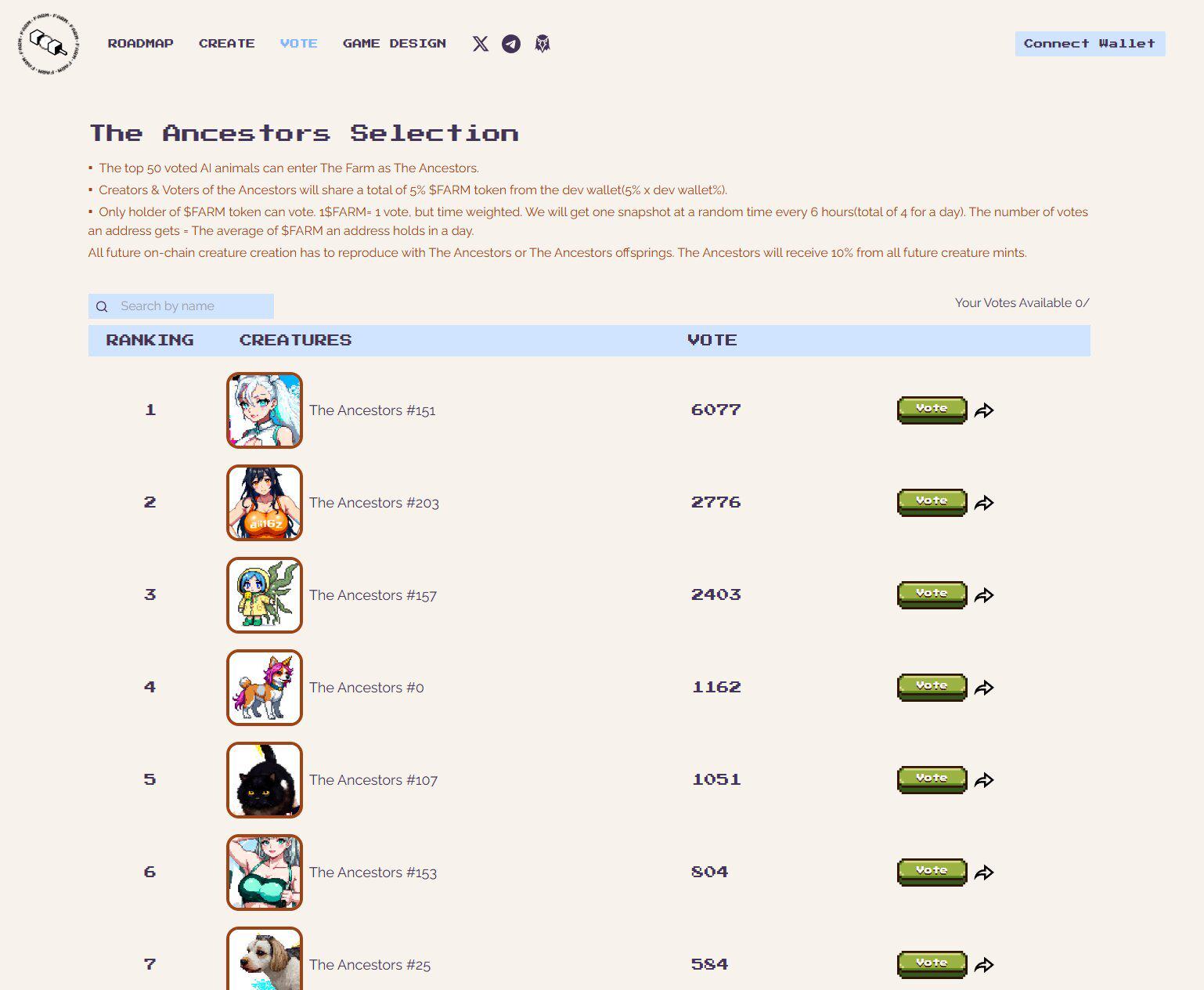

Phase 1: The Ancestors

This phase went live on December 13, 2024 and ended a week after launch. During this period, players can upload two photos to generate pixel-style hybrid creatures created by the GenAI model for free. After spending 100 USDC to cast their favorite creatures, they will participate in the vote, and the top 50 creatures in the voting results will become "ancestors". "Ancestors" will receive 10% of all future creature casting revenue. Ancestors and their creators and voters will also receive airdrop rewards from the developer wallet.

Stage 2: Evolution

This phase begins immediately after the ancestor selection ends on December 20, and its features will continue to roll out. All creatures are given characteristics, attributes, skills, personalities, favorite foods, etc., all of which are generated by AI. Creatures will be given personalities, on-chain wallets, and support text and voice conversations. These creatures can learn AI skills such as tarot divination and drawing fortunes. Players can train creatures by uploading data, and buy food or sign up for courses to improve their attributes. In addition, creatures will gradually unlock autonomous agent behaviors.

Phase 3: The Battlefield

According to The Farm roadmap, this phase is scheduled to be launched in mid-February 2025. Creatures can participate in battles independently or in guilds formed by players. The battle mode supports betting, and the winner will win the loser's bet reward, and the loser's creatures may perish as a result. In this phase, the interaction and competition dimensions of creatures will be further expanded.

System Design of The Farm

According to an article published by The Farm introducing its system design, the game did not adopt the more mainstream SWARM system, but was based on and inherited the design concept of Langchain.

SWARM (cluster) has its autonomy, decentralization and flexibility. Each AI agent acts as an independent node in the SWARM pool, and its notable feature is emergent behavior, which leads to dynamic propagation in task management. That is, tasks are processed in a decentralized and adaptive interactive way, and agents discover and collaborate to complete tasks based on local decisions and interactive dynamics.

When a request is sent to an AI agent in the SWARM pool, the agent either completes the request independently and returns the result, or breaks down the request into subtasks, processes part of it, and then passes the remaining subtasks to other AI agents in the SWARM pool for processing. In the second case, since the agent cannot obtain a global view of the capabilities of all agents in the SWARM pool, its dynamic propagation methods may include broadcasting subtasks, forwarding based on local knowledge, assigning subtasks randomly or based on simple rules, and reading agent capability information from decentralized ledgers. Although these dynamic propagation methods give the SWARM system agents autonomy, due to the lack of task planning and trajectory planning mechanisms, there may be defects such as time-consuming, high cost, and loss of execution status.

As an agent game that will involve multiple agent interactions, Farm has proposed another complete design concept to achieve higher task planning accuracy and better agent coordination. Farm believes that the on-chain multi-agent system should have higher task trajectory planning accuracy and should track the status of agent execution, which can be achieved through the data availability layer (DA).

Unlike the SWARM system, Farm introduces Orchestrator AI or on-chain AI Oracle services. The functions of this design concept include: task decomposition and allocation, service discovery and global view, subtask execution status and agent output result tracking, and dynamic adjustment to ensure the integrity of the task cycle (if an agent cannot handle a task or times out, the system will reallocate the subtask). Through a global view and optimal path planning, it avoids redundant calculations and resource waste caused by dynamic propagation, and greatly improves the execution efficiency and success rate of complex tasks. This approach also reduces the risk of state loss and provides a basis for collaboration between agents, enabling multi-agent networks to achieve a higher degree of interoperability.

Token model: Half of the protocol revenue is used for FARM repurchase and destruction

Starting from an AI agent game based on generative artificial intelligence (GenAI), The Farm initially plans to attract users through on-chain creature generation (similar to CryptoKitties 2.0) combined with simulation business gameplay (such as "Stardew Valley") and battle mechanisms (such as "Pokémon Go"), and gradually expand to a general AI agent launch platform, and eventually provide Rollup as a service functions, so that AI agents can have their own application chains and develop their ecosystems.

In terms of revenue mechanism, the game part of The Farm uses $FARM tokens for on-chain creature generation, in-game item and skill sales, and battle/betting commissions. The general AI agent launch platform supports agents to issue their tokens and collect fees through pre-sales and liquidity launch phases, while taking commissions from agent services.

For agents who support the application chain, they need to start the application chain by staking $FARM. 50% of the protocol income is used for $FARM repurchase and destruction, 40% is allocated to $FARM stakers, and 10% is allocated to the team. In addition, $FARM stakers can obtain $veFARM to share income and proxy priority configuration, realizing the continuous accumulation of token value.

By introducing AI agents, The Farm aims to enhance the experience of open world game players exploring the unknown world and growing. Players can create characters that can continuously evolve according to their personal preferences, rather than being limited to a few fixed templates. The game world no longer has a preset script, and all players' creativity will jointly shape the world. In addition, the characters can interact with real people, breaking the boundary between virtual and reality.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models