Hong Kong Set to Approve First Stablecoin Licenses in March — Who’s In?

The Hong Kong financial regulator (HKMA) is about to approve the first license for a stablecoin issuer in March, as shown by a report by Reuters.

The development occurs following a period of regulatory review and the unveiling of one of the most comprehensive stablecoin frameworks in the world, which came into force in August last year.

At a Legislative Council meeting on Monday, Hong Kong Monetary Authority chief executive Eddie Yue said that the review process is almost finished, adding that only a very small number of applicants will be approved at first.

Yue added that assessments are focusing on core areas such as stablecoin use cases, reserve backing, risk management, and anti-money laundering controls.

Hong Kong’s Stablecoin Era Begins Slowly as Regulators Tighten the Bar

As of early February, no stablecoin issuer has yet been approved under Hong Kong’s new regime.

The HKMA has indicated that it is assessing 36 applications in the first round, though the wider industry interest had more than 40 prospective applicants at one point.

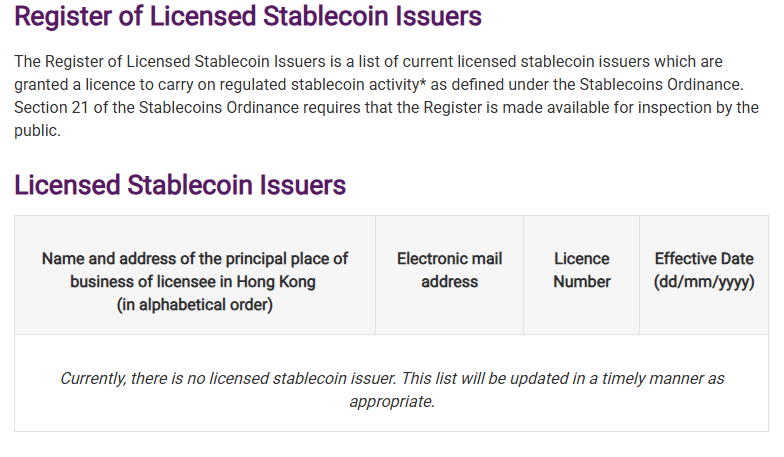

The regulator has so far been cautious and in July 2025 introduced a public registry to monitor licensed issuers, but the registry is currently empty.

Source: HKMA

Source: HKMA

The licensing regime implemented in August covers all issuers of fiat-referenced stablecoins in Hong Kong, as well as foreign issuers of tokens pegged to the Hong Kong dollar.

The rules permit licensed issuers to issue, administer, and redeem stablecoins, as long as they have full 1:1 reserve support of high-quality, liquid assets under trust arrangements with approved custodians.

Issuers must honor redemption requests at par value within one business day and are prohibited from paying interest to stablecoin holders.

Governance and compliance are also given great focus by the regime.

According to the rules, issuers should be locally incorporated or authorized organizations that have strong internal controls and have boards that have independent directors with specific compliance functions.

They must perform due diligence of customers, adopt the use of wallets, and adhere to anti-money laundering and counter-terrorist financing requirements.

HKMA has a wide range of supervisory authority and can add further terms to the license, introduce managers, or cancel the license in case of breach of requirements.

Hong Kong Sandbox Draws Banks, Tech Giants, and Web3 Firms

A number of high-profile companies have already become the major participants by applying to the regulatory sandbox of the HKMA.

These include a joint venture between Standard Chartered’s Hong Kong arm, Animoca Brands, and telecoms provider HKT, operating under the name Anchorpoint Financial.

Ant Group’s digital technology unit has confirmed it is pursuing a license, while Bank of China Hong Kong has been reported as an applicant.

HSBC and ICBC also signaled their intention to apply last year, although the HKMA has not confirmed the identities of any applicants and has warned that early approvals should not be seen as endorsements of specific business models.

The stablecoin rollout sits within a broader regulatory and strategic push by Hong Kong to develop a full digital asset stack.

The city already operates a licensing regime for virtual asset trading platforms under the Securities and Futures Commission, with 11 exchanges approved so far, including OSL, HashKey, and Bullish.

Government officials have repeatedly framed stablecoins as infrastructure rather than speculative products.

At the World Economic Forum in Davos in January, Financial Secretary Paul Chan said Hong Kong’s approach to crypto regulation is intended to be “responsible and sustainable,” describing digital finance as a strategic growth pillar for the city.

At the same time, industry groups have cautioned that rising compliance costs could slow institutional participation if rules become overly restrictive.

You May Also Like

Telos Advisers Welcomes Stephen Gardner as a Strategic Advisory Board Member

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon