Is HBAR Price Finding a Floor Despite Market Weakness?

The post Is HBAR Price Finding a Floor Despite Market Weakness? appeared first on Coinpedia Fintech News

HBAR price is trading near $0.09418 as bearish pressure continues across the broader altcoin market. Despite the drawdown, on-chain signals tied to development activity and real-world asset focus suggest Hedera is retaining underlying demand, offering context for why the HBAR price has avoided a deeper unwind so far.

HBAR Price Finds Support Amid Persistent Market Pressure

At the surface level, HBAR crypto appears to be moving with the market’s broader risk-off tone. Selling pressure has persisted, and price has yet to establish a decisive recovery trend. However, unlike many comparable altcoins, HBAR price USD has spent more time consolidating than accelerating lower.

This relative stability stands out. While price momentum remains cautious, the absence of aggressive capitulation hints that sellers are meeting steady demand, particularly near established support zones.

Meanwhile, market participation metrics suggest interest has not meaningfully deteriorated, even as price continues to grind lower.

Development Activity Offers Structural Support

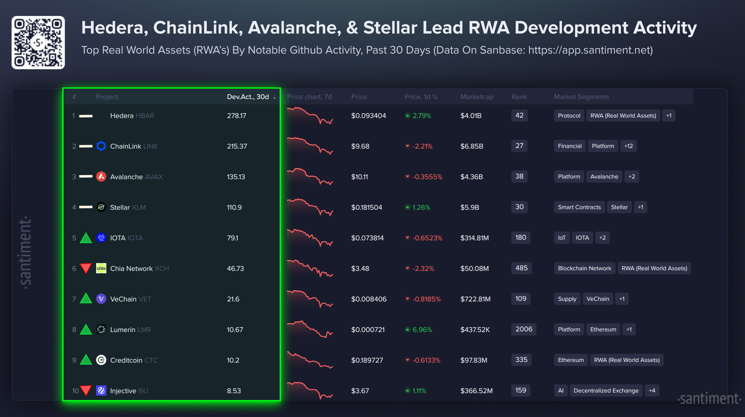

One of the clearest differentiators for Hedera remains its ecosystem activity. Santiment data tracking the top ten real-world asset-focused networks by 30-day GitHub development activity places Hedera near the top of the list. This positioning highlights sustained engineering momentum rather than short-term narrative cycles.

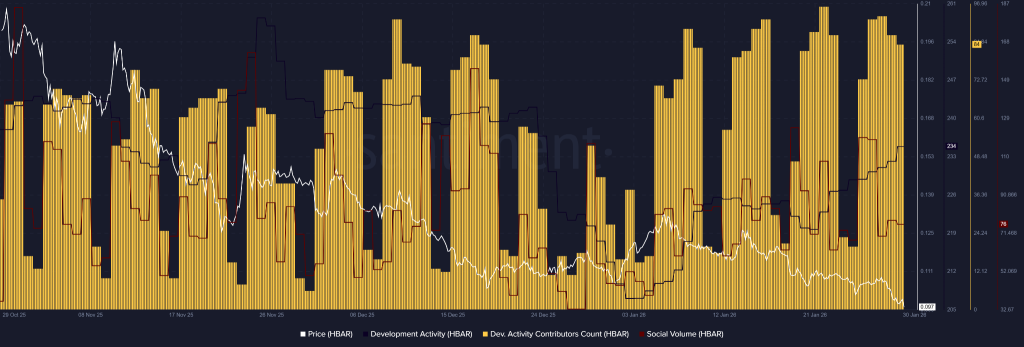

At the same time, Santiment data reinforces this view. Since January, Hedera’s development activity has remained elevated, recently registering around 234. Notably, this strength has persisted even as price declined, signaling a disconnect between market valuation and underlying network work.

Social volume has also increased over the same period. Still, unlike speculative spikes, this rise has occurred alongside falling prices, suggesting discussion has leaned analytical rather than euphoric.

Enterprise Narrative Continues to Anchor Hedera

From a structural perspective, Hedera’s enterprise-first design continues to define its appeal. The network’s governance model, low transaction costs, and fast finality are tailored to regulated use cases, particularly in financial and real-world asset contexts.

Ongoing upgrades and collaborations with large institutions also reinforce this positioning. That backdrop helps explain why HBAR price has shown resilience during periods when speculative demand across altcoins has faded.

Rather than chasing momentum, Hedera crypto appears to be retaining relevance through utility-driven participation.

HBAR Price Chart Signals Compression, Not Capitulation

From a technical perspective, on the daily timeframe, the HBAR price chart still reflects an overall downtrend, marked by lower highs and lower lows. Beyond the existing downtrend, early February’s recent price action adds nuance, as HBAR/USD dipped to near $0.0840 before rebounding, suggesting demand is emerging near support.

This bounce doesn’t come from just any level; in fact, it closely aligns with the lower boundary of a falling wedge pattern. While the pattern often works but still has a chance of failing, this support still fuels some hope, as it introduces the possibility of stabilization rather than the continuation of decline.

If HBAR price reverses from the wedge’s lower edge, resistance comes into focus around $0.108–$0.110, depending on broader market conditions.

Conversely, a sustained move below $0.088 would expose the $0.083–$0.085 zone, with $0.078 acting as the next area of potential demand if weakness deepens. In this context, HBAR price continues to trade at a technical crossroads shaped by both structure and fundamentals.

You May Also Like

Tom Lee’s BitMine Hits 7-Month Stock Low as Ethereum Paper Losses Reach $8 Billion

Crypto-Fueled Rekt Drinks Sells 1 Millionth Can Amid MoonPay Collab