Crypto Market Crash: Bitcoin Price Loses $75,000, Altcoins Struggle to Find Bottom

Key Insights:

- Crypto market liquidations have shot to $5 billion in less than a week, amid a crash across asset classes like Gold, commodities, US equities, etc.

- Bitcoin price selling pressure has triggered a 16% downside over the past month, in a poor start to 2026.

- Ethereum has fallen more than 23% over the past week, with major altcoins posting steep losses.

The broader crypto market is facing yet another crash, with over $672 million in liquidations in the last 24 hours. The dominoes are falling as crypto, Gold, S&P 500, and every other asset class are dropping. Bitcoin price volatility has also shot up, with BTC taking a dive under $75,000, thereby leaving investors rattled.

Crypto Market Crash Triggers $736 Million Liquidation

The broader crypto market is facing yet another $736 million in liquidations amid Bitcoin and altcoin crashes. Over the last four trading sessions, the total crypto liquidations have shot past $5 billion. This marks the largest wave of liquidations since October 2025.

Earlier today, the Bitcoin price crashed under $75,000, while Ethereum (ETH) dropped under $2,200. ETH and other top altcoins like BNB, XRP, and Solana (SOL) have extended their weekly losses by 15-23% on the weekly chart.

This massive selling pressure is visible across different asset classes as of now. US equity futures extended losses, with Nasdaq 100 futures down about 1.1%. On the other hand, spot gold fell below $4,600 per ounce. Over the past three trading sessions, the yellow metal has dropped 17-18%, losing over $1,100.

According to Coinglass data, the 24-hour crypto market liquidations stand at $743 million. Of this, $572 million is in long liquidations, with nearly 200K traders liquidated so far. Analysts at The Kobeissi Letter stated that sharp selloffs have been a recurring feature of the crypto market.

They added that during sucha period of downturn, a narrative about the “end of crypto” has picked up. The commentary argued that, in hindsight, previous crashes have ultimately faded into minor long-term setbacks.

Crypto market drawdowns | | source: The Kobeissi Letter

Crypto market drawdowns | | source: The Kobeissi Letter

The analysts added that the current 2025–2026 bear market is likely to follow a similar pattern. However, this could mark the bottom, while increasing the chances of a greater upside ahead.

Bitcoin Price Sees Rough January, What’s Ahead?

Bitcoin and the broader crypto market had a rough start to the year 2026. Over the past month, Bitcoin price tanked over 16%. Some market analysts have been weighing a potential further crash to $50,000.

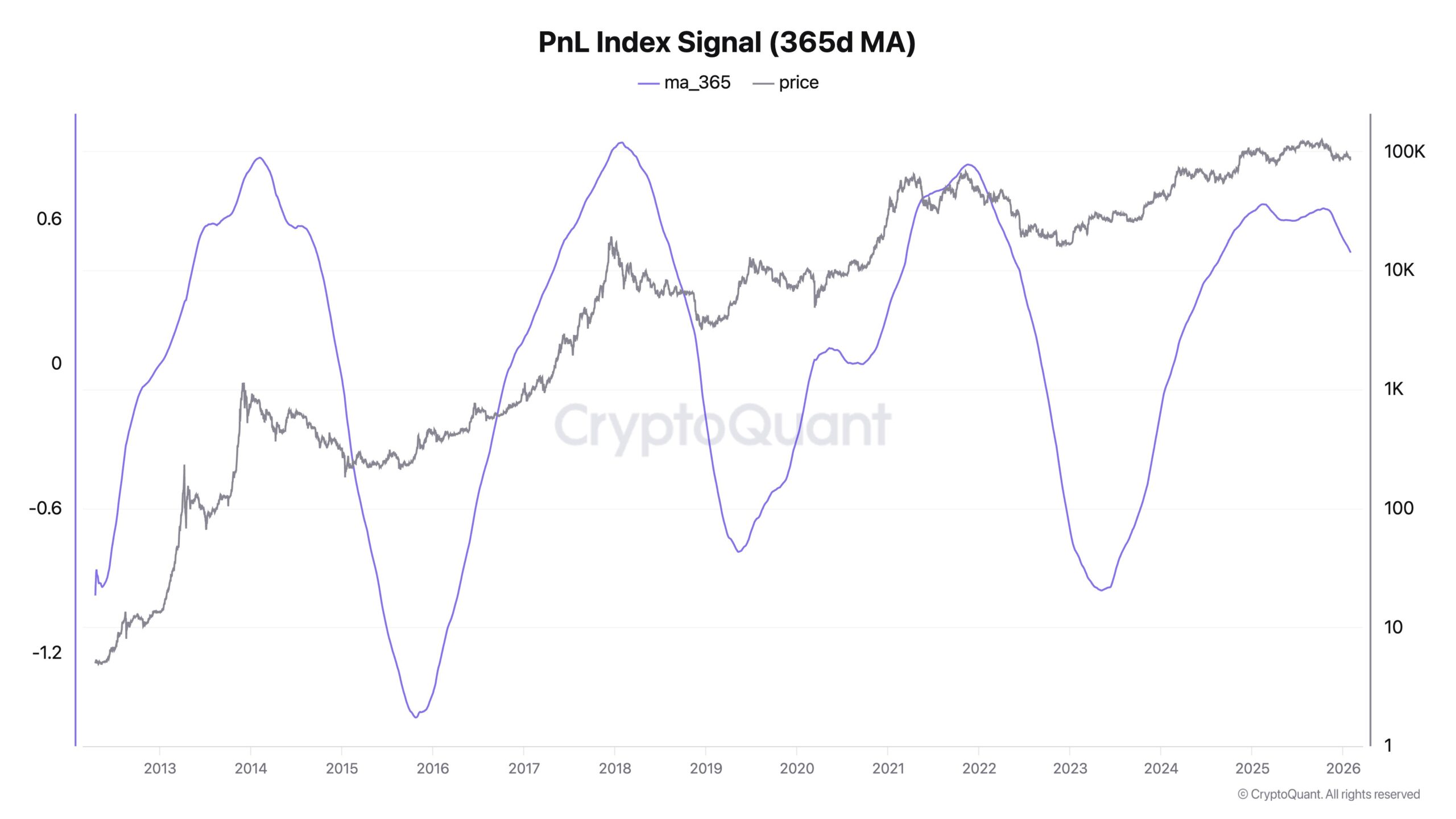

CryptoQuant CEO Ki Young Ju said Bitcoin is continuing to decline as selling pressure remains high, with new capital flows stalling. In a market update, Ki said Bitcoin’s realized capitalization has flatlined. This signals a lack of fresh capital entering the market.

Ju also pointed out to the major profit-booking by very early Bitcoin accumulators and whales. Those holders, he said, have been taking profits since early last year. Now that new inflows are fading, the selling pressure has become more visible.

Bitcoin Selling pressure surges | Source: CryptoQuant

Bitcoin Selling pressure surges | Source: CryptoQuant

Ki described MicroStrategy as a major driver of the latest rally. He added that unless Michael Saylor were to significantly reduce the company’s Bitcoin holdings. Thus, a sharp 70% drawdown similar to prior cycles is unlikely.

Ethereum Leads Altcoins Crash

Ethereum price has faced major selling pressure, crashing 23% over the past week, and slipping under $2,200 on Feb. 1. In the last 24 hours, the ETH price is down 9.32%, marking one of the biggest drawdowns. Other altcoins like BNB, Solana (SOL), XRP, and DOGE are also down by 5-6% on average in the last 24 hours.

JAVON MARKS on Twitter / X

JAVON MARKS on Twitter / X

The chart for altcoins-to-BTC ratio is currently showing a falling wedge pattern. However, crypto analyst Javon Marks is bullish that a breakout from the pattern could lead to a 2017-like bull rally.

The post Crypto Market Crash: Bitcoin Price Loses $75,000, Altcoins Struggle to Find Bottom appeared first on The Market Periodical.

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

CME Group to launch options on XRP and SOL futures