Epstein Tracked Bitcoin’s Rise, Funded Early Infrastructure, Files Show

During the initial years of the cryptocurrency industry, Jeffrey Epstein had interesting connections with cryptocurrency creators, investors, and projects.

These connections were revealed in the recently released Epstein files, which were made public on January 30.

The latest trove of Epstein files reveal a range of conversations, including philosophical musings, financial strategies, and interactions with key players in Bitcoin's meteoric development.

The Department of Justice (DOJ) has released an astounding 3.5 million pages of papers as a result of the Epstein Files Transparency Act. These documents shed light on how Epstein maintained a clandestine network of influence even after his 2008 sentence.

His 2016 endeavors to arrange a deal between a new Middle Eastern currency and the "founders of Bitcoin" are among the most peculiar revelations.

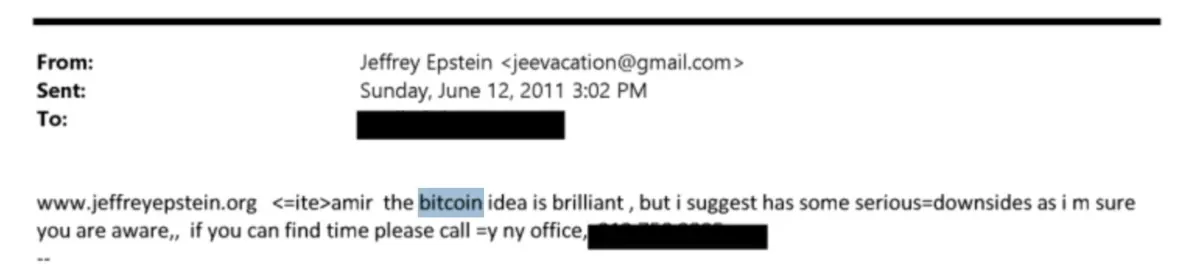

Epstein foresaw Bitcoin's potential as far back as 2011.

While Bitcoin's price surged beyond $30 and then crashed 90% that year, the total trading volume for the cryptocurrency did not exceed $100 million.

In 2013, he was provided with a briefing that evaluated the potential opportunities that Bitcoin presents as a means of trade. Around the middle of that year, when Bitcoin peaked to a record high, Eptstein in an email said, "Bitcoin is a brilliant idea, but it also has some serious drawbacks." That remark became part of a broader discussion.

The files show that Epstein was keeping a close eye on Bitcoin's potential before it was famous or got into mainstream mechanism.

Venture capitalist Peter Thiel and Epstein engaged in a lengthy conversation about the notion of Bitcoin in July 2014. According to a discussion from 2014, Epstein played a crucial role in providing the initial funding for Blockstream, a significant player behind Bitcoin infrastructure.

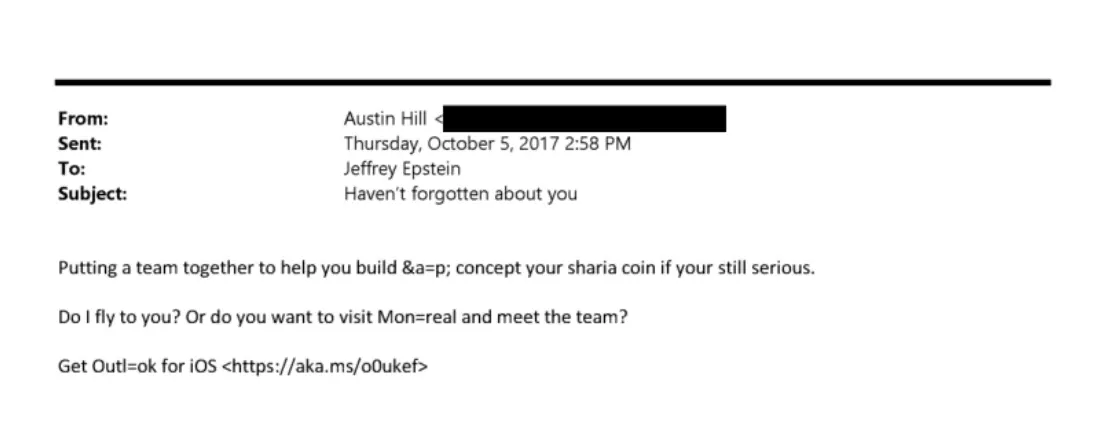

In 2016, Epstein approached a Saudi royal advisor with a unique proposal for the creation of two digital currencies; one of these would be a "sharia" cryptocurrency targeted at Muslim nations.

With reference to the “Sharia Coin," in an email, he wrote, “I have spoken to some of the founders of Bitcoin who are very excited.”

Emails dated October 2016 were located in "Data Set 9"— a section of the DOJ dump.

Epstein used these communications to court wealthy Saudis and other high-ranking investors with a financial idea. Similar to the US dollar but modified to reflect Islamic religious principles, with the words "In God We Trust," was proposed.

But the technology behind it was the shocking discovery.

Epstein claimed to have been in touch with the "founders of Bitcoin," who were quite supportive of the idea, and he suggested a blockchain-based digital version of this coin.

Also, the question of who exactly is Satoshi Nakamoto has been brought up again in response to Epstein's mention of "founders." Crypto advocates have long speculated that Bitcoin may not have sprung from a single individual but rather a group.

Even if Epstein's emails don't prove anything, they show that he was trying to position himself as a go-between for the anonymous creators of the biggest cryptocurrency in the world.

The conversations over the years show that Epstein knew his stuff when it came to the ideological arguments regarding Bitcoin.

But he was not convinced enough to invest in crypto.

Someone asked Epstein, in an email dated August 31, 2017, "Is purchasing a Bitcoin a wise decision?"

"No," was the short response from Epstein.

Despite his initial interest, this suggests he remained skeptical of Bitcoin's value as an asset even at its peak that year.

In the world of crypto, Epstein was hardly a mysterious person. But the paperwork shows he was more involved in the early Bitcoin community than was previously thought.

He kept tabs on conversations, helped fund infrastructure projects, and connected with people who are now considered industry heavyweights.

Being nearby frequently means making a big splash in the world of bitcoin. That is why these discoveries are so important. But importantly, the investigation has not found any indication in Epstein's paperwork of digital wallets, blockchain operations, or cryptocurrency-related offenses.

The DOJ has said that while many parts of the release are still up for debate, they have not found any proof that Epstein laundered funds or evaded scrutiny using Bitcoin.

He appears to be mostly involved in the cryptocurrency space as a relationship broker, occasional player, and curious spectator.

Blockcast – Licensed to Shill: What's in Store for 2026 – Stablecoins, the Future of DeFi.. and a Return of NFTs?

Licensed to Shill opens 2026 with a forward-looking conversation on the forces shaping the next phase of digital assets. Real-world assets, prediction markets, NFTs beyond the hype cycle, and the role of SMEs in pushing practical adoption all feature as the panel weighs what’s likely to matter – and what’s likely to fade – in 2026.

Thanks for tuning in! If you enjoyed this episode, please like and subscribe to Blockcast on your favorite podcast platforms like Spotify and Apple.

Be at the heart of TradFi–DeFi collaboration at Money20/20 Asia 2026.

Are you looking to forge partnerships with banks and fintechs? To expand into new markets across Asia, or to secure funding from top-tier investors? This April, the world of digital assets, blockchain, and Web3 converges with the biggest players in APAC’s financial ecosystem at Money20/20 Asia 2026 and its brand new ‘Intersection’ zone, complete with a dedicated content stage, TradFi-Defi innovator showcase, and curated networking spaces. From traditional banking giants to decentralised innovators, private equity leaders, and cutting-edge fintech disruptors, this is where they meet to forge partnerships, spark dialogue, and shape the future of finance.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

While Shiba Inu and Turbo Chase Price, 63% APY Staking Puts APEMARS at the Forefront of the Best Meme Coin Presale 2026 – Stage 6 Ends in 3 Days!