Daily Market Update: Stock Futures and Bitcoin Climb Higher after Monday’s Crash

TLDR

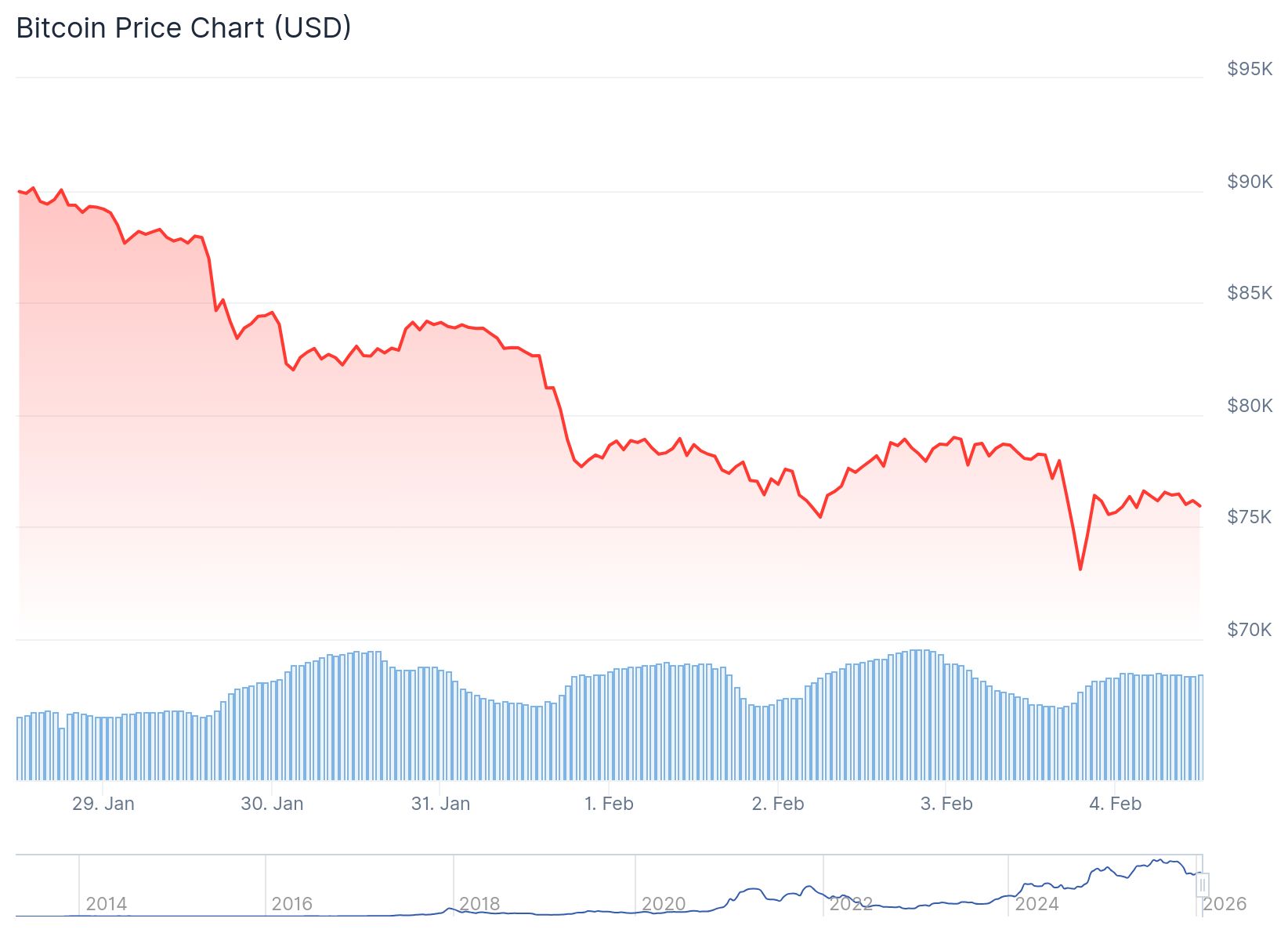

- Bitcoin recovered to $78,000 with a 5% gain from Monday’s lows while total cryptocurrency market capitalization increased 1.7% to $2.65 trillion

- Global crypto investment products experienced $1.7 billion in outflows last week, marking the second consecutive week of heavy withdrawals from Bitcoin funds

- Stock futures showed mixed signals with S&P 500 contracts steady and Nasdaq 100 futures down 0.1% after technology stocks declined more than 2%

- Long-term Bitcoin holders entered unrealized losses, a bearish signal that historically precedes market bottoms according to CryptoQuant data

- AMD dropped 7% and Chipotle fell 7% in after-hours trading on disappointing guidance and traffic warnings

Cryptocurrency markets stabilized on Wednesday following intense volatility earlier in the week. Bitcoin traded above $78,000 during Asian and European sessions, representing a 5% increase from Monday’s lowest levels. The broader crypto market capitalization climbed 1.7% to approximately $2.65 trillion.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The rebound came after sharp price swings driven by thin liquidity and heavy liquidations. Buyers stepped in after the initial selloff pushed prices to weekly lows. Bitcoin’s upward movement stalled near resistance zones that have capped gains since early February.

Alternative cryptocurrencies displayed uneven performance during the recovery. BNB led the gains with renewed backing from Binance founder Changpeng Zhao. Dogecoin also moved higher following fresh comments from Elon Musk.

Most major tokens only managed small recoveries. These digital assets remained far below their peak levels from earlier in 2025. The choppy trading reinforced cautious sentiment among short-term market participants.

Crypto Fund Outflows Continue

Investment flow data revealed ongoing defensive positioning among crypto investors. CoinShares reported that global crypto investment products recorded $1.7 billion in outflows during the past week. This represented the second straight week of substantial redemptions.

Bitcoin-focused funds accounted for the majority of withdrawals. Ether products and other cryptocurrency investment vehicles also experienced outflows. The persistent negative flows signal reduced institutional appetite for crypto exposure.

Blockchain data showed long-term Bitcoin holders moved into unrealized losses. CryptoQuant analysts label this condition as “extremely bearish” though it can indicate potential local price bottoms. The metric suggests veteran holders are facing paper losses on their positions.

Stock Market Futures Hold Steady

U.S. stock index futures traded near flat levels on Tuesday evening. Contracts tied to the S&P 500 held slightly above baseline while Nasdaq 100 futures declined 0.1%. Dow Jones Industrial Average futures advanced 0.1%.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

During regular Tuesday trading, stocks retreated broadly as investors rotated away from technology stocks. The S&P 500 dropped approximately 0.8% while the Nasdaq Composite fell 1.4%. The Dow Jones declined nearly 170 points or 0.3%.

Technology shares bore the heaviest selling pressure. Nvidia and Microsoft each lost more than 2% during the session. Other AI-related companies including Broadcom, Oracle, and Micron Technology also closed lower. The technology sector overall declined more than 2% within the S&P 500.

Traders shifted capital from high-growth tech companies toward more economically sensitive sectors. The rotation reflected worries that rapid AI development could disrupt traditional software business models.

Extended Losses in After-Hours Trading

After-hours trading saw multiple prominent stocks deepen their losses. AMD shares tumbled over 7% as the market reacted poorly to the company’s first-quarter forecast. Chipotle dropped nearly 7% after the restaurant chain reported continued customer traffic declines and cautioned that same-store sales growth might stall in 2026.

The post Daily Market Update: Stock Futures and Bitcoin Climb Higher after Monday’s Crash appeared first on Blockonomi.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

SEI Technical Analysis Feb 6