Billionaire Michael Saylor Says This Bitcoin-Backed Investment Could Replace Your Retirement Plan

Billionaire Strategy Executive Chairman Michael Saylor has positioned his company’s Bitcoin-backed securities as a compelling alternative to conventional bank savings for retirement planning, presenting yields of 9.5% versus traditional savings rates ranging from 0.1% to 4%.

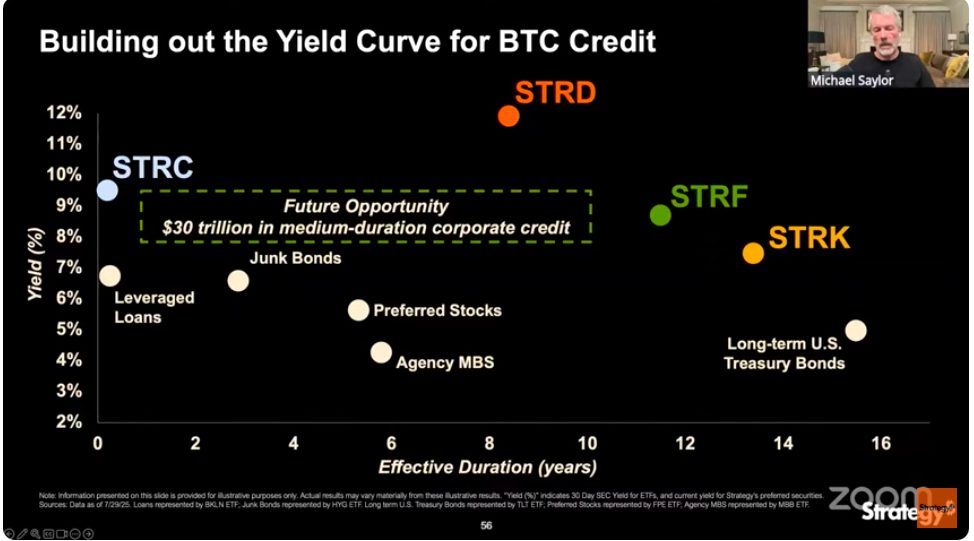

During MicroStrategy’s second-quarter earnings call on July 31, Saylor highlighted the firm’s newest preferred stock offering, STRC, as especially appealing to conservative investors seeking returns on their income.

Source: Strategy

Source: Strategy

“This presents opportunities for retirees and an entire demographic of investors,” Saylor explained, emphasizing the product’s attraction for those pursuing enhanced returns without extended lock-up periods.

He further noted that MicroStrategy’s preferred equity instruments provide exceptional yield-generating collateral for investors.

Saylor’s Bitcoin-Backed Retirement Plan: 9.5% Yields vs 0.1% Banks

The STRC preferred stock offering successfully raised $2.5 billion on July 30, funds that were immediately deployed to purchase 21,021 Bitcoin in what became 2025’s largest US initial public offering to date.

Strategy already announced that STRC will commence trading on the Nasdaq this Wednesday, marking it as America’s first exchange-listed perpetual preferred security from a Bitcoin treasury corporation offering monthly, board-determined dividends targeted at income-seeking investors.

Notably, STRC represents the newest addition to MicroStrategy’s expanding portfolio of perpetual preferred securities designed to fund Bitcoin acquisitions.

The series includes Strike (STRK), a convertible instrument with an 8% fixed dividend; Strife (STRF), a non-convertible option featuring a 10% cumulative yield; and Stride (STRD), which distributes a 10% non-cumulative dividend.

This strategic positioning coincides with MicroStrategy’s announcement of record quarterly earnings totaling $10 billion, primarily fueled by Bitcoin’s appreciation from $77,000 in Q1 to above $111,000 in Q2.

The Virginia-headquartered corporation, previously operating as MicroStrategy, established the blueprint for corporate Bitcoin treasury adoption and currently maintains 628,791 BTC valued at over $72.6 billion, representing approximately 3% of Bitcoin’s total supply.

MicroStrategy’s retirement plan initiative aligns with broader momentum toward incorporating Bitcoin into 401(k) investment options.

U.S Government Greenlights Bitcoin-Backed Retirement Plans in Crypto 401(k)s Policy Change

Notably, the U.S. Department of Labor withdrew its 2022 guidance discouraging cryptocurrency inclusion in workplace 401(k) programs this July.

This regulatory reversal is expected to rekindle enthusiasm for cryptocurrency investment vehicles within retirement and mortgage savings frameworks.

Similarly, Bitcoin adoption in retirement portfolios appears to be accelerating across multiple fronts.

In May 2024, the State of Wisconsin Investment Board (SWIB), America’s ninth-largest pension fund, allocated $99 million to Bitcoin purchases, while Florida’s Chief Financial Officer Jimmy Patronis advocated for Bitcoin inclusion in the state’s pension system.

International adoption is already underway, with UK retirement schemes dedicating up to 3% of their portfolios to Bitcoin, anticipating superior returns for beneficiaries.

These pension investments received guidance from Cartwright, a firm specializing in defined benefit scheme management that provides employees with guaranteed monthly retirement income based on service duration and salary levels.

Performance data indicates that Cartwright-managed pension fund Bitcoin investments have generated over 60% returns in less than twelve months, significantly outpacing traditional assets, including bonds, gold, and the S&P 500.

Cartwright has also published specialized research targeting corporate treasurers, defined benefit administrators, and institutional investors, focusing on Bitcoin’s practical applications, volatility characteristics, and expanding macroeconomic significance.

You May Also Like

Regulatory Clarity Could Drive 40% of Americans to Adopt DeFi Protocols, Survey Shows

Michael Burry’s Bitcoin Warning: Crypto Crash Could Drag Down Gold and Silver Markets