XRP Price Analysis: How Current Trends Point to a Possible $1 Floor Breach

- XRP hit $1.53 on February 4 and traded near $1.60, keeping the $1 level in focus as price stays far below the $3.65 high from July 2025.

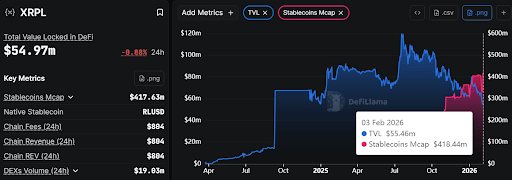

- However, XRPL TVL is $54.6 million and down 32% since early Jan, while last month’s spot XRP ETF inflows slowed to $15.59 million.

XRP extended its weekly decline on February 4, falling to $1.53 before rebounding to about $1.60. The price action marked a decline of over 15% in seven days and had the altcoin trading well lower than its July 2025 peak of $3.65.

Derivatives positioning also played a role in the fall. Leveraged long positions were pushed out as the prices dropped, accelerating the downswing. Over the last 24 hours, over $528 million in long liquidations occurred in crypto markets, and nearly $6.65 million in long liquidations were XRP.

Other than price action, other indicators of activity on the XRP Ledger have indicated a cooling. The network’s decentralized finance segment remains relatively small and has contracted since early January. Total value locked sits near $54.9 million, down by 30% from levels seen at the start of the year.

Source: DeFiLlama

Source: DeFiLlama

A lower locked value is generally an indicator of decreased capital commitment to lending, liquidity, and associated on-chain strategies that can be translated into weak near-term demand.

Meanwhile, early on today, we reported that the XRP Ledger went live with Permissioned Domains under the XLS-80 amendment after gaining more than 91% validator support. The upgrade introduces credential-based access controls built on the XLS-70 framework.

Network Operation and ETF Flows Indicate Decline in XRP Support

The rate of XRP burns has also slowed down, which indicates that there is less fee-burning than last year. Approximately 523 tokens were burned on February 3, which is much lower than the over 4,500 that were burned on average in August 2025.

Institutional allocation through spot XRP exchange-traded funds has slowed as well. After stronger early inflows when the products launched in November 2025, January recorded net inflows of about $15.59 million, compared with the higher figures seen in November and December.

The slowdown in ETF purchases can affect a continuous stream of demand that can absorb open-market supply.

On the weekly chart, the XRP price action is on a downward parallel channel, a trend that relates to low highs and continuous selling efforts. In case of the failure of current support, the level of $1.00 is the reference point.

A decline below $1 would focus attention upon lower downside levels, including the $0.78 zone, which is an important reversal zone. At the time of press, the crypto was trading at $1.58. The altcoin’s 24-hour trading volume stood at $4.04 billion, while its market cap was $96.4 billion.

You May Also Like

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy

Ondo Finance launches USDY yieldcoin on Stellar network