Crypto crash today: Bitcoin, altcoins slump as Fear and Greed Index hits 14

Crypto wasn’t spared from the tech risk-off mood. Bitcoin slid 2.5% to around $73,000 — its lowest level since early November 2024 — officially giving back the entire post-Trump election rally, no receipt required.

Strategy Inc. sank 8% to its weakest level since September, while Solana (SOL) and Ethereum (ETH) joined the selloff, falling about 7% and 5%, respectively.

- The crypto market crash continued falling on Wednesday, with Bitcoin moving below $75,000.

- This crash coincided with the stock market sell-off.

- Most geopolitical analysts believe that Donald Trump will attack Iran.

Crypto crash coincided with stock market weakness

The ongoing crypto crash coincided with the selling of risky assets. For example, the tech-heavy Nasdaq 100 Index continued its strong downward spiral, with top companies like AMD, AppLovin, and Palantir falling by over 10%.

These technology companies declined as investors remained concerned about the AI industry and its impact on key sectors such as software. Indeed, most software companies, including ServiceNow, Adobe, Intuit, and Salesforce, have plunged by over 50% from their all-time highs.

In addition, the iShares Expanded Tech-Software ETF fell for a seventh straight session and retreated to levels last seen when President Trump unveiled his tariff plans in April 2025.

The crypto crash is also happening as investors remain concerned about the Middle East, where Donald Trump has sent an armada, whose aim is to attack Iran.

While talks between the two sides are set to happen in Turkey on Friday, most geopolitical analysts believe that Trump will ultimately attack. The Trump administration has made demands that Iran will not accept, including ending its civilian nuclear energy and reducing its ballistic missiles.

Commodity prices have also priced in an attack happening soon. Gold, often seen as a safe-haven, has jumped back to over $5,000, while crude oil prices have soared to nearly $70.

Crypto Fear and Greed Index has slumped

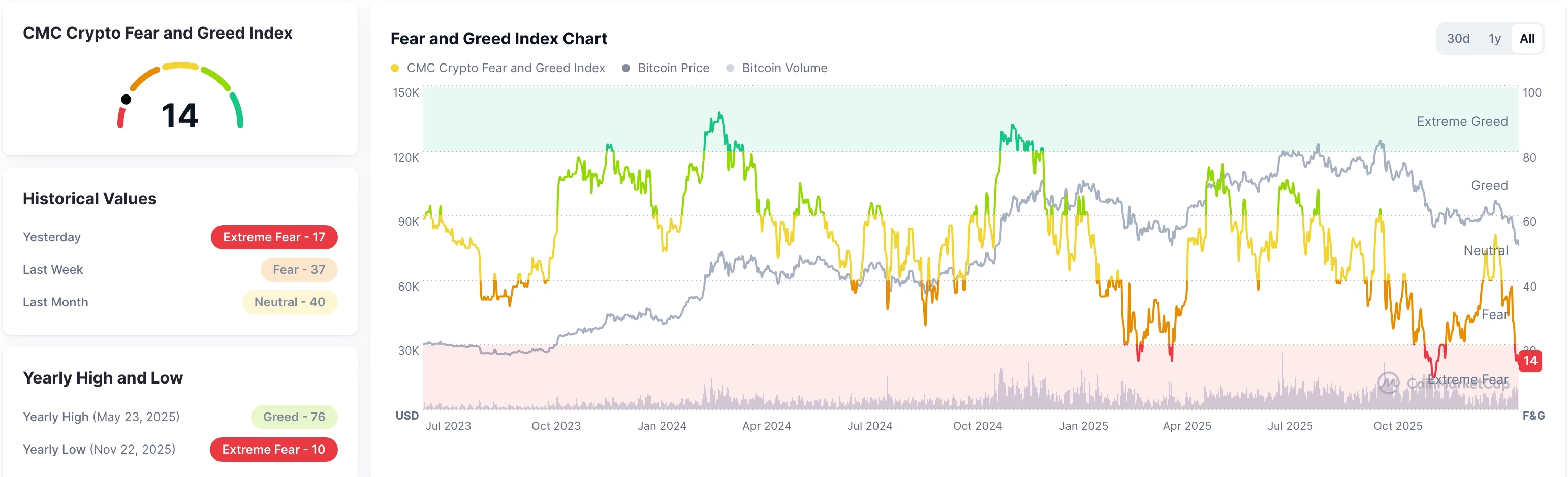

All these factors have pushed more investors on the sidelines, with the Crypto Fear and Greed Index moving to the extreme fear zone of 14. Cryptocurrencies often drop when investors are fearful.

Fear and Greed Index has slumped | Source: CMC

Fear and Greed Index has slumped | Source: CMC

On the positive side, crypto market rallies normally start when the index moves to the extreme greed zone as we saw earlier this year when Bitcoin (BTC) jumped to $98,000. This rally started when the index dropped to the extreme fear zone of 10.

Crypto prices have also slumped amid rising liquidations. Data show that liquidations jumped 192% over the last 24 hours to over $794 million.

Over 174,000 traders were liquidated, with Ethereum and Bitcoin leading the pack. Ethereum positions worth $307 million were liquidated in this period.

You May Also Like

⁉️ Epstein, a convicted pedo, invested in Coinbase

North America Sees $2.3T in Crypto