Daily Market Update: Stock Futures Gain Before Amazon Earnings as Bitcoin Hits $70K

TLDR

- Bitcoin trades in the mid-$70,000s with on-chain data showing bear market signals including zero Bull Score Index and weak spot demand

- U.S. spot bitcoin ETFs have switched from net buyers to net sellers, creating a demand gap of tens of thousands of bitcoin year-over-year

- Stablecoin market cap growth turned negative for the first time since 2023, signaling tighter liquidity conditions

- Stock futures mixed Thursday morning with S&P 500 up 0.2% and Nasdaq 100 up 0.4% as investors digest tech earnings and await Amazon results

- Treasury Secretary Scott Bessent stated the government will not bail out bitcoin after its decline to around $71,000

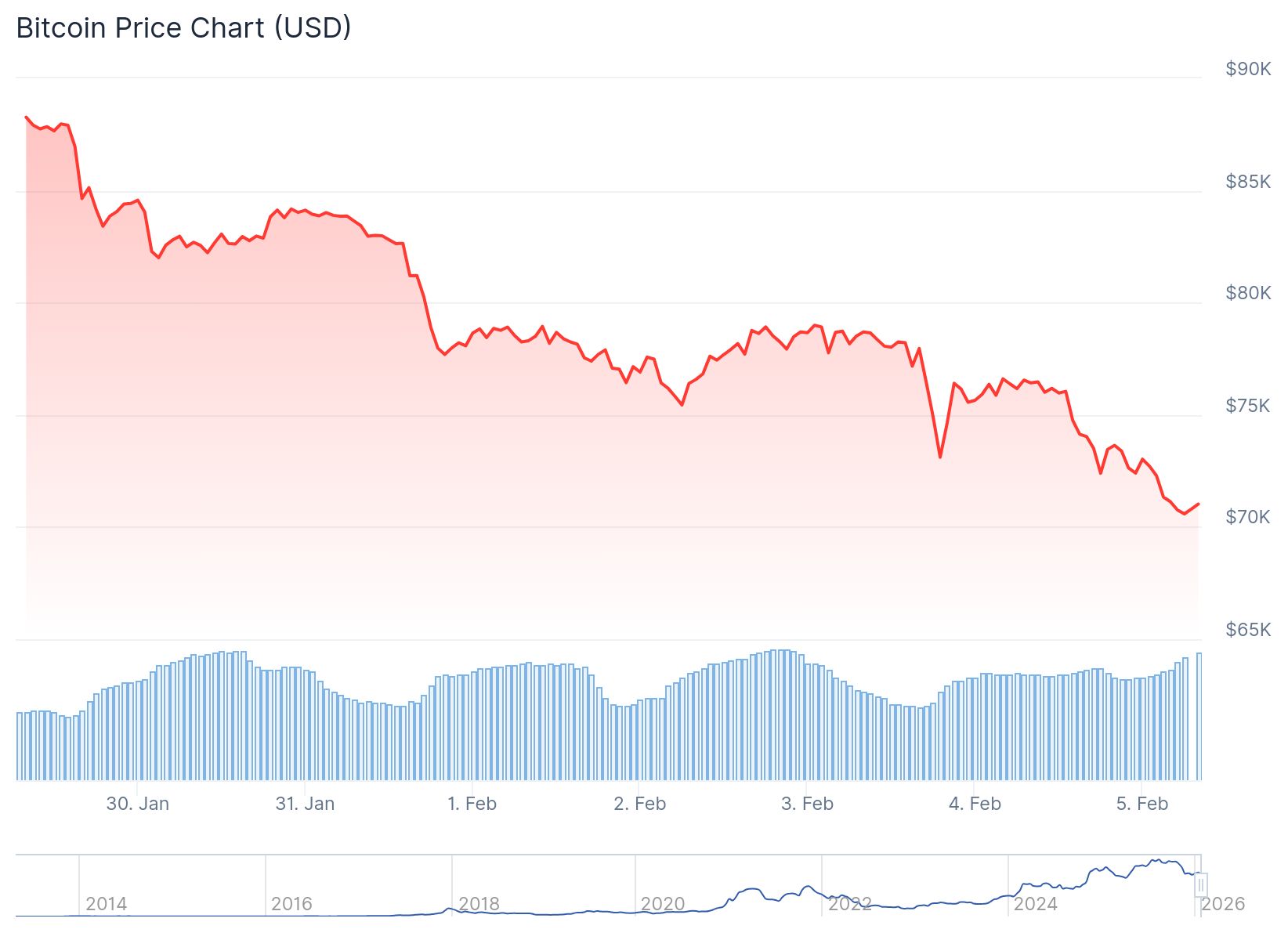

Bitcoin dropped toward the $70,000 level as multiple data sources pointed to weakening market conditions. On-chain metrics showed the cryptocurrency entering bear market territory with reduced participation and liquidity concerns.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The CryptoQuant Bull Score Index registered zero while bitcoin traded well below its October peak. The analytics firm described the weakness as structural rather than cyclical in its latest weekly report.

Glassnode data confirmed weak spot trading volumes across exchanges. The decline showed a lack of buying interest rather than panic selling pressure.

U.S. spot bitcoin exchange-traded funds shifted from net accumulation to net selling over the past year. This change created a demand gap measured in tens of thousands of bitcoin compared to the same period last year.

The Coinbase premium remained in negative territory since October. This metric tracks the price difference between U.S. and global exchanges and historically indicates American investor sentiment.

Past bitcoin bull markets coincided with strong U.S. spot demand. That buying pressure has been absent despite lower prices in recent months.

Stablecoin Growth Turns Negative

Stablecoin market capitalization growth entered negative territory for the first time since 2023. USDT market cap declined after years of steady expansion that typically fueled trading activity.

Longer-term demand growth metrics collapsed from 2025 highs. The data suggested reduced market participation beyond just leverage liquidations.

Bitcoin technical analysis showed the cryptocurrency trading below its 365-day moving average. On-chain valuation models placed major support levels between $70,000 and $60,000.

Prediction markets indicated traders expect the Federal Reserve to hold rates steady at the April meeting. Only modest probability was assigned to a potential June rate cut.

President Donald Trump commented on his Fed chair nominee Kevin Warsh during an NBC News interview. Trump stated a Fed chair wanting to raise rates would not have received the job nomination.

Treasury Secretary Scott Bessent told reporters the government would not bail out bitcoin. The statement came as the cryptocurrency traded around $71,000 per token.

Stock Market Futures Show Mixed Performance

Stock futures traded mostly higher Thursday morning before the market open. S&P 500 futures gained 0.2% while Nasdaq 100 futures rose 0.4%.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

Dow Jones Industrial Average futures hovered slightly below flat. The index contains fewer technology companies than the S&P 500 and Nasdaq.

Alphabet reported quarterly earnings Wednesday evening with plans to increase AI investment spending. The Google parent company projected capital expenditures could reach $185 billion in 2026.

Alphabet shares fell 1% in premarket trading despite the earnings beat. Investors focused on the higher spending outlook for AI infrastructure development.

Chipmaker stocks showed mixed performance in premarket activity. Nvidia and Broadcom shares gained on optimism about data center demand linked to AI buildout.

Qualcomm shares dropped after issuing a weaker forecast than analysts expected. The company cited a global memory shortage as a headwind to near-term growth.

Amazon earnings were scheduled for release Thursday after market close. Investors planned to watch weekly jobless claims data for labor market health signals.

Software stocks declined Wednesday following news about Anthropic’s new AI tools. Concerns emerged about potential disruption to traditional software business models.

Ether traded just above $2,000 with limited momentum. The second-largest cryptocurrency mirrored bitcoin’s weakness as broader risk sentiment remained cautious.

Gold prices rebounded toward the $5,000 to $5,100 range on safe-haven demand. The precious metal gained following U.S.-Iran tensions and mixed economic data that shifted Fed policy expectations.

The post Daily Market Update: Stock Futures Gain Before Amazon Earnings as Bitcoin Hits $70K appeared first on CoinCentral.

You May Also Like

Relax, Core v30 Won’t Kill Bitcoin

United States Building Permits Change dipped from previous -2.8% to -3.7% in August