Election Highs Ease but Activity Remains for Prediction Markets Polymarket and Kalshi

Polymarket and Kalshi, two prominent prediction markets, have continued to record substantial trading activity into 2025, with volumes, active accounts, and market offerings reflecting ongoing participation beyond the 2024 U.S. Election.

Data Shows Polymarket Volumes Remain Above Pre-Election Levels

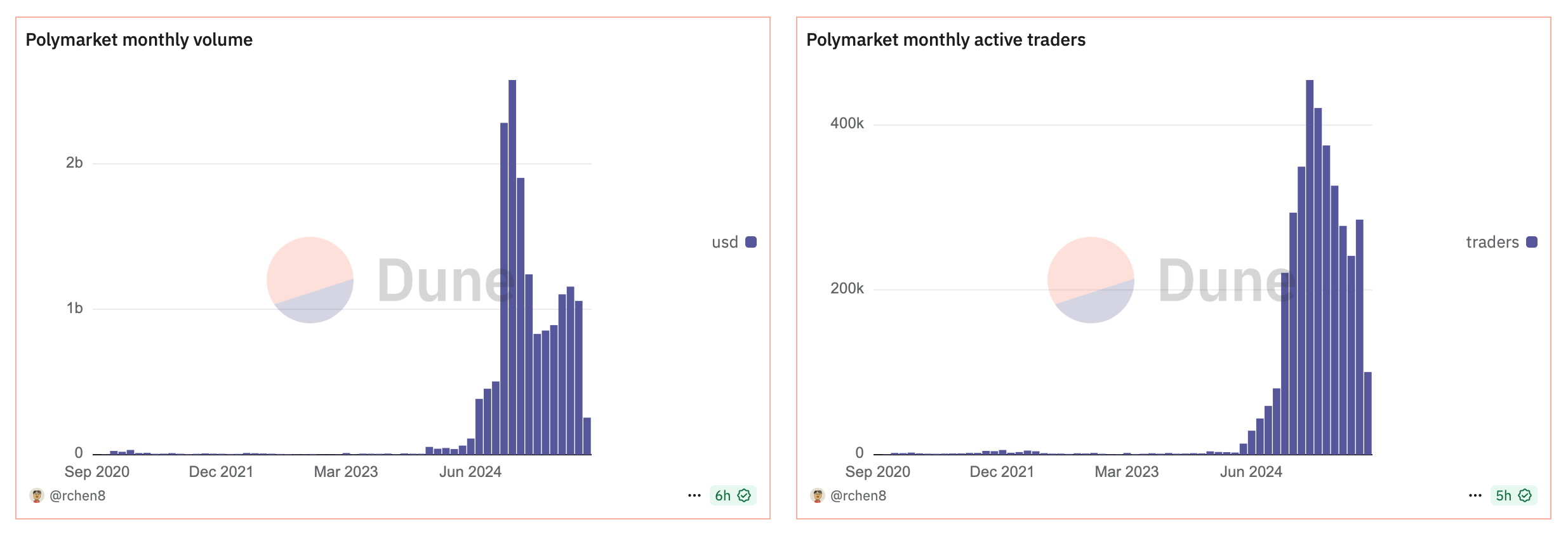

Metrics from Dune Analytics show that Polymarket, the blockchain-based predictions marketplace, has maintained activity into 2025. Monthly volume, which reached more than $2 billion during the election period, has decreased but remains above pre-election levels.

Trading volume ticked higher in mid-to-late 2024, with several months above $2 billion in value exchanged. Activity has declined since the election, but recent months have reported more than $1 billion in trades. Daily totals generally range between $20 million and $50 million, with occasional days above $70 million during major events.

Source: Dune Analytics

Source: Dune Analytics

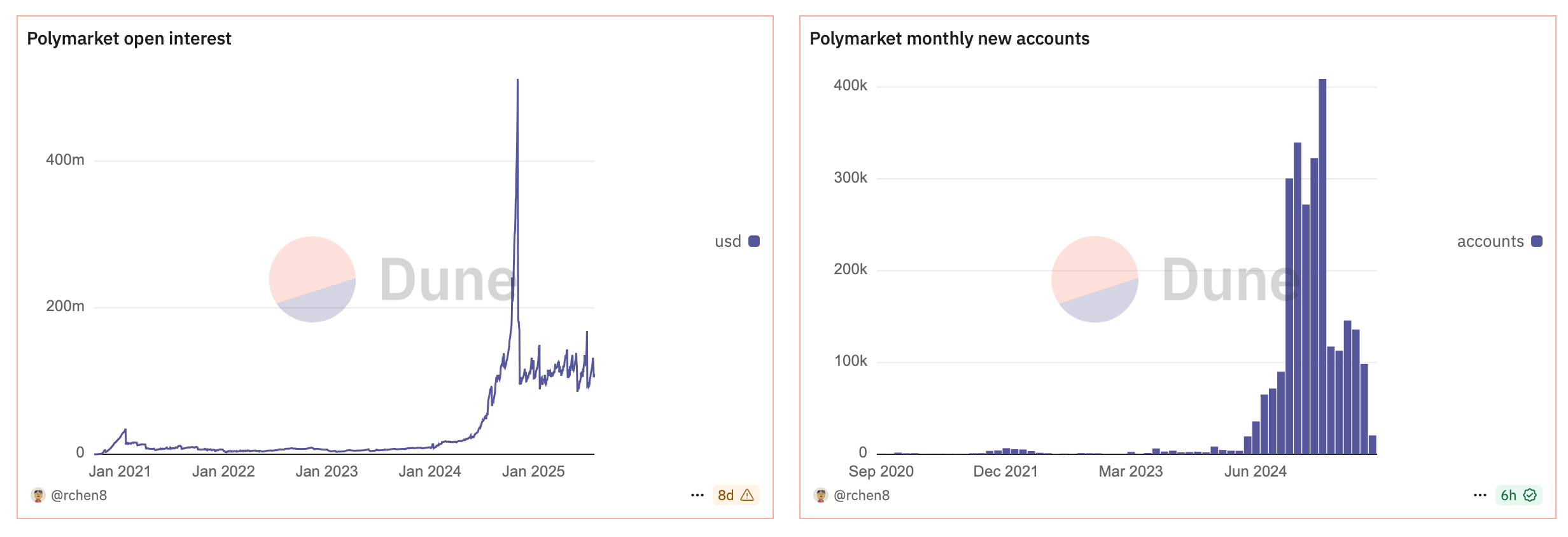

Monthly active accounts surpassed 400,000 during the election between Trump and Harris and have remained in the hundreds of thousands through mid-2025. Daily active accounts typically range from 20,000 to 30,000, with increases during major deadlines or developments. New account creation peaked above 400,000 in one month and has continued each month since.

Polymarket wagers with the highest recent volumes include sports, geopolitics, and event-based contracts. On Aug. 5, 2025, the markets with the largest daily volumes were “LIV Golf Chicago Winner,” “UFC Fight Night” matchups, and “Megaquake by September 30?” Political markets remain active, including contracts on a possible meeting between President Trump and Vladimir Putin, ceasefire agreements, and central bank policy decisions.

Source: Dune Analytics

Source: Dune Analytics

Political markets include contracts with significant liquidity. As of early August, the market for a Trump-Putin meeting before Aug. 15 showed an 87% probability with nearly $1 million in trades. Other active contracts include the 2028 U.S. presidential election, the Bolivian presidential election, and possible changes to Federal Reserve leadership.

Data indicates that activity after the election includes both political and non-political markets. While political events coincide with higher volumes, participation is also present in sports, economic, and niche contracts.

Figures over the past year show activity beyond the election cycle, with consistent daily volumes, ongoing active accounts, and continuing account creation.

Kalshi Trading Patterns Mirror Post-2024 Election Trends

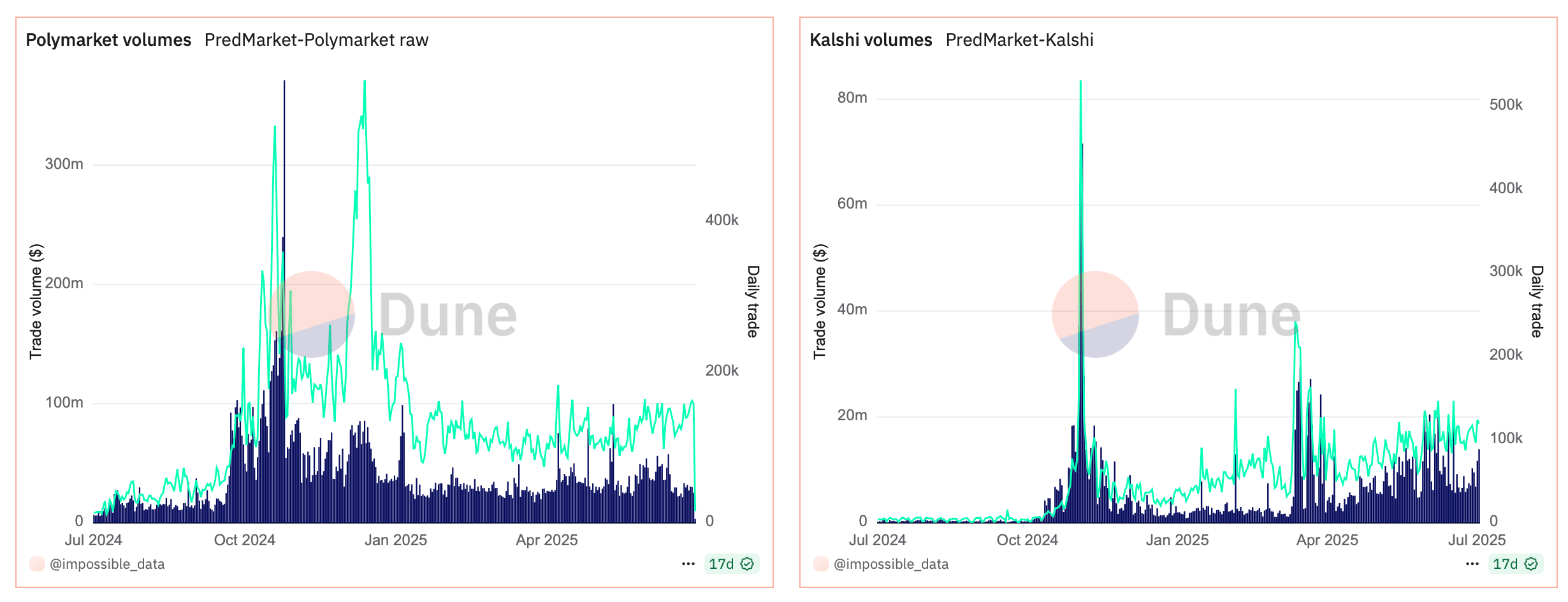

Kalshi, a U.S.-based prediction market, continued operations into 2025 with activity levels different from those of Polymarket. Dune Analytics figures show Kalshi’s daily trade volume rose in late 2024 during the U.S. election period and has since maintained a consistent range. Daily volumes vary, with occasional larger changes, including a 231% increase on June 22, 2025.

Source: Dune Analytics

Source: Dune Analytics

In comparative volume charts, Kalshi’s highest single-day volume reached about $80 million. The platform’s daily trade counts have remained consistent. Its structure enables participation from U.S.-based users. Just like Polymarket, Kalshi’s markets cover politics, sports, economics, and popular culture.

As of August 2025, active markets include “Fed decision in September” (pricing a 76% probability for a 25-basis-point cut with nearly $150 million in traded volume), “Which party will win the House next year?” (68% probability for Democrats), and “Pro Football Champion?” along with contracts on movie review scores and celebrity relationship outcomes.

Political and economic markets represent a significant portion of Kalshi’s activity. The market “Who will Trump meet with this year?” prices a 94% probability for Vladimir Putin and 69% for Xi Jinping. Other contracts focus on consumer price index releases, hurricane formation timelines, and foreign elections.

Daily change data shows fluctuations tied to news events, with both increases and decreases sometimes exceeding 20%. On several dates, Kalshi recorded changes above 50% in daily volume.

Data from both Polymarket and Kalshi indicate that prediction markets remain active beyond major election cycles. Polymarket records higher global volumes, while Kalshi operates within U.S. regulations and concentrates activity in political and economic contracts. Together, the figures show activity across multiple event categories throughout the year.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse