Bitcoin Stalls After Mixed CPI Data

The market was waiting for a clear signal from Tuesday’s CPI report but despite no increase in overall prices, certain items saw inflation jump to a two-year high.

Ambiguous CPI Figures Leave Bitcoin Flat

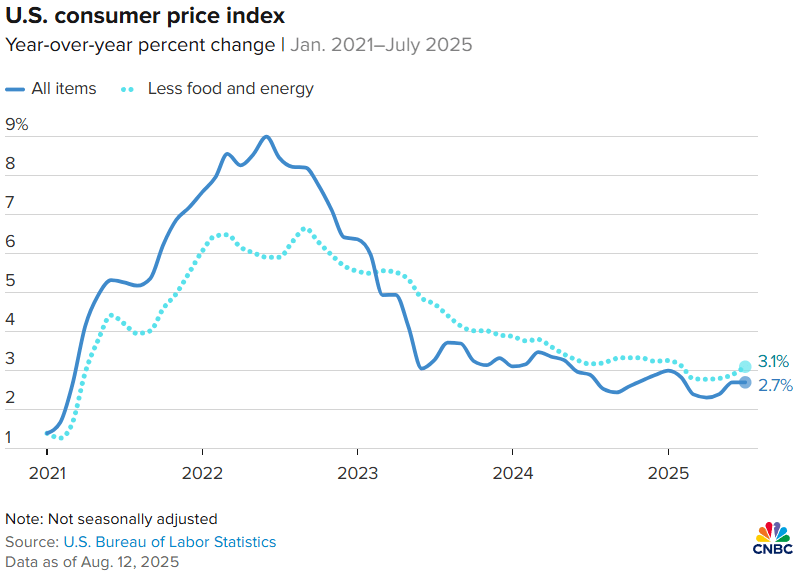

The U.S. Department of Labor Statistics published its consumer price index (CPI) data for July on Tuesday, revealing lower-than-expected inflation for all goods, but “core” inflation, which strips out items with volatile prices such as food and energy, climbed to a two-year peak, raising questions among traders about which direction markets should go. Bitcoin decided to go nowhere, treading water at $119K after a weekend rally that saw the cryptocurrency soar to $122K before it retreated.

Overall inflation came in at 2.7% in July on an annualized basis, lower than the 2.8% many economists had predicted. Core inflation, with food and energy prices excluded, jumped to 3.1%, higher than what most experts forecasted, and the highest level since 2023.

(July CPI data shows a lower-than-expected annual inflation rate of 2.7%, but it also reveals higher-than-expected “core” inflation at 3.1% / CNBC and U.S. Bureau of Labor Statistics)

(July CPI data shows a lower-than-expected annual inflation rate of 2.7%, but it also reveals higher-than-expected “core” inflation at 3.1% / CNBC and U.S. Bureau of Labor Statistics)

Some analysts blamed the increase in core CPI on the Trump administration’s controversial tariff policy, arguing that the high core figure is a leading indicator of future runaway inflation. But White House Chairman of the Council of Economic Advisors and recent Federal Reserve Governor nominee Stephen Miran, disagreed during a CNBC interview.

“There just still continues to be no evidence whatsoever of any tariff-induced inflation,” Miran explained. “One good or service gets more expensive and another one gets cheaper. That will always happen. But at the aggregate level, when you look holistically across the inflation data, there’s just no evidence of it whatsoever.”

Overview of Market Metrics

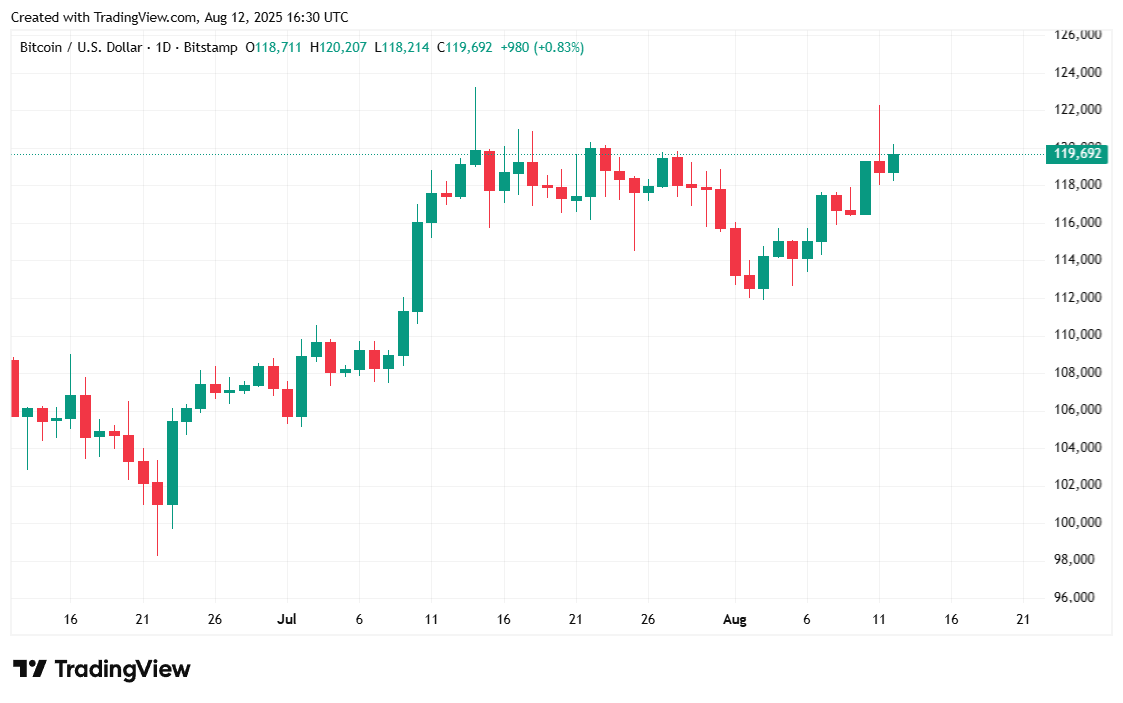

Bitcoin was trading at $119,898.64 at the time of writing, according to Coinmarketcap, down slightly by 0.46% over the past 24 hours, but still up 5.9% for the week. The cryptocurrency has been trading between $118,159.03 and $120,193.39 since yesterday.

( Bitcoin price / Trading View)

( Bitcoin price / Trading View)

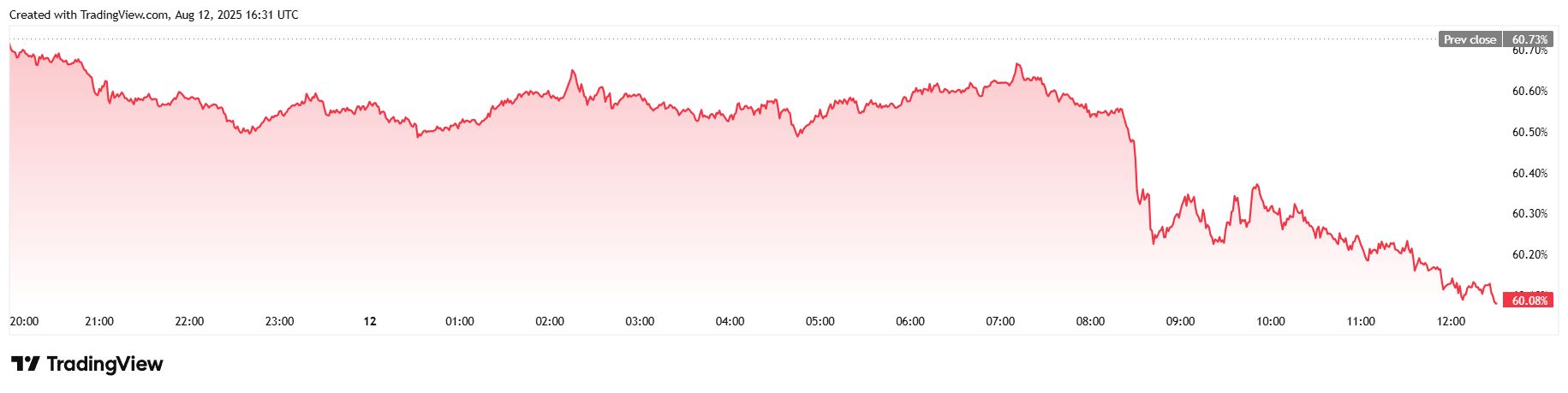

Twenty-four-hour trading volume was down 15.82% at $73.98 billion, and market capitalization eased by 0.71% to $2.38 trillion. Bitcoin dominance tumbled to 60.08%, a 1.09% decrease in the last 24 hours, indicating higher performance from altcoins.

( BTC dominance / Trading View)

( BTC dominance / Trading View)

Total bitcoin futures open interest on Coinglass fell 2.09% and stood at $80.80 billion at the time of reporting. BTC liquidations reached $56.33 million overall, but unlike yesterday, that sum was dominated by long positions, which lost $43.83 million, while shorts saw a smaller $12.50 million wiped out.

You May Also Like

Recovery extends to $88.20, momentum improves

Fed Decides On Interest Rates Today—Here’s What To Watch For

U.S. regulator declares do-over on prediction markets, throwing out Biden era 'frolic'

Copy linkX (Twitter)LinkedInFacebookEmail