Pump.fun Reclaims Solana Memecoin Lead With $800M Revenue

TLDR

- Pump.fun leads Solana’s memecoin market with $800M in revenue, ahead of LetsBonk.

-

Pump.fun dominates 91% of daily token listings, leaving LetsBonk at just 3%.

-

Pump.fun launched 24,911 tokens, with higher volume and a 0.84% graduation rate.

-

LetsBonk struggles to close the gap despite new rewards systems and buyback efforts.

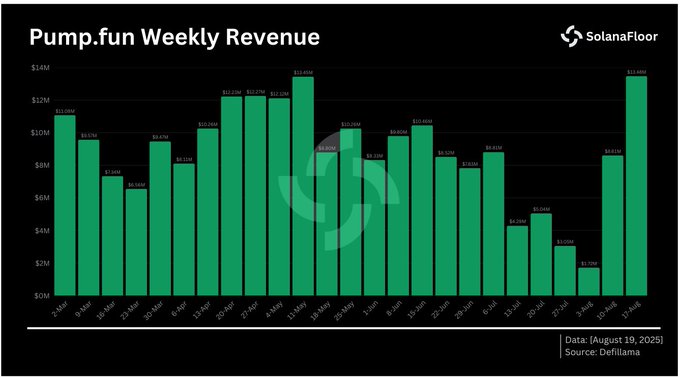

Pump.fun has surpassed $800 million in lifetime revenue, cementing its position as the dominant launchpad for Solana-based tokens. The platform’s success is largely attributed to its 1% swap fee on token transactions, which has driven substantial income since its launch. Pump.fun has now regained its lead over LetsBonk, which had briefly overtaken it in July due to a surge in activity.

Despite LetsBonk’s recent growth, which captured nearly 74% of daily Solana token launches during that period, Pump.fun has bounced back with increased user activity and higher transaction volumes. In early August, Pump.fun was generating approximately $1.35 million in daily revenue, far surpassing LetsBonk’s $250,000.

Pump.fun’s Recovery and Market Confidence Boost

Pump.fun’s swift recovery from its earlier downturn in July demonstrates its resilience in the competitive Solana memecoin launchpad market. In addition to regaining market share, Pump.fun launched a $33 million buyback program for its PUMP tokens. This initiative aims to limit supply and increase token value, contributing to a more positive outlook in the market.

Recent data shows that Pump.fun now accounts for 91% of all daily token listings on Solana, while LetsBonk has fallen to just 3%.

-

- Source: X

This market share shift reflects a growing preference among token creators for Pump.fun’s platform, which offers greater liquidity and higher daily volumes compared to LetsBonk. The platform’s success is also linked to its larger active user base, with over 38,000 active users compared to LetsBonk’s 633.

Look at Platform Activity and Token Launches

Pump.fun has launched an impressive 24,911 tokens with a graduation rate of 0.84%, a key metric for assessing the platform’s success in token launches. In comparison, LetsBonk has launched only 442 tokens, but with a slightly higher graduation rate of 2.26%.

Despite this, the disparity in volume and user engagement remains clear, with Pump.fun leading the way in both daily trading volume and user participation.

In the past month, Pump.fun has also shown impressive growth, with daily transaction counts reaching nearly 550,000 compared to LetsBonk’s 33,716. This increased activity is a testament to the platform’s strong position within the Solana ecosystem, particularly in terms of market penetration and investor interest.

Future of Memecoin Launchpads and Innovation

The ongoing competition between Pump.fun and LetsBonk is emblematic of a larger trend in the Solana memecoin space, where platforms are continuously pushing for innovation and better liquidity solutions.

To maintain its edge, Pump.fun introduced the Glass Full Foundation (GFF), a new initiative designed to support promising tokens by injecting liquidity into selected projects. This effort aims to reduce the failure rate of new launches, further solidifying Pump.fun’s reputation as a top-tier memecoin launchpad.

LetsBonk, on the other hand, has implemented a new rewards system and committed 1% of its revenue to buybacks of its BONK ecosystem tokens in an effort to close the gap with Pump.fun. However, despite these efforts, the platform has not been able to regain the momentum it had earlier in the year.

The post Pump.fun Reclaims Solana Memecoin Lead With $800M Revenue appeared first on CoinCentral.

You May Also Like

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy