Blockchain Wants to Be the Dealer in Your Next Game of Poker

Online gambling is undergoing a high-tech transformation. GambleFi, short for “Gamble Finance” has emerged as a trend combining cryptocurrency and decentralized finance with traditional betting. By leveraging blockchain networks and smart contracts, GambleFi projects (from decentralized casinos to prediction markets) aim to solve longstanding issues of trust, transparency, and fairness in online gambling. This isn’t just a niche experiment; it’s slowly evolving to become a significant part of the gambling industry’s future. As of 2025, nearly 1 in 5 adults worldwide, over 880 million people have gambled online, and the global online gambling market is around $117 billion in size. Crypto-based platforms are rapidly staking out a share of this market, with crypto casinos generating over $81 billion in revenue (GGR) in 2024 alone.

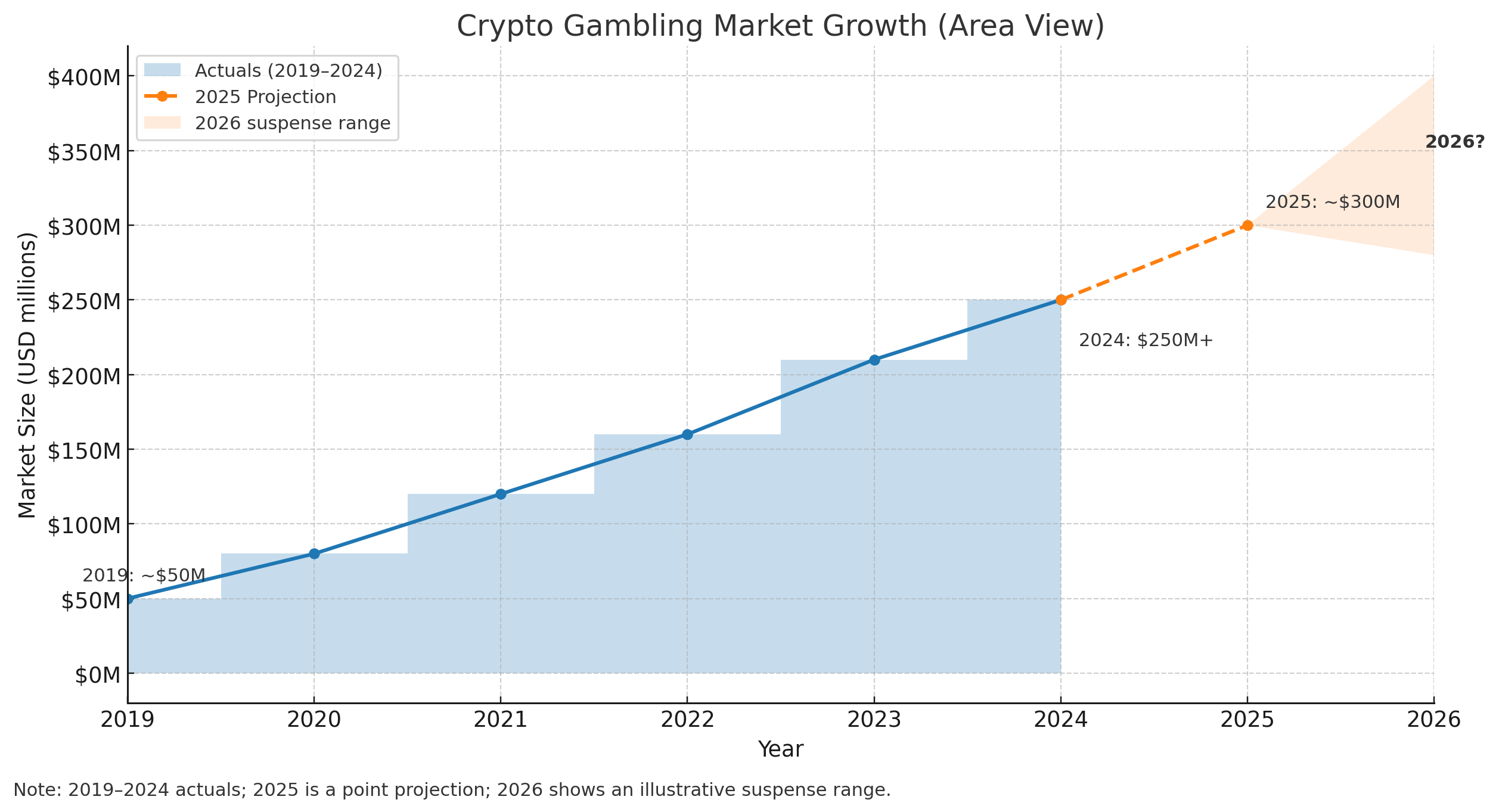

To add perspective, the crypto gambling sector has seen explosive growth in just a few years. Blockchain-powered betting is on a sharp upward trajectory.

This surge signals a broader shift in online gambling behavior. Below, we’ll explore what’s driving this growth, how new technology like Verifiable Random Functions (VRF) ensures provably fair gaming, and what innovative GambleFi projects are bringing to the table for tech-savvy players.

What Is GambleFi (Decentralized Gambling)?

GambleFi refers to the fusion of decentralized tech and online gambling. In practice, this means casino and betting platforms built on blockchains or using crypto, often governed by smart contracts. These decentralized casinos and betting dApps let users wager with cryptocurrencies in games like slots, poker, sports bets, lotteries, and more, all without the need for a traditional house or middleman. Because they run on blockchain networks, every bet, outcome, and payout can be recorded on a public ledger. This transparency is a game-changer for an industry that historically required players to “trust the house.”

In conventional online casinos, players have little visibility into what’s happening behind the scenes, they must trust that the random number generators (RNGs) aren’t rigged and that payouts will be honored. GambleFi flips this model by using smart contracts and open algorithms to make the process “trustless.” The code (often open-source) governs game outcomes and payouts automatically, removing the need to trust a centralized operator. All transactions and results are auditable by anyone on the blockchain. Essentially, GambleFi platforms strive to provide a secure, tamper-proof environment for betting, addressing the traditional online gambling issues of trust, transparency, and fairness.

Why Crypto Casinos Are Booming

What advantages do crypto and blockchain-based casinos offer over traditional online betting sites? The rapid growth of GambleFi is fueled by several key factors:

- Faster, Borderless Transactions: Players aren’t slowed down by banks or payment processors, and there are no currency conversion hassles. Anyone with an Internet connection and a crypto wallet can play, even in regions where traditional gambling payments face hurdles.

- Privacy and Anonymity: Many blockchain casinos require minimal KYC (Know Your Customer) checks or allow pseudonymous play via wallet addresses. For players concerned about privacy or those in jurisdictions where gambling is restricted, this is a huge draw.

- Provably Fair Play: Provably fair algorithms powered by cryptography let players verify each game’s outcome for fairness. Users can actually check that rolls of the dice or shuffle of cards were random and not manipulated by the house. This transparency in RNG (Random Number Generation) is often achieved through on-chain random seeds or cryptographic proofs (We’ll dive deeper into how this works with VRF shortly.)

- Global Access & Decentralization: A truly decentralized casino isn’t bound by geography or a single company’s servers. Smart contracts run games on distributed networks, meaning anyone can participate without needing a specific country license or an intermediary to “approve” the bet.

These advantages translate into real numbers. Daily active users on blockchain dApps, including gambling platforms, reached around 7 million in early 2025, up 386% from January 2024, showing that more players are gravitating toward these new platforms.

Provably Fair Randomness: How VRF Ensures Fair Play

One of the most groundbreaking aspects of GambleFi is the ability for games to prove their fairness cryptographically. The concept of provably fair gaming means that neither the player nor the house can secretly manipulate an outcome – and both can verify this after each round. At the heart of many provably fair systems today is the Verifiable Random Function (VRF), a cryptographic random number generator that comes with proof of its own integrity.

Chainlink VRF is a leading implementation of this technology and is widely used in decentralized gambling applications. In simple terms, Chainlink VRF provides random numbers to smart contracts along with a cryptographic proof that the number was generated fairly. The smart contract will only accept the random output if the accompanying proof is valid, meaning the result truly is random and hasn’t been tampered with by any party. This is a big upgrade from traditional online casinos’ RNGs, which are essentially black boxes that players must take on faith.

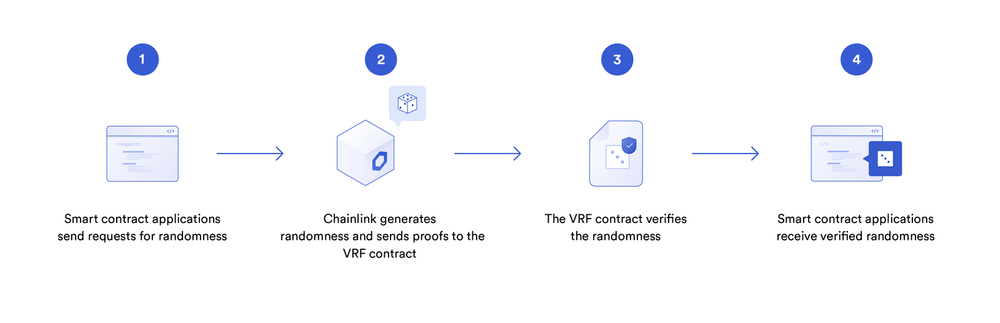

How does VRF work in practice? Suppose a decentralized casino smart contract needs a random outcome (for a dice roll, a card draw, a slot reel, etc.). The workflow would look like this:

- The smart contract requests a random number from the VRF oracle (e.g. Chainlink’s network).

- The VRF system generates a random number off-chain using a secure algorithm, and simultaneously produces a cryptographic proof of the number’s authenticity.

- The random number plus its proof are returned to the smart contract. The contract automatically verifies the cryptographic proof before using that random number in the game outcome.

If the proof doesn’t check out, the contract rejects the number. But if it’s valid, the contract knows the random value is legitimate. The key innovation is that every random result comes with an “audit trail.” Anyone (players, auditors, regulators) can later verify on-chain that the RNG was fair for that bet. This removes the need to simply trust a casino’s word that they aren’t cheating – the fairness is independently verifiable.

In practice, this means no single entity, not even the casino operator, can rig the game outcomes. Any attempt to manipulate the randomness (say, by an insider or attacker) would invalidate the cryptographic proof, and the smart contract would ignore that result. Compared to traditional RNG systems that require trust, VRF-based randomness provides mathematical guarantees of fairness.

Try it yourself

Sample Code for the Python Geeks

# Prereqs pip install web3 # Set your environment (example: Polygon mainnet) export RPC_URL="https://polygon-rpc.com" export VRF_COORDINATOR="0xec0Ed46f36576541C75739E915ADbCb3DE24bD77" export FROM_BLOCK=56000000 export TO_BLOCK=56100000 export OUT_CSV="vrf_latency_sample.csv" \

# vrf_telemetry.py — minimal import os, csv from web3 import Web3 from statistics import median RPC = os.getenv("RPC_URL") COORDINATOR = Web3.to_checksum_address(os.getenv("VRF_COORDINATOR")) FROM_BLOCK = int(os.getenv("FROM_BLOCK", "0")) TO_BLOCK = int(os.getenv("TO_BLOCK", "latest")) if os.getenv("TO_BLOCK","").lower()!="latest" else "latest" OUT_CSV = os.getenv("OUT_CSV", "vrf_latency_sample.csv") ABI = [ {"anonymous": False,"inputs":[ {"indexed":False,"name":"keyHash","type":"bytes32"}, {"indexed":False,"name":"requestId","type":"uint256"}, {"indexed":False,"name":"preSeed","type":"uint256"}, {"indexed":False,"name":"subId","type":"uint64"}, {"indexed":False,"name":"minimumRequestConfirmations","type":"uint16"}, {"indexed":False,"name":"callbackGasLimit","type":"uint32"}, {"indexed":False,"name":"numWords","type":"uint32"}, {"indexed":True, "name":"sender","type":"address"}], "name":"RandomWordsRequested","type":"event"}, {"anonymous": False,"inputs":[ {"indexed":False,"name":"requestId","type":"uint256"}, {"indexed":False,"name":"outputSeed","type":"uint256"}, {"indexed":False,"name":"payment","type":"uint96"}, {"indexed":False,"name":"success","type":"bool"}], "name":"RandomWordsFulfilled","type":"event"} ] w3 = Web3(Web3.HTTPProvider(RPC)) coord = w3.eth.contract(address=COORDINATOR, abi=ABI) def ts(block_number): return w3.eth.get_block(block_number)["timestamp"] req_logs = coord.events.RandomWordsRequested().get_logs(fromBlock=FROM_BLOCK, toBlock=TO_BLOCK) ful_logs = coord.events.RandomWordsFulfilled().get_logs(fromBlock=FROM_BLOCK, toBlock=TO_BLOCK) requests = {} for ev in req_logs: rid = ev["args"]["requestId"] requests[rid] = { "req_block": ev["blockNumber"], "req_time": ts(ev["blockNumber"]), "sender": ev["args"].get("sender"), "min_conf": ev["args"].get("minimumRequestConfirmations"), } rows, latencies = [], [] for ev in ful_logs: rid = ev["args"]["requestId"] if rid not in requests: continue req = requests[rid] ful_block = ev["blockNumber"] ful_time = ts(ful_block) dt = ful_time - req["req_time"] latencies.append(dt) rows.append({ "requestId": int(rid), "sender": req["sender"], "req_block": req["req_block"], "ful_block": ful_block, "latency_s": dt, "min_conf": req["min_conf"], "success": ev["args"].get("success") }) print(f"Requests: {len(requests)} | Matched fulfillments: {len(rows)}") if latencies: print(f"Latency (s) — min: {min(latencies)} median: {median(latencies)} max: {max(latencies)}") with open(OUT_CSV, "w", newline="") as f: writer = csv.DictWriter(f, fieldnames=rows[0].keys() if rows else ["requestId","sender","req_block","ful_block","latency_s","min_conf","success"]) writer.writeheader(); writer.writerows(rows) print(f"Wrote CSV: {OUT_CSV}") - Requests = VRF randomness asked for (one per round).

- Matched fulfillments = randomness delivered with a valid proof and accepted on-chain; your window might miss late fulfillments.

- Latency (s) = request→fulfillment wall-clock time (confirmations + proof + callback). \n Open the CSV to chart

latency_s, comparesenderdApps, or correlatemin_confwith latency.

Example: The impact of VRF isn’t just theoretical. Many live platforms already use it. For instance, PancakeSwap’s lottery on BSC uses Chainlink VRF so that every draw is publicly verifiable, bringing “unprecedented fairness and transparency” to the process. PoolTogether, a popular no-loss savings lottery, likewise relies on VRF to pick winners in an unbiased way. Even fully on-chain casinos like GamesOnChain (Polygon network) integrate VRF to power their coin flips and raffles, preventing any rigging attempts. These examples show how provably fair randomness is becoming a cornerstone of GambleFi, increasing user trust by eliminating the possibility of hidden bias.

Challenges and Future Outlook

Despite its promise, GambleFi faces important challenges and is subject to uncertainties moving forward. It’s worth tempering the enthusiasm with a look at what could slow down or complicate this revolution in online betting:

- Regulatory Uncertainty: Online gambling has always been a legally complex area, varying country by country. Throwing decentralized crypto platforms into the mix creates even more ambiguity. Many crypto casinos operate in a gray area, and major markets like the U.S., UK, and China have tried to block access to unlicensed crypto betting sites. Regulators are concerned about issues ranging from money laundering to consumer protection. In 2025, some forward-thinking jurisdictions (Malta, Curacao, the UK, etc.) have started updating gambling licenses to account for blockchain-based operators.

- User Adoption and Trust: For many casual users, setting up a Web3 wallet, acquiring cryptocurrency, and using a DApp can be intimidating compared to just logging into a traditional betting site with a credit card. Accessibility and user experience need to improve for GambleFi to reach a broader audience. Ironically, even if the code is provably fair, non-technical users might still feel less secure if there’s no familiar company in charge. Education and transparent operation will be key to gaining the trust of mainstream players.

- Scalability and Performance: Running games on a blockchain can introduce latency and cost (e.g., transaction fees) that traditional casinos don’t face which leads to casinos operating on Layer 2 networks.

Conclusion

GambleFi represents a significant shift in online gambling, injecting the industry with the ethos of decentralization and the rigor of cryptography. By harnessing blockchain technology, decentralized casinos and betting platforms are making games fairer, more transparent, and more accessible than ever before. A roll of the dice or a spin of the slot can now come with a publicly verifiable proof of fairness, a concept that simply didn’t exist in the casino world a decade ago. For players, this means a new level of trust: you no longer have to take the operator’s word that a game isn’t rigged, you can see it on the blockchain.

The rise of GambleFi is also expanding the very definition of gambling. It’s blending with financial engineering (yield-bearing tokens, DeFi liquidity), with digital ownership (NFTs, metaverse casinos), and with community governance (DAO-run platforms). . There will be lessons to learn and bumps along the road, from regulatory battles to technical hiccups, but the momentum suggests GambleFi is here to stay.

For tech readers and blockchain enthusiasts, GambleFi is a case study in how decentralization can disrupt a traditional industry. It demonstrates real-world use of smart contracts and oracles (like VRF for randomness) to solve age-old problems of fairness and trust in a high-stakes environment. In the coming years, as legal frameworks mature and technology continues to improve, we may well see decentralized gambling move from the fringes into the mainstream consciousness. GambleFi has the potential to reshape online wagering, turning it from a closed, opaque system into an open, verifiable, and innovative ecosystem. And if that promise holds, placing a bet online in 2030 might feel as radically different from 2020 as using Uber felt compared to hailing a taxi, a transformative leap powered by tech.

You May Also Like

Egrag Crypto: XRP Could be Around $6 or $7 by Mid-November Based on this Analysis

‘High Risk’ Projects Dominate Crypto Press Releases, Report Finds