In-depth analysis of the misaligned arbitrage opportunities on Pendle

Author:hoeem

Compiled by: johyyn, BlockBeats

Editor's note: In Pendle's DeFi protocol, Yield Token (YT) represents the "future income rights" of a certain income asset. The current market pricing of csUSDL-YT is seriously underestimated. This article calculates the potential value of Coinshift points airdrops and points out that although YT's income is not as stable as PT on the surface, its "points are capital" nature determines its ultra-high leverage potential and airdrop arbitrage value, which can be regarded as one of the most cost-effective gaming opportunities in the current market.

The following is the original content (for easier reading and understanding, the original content has been reorganized)

Can you imagine achieving a 260% ROI with stablecoins in less than two months? Now, there is such a dislocation opportunity in front of us: buy YT-csUSDL on Pendle.

What is YT?

YT is the Yield Token, one of the core mechanisms of Pendle. You can use it to trade the future income rights of a certain income asset.

When csUSDL (Paxos-backed Treasury stablecoin) is tokenized into SY, it is split into two parts:

1. PT (Principal Token): represents fixed income and has lower risk;

2.YT (Yield Token): represents the right to future income, has large fluctuations, but is often underestimated by the market.

The special thing is that in addition to the income, YT can also obtain a large number of airdrop points, but these incomes are often not correctly priced by the market.

Current Arbitrage Opportunities: YT-csUSDL

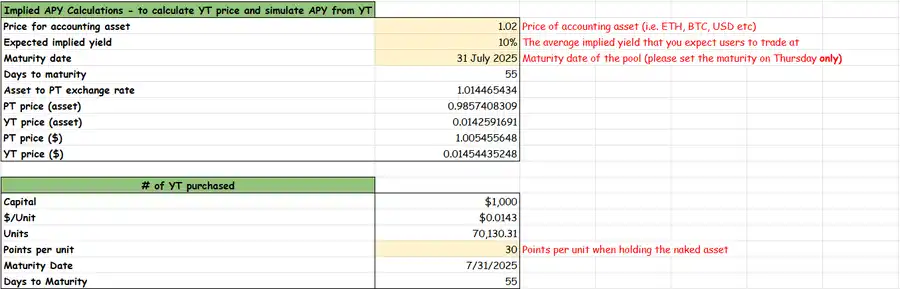

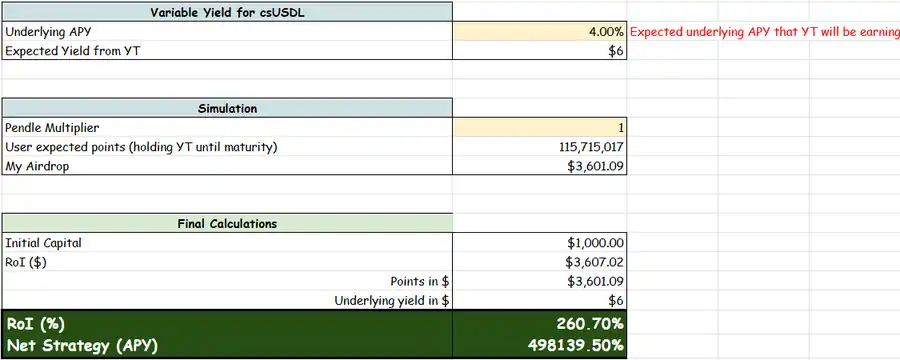

Assume you invest $1,000 and buy csUSDL YT which will expire on July 31, 2025:

- Basic APY (csUSDL): about 4%

- Market Implied APY: About 10%

- Current YT unit price: approximately $0.0143

- Available units: Approximately 70,130

- Pendle Points Multiplier: 1x

- Daily Coinshift Points: 30

It seems like you are paying a high price for a low return. But in fact, the greatest value lies in the point return that has been ignored by the market. At the same time, the core question is obvious: if you can lock in a 10% return, why accept a 4% return? The answer is essentially: Points = Capital.

Why is this operation feasible?

Although most users ignore the yield token (YT) due to the apparent difference in yield (4% vs. 10% of the underlying assets), the misjudgment of its value stems from the failure to price the capitalization of points (Points as Capital) - the 6% implied yield gap reflects the market's systematic underestimation of the value of points. Holding YT can generate 30 SHIFT points per day. If it is held until 55 days, a total of 115,715,017 points will be obtained; the core proposition that needs to be answered at this time is: How to accurately value this implicit capital?

Airdrop value calculation

Holding time: 55 days

Total points income:

70,130 × 30 × 55 = 115,715,017 points

Assumptions:

1. Current total points: 7.6 billion

2. Daily growth: 300 million

3. Airdrop time: 55 days later

4. Estimated total airdrop points: 24.1 billion

5. Airdrop ratio: 5%

6. Token listing valuation (TGE FDV): $150 million

Based on the above estimates, each point is worth approximately $0.0000311

Then your total points value = 115,715,017 × 0.0000311 = $3,601.09

Plus base income of $6

Total return is approximately $3,607.09

That means a ROI of 260.7% was achieved in less than two months!

Conservative estimate

Even if FDV is cut in half to $75 million, a return rate of about 80% can still be achieved; considering that Coinshift's latest financing valuation is $150 million, if investors hope to make a profit, the future market value will most likely be higher, so this valuation is reasonable and has reference value.

Note: The calculation formula for FDV (Fully Diluted Valuation) is: Fully Diluted Valuation = Maximum Supply * Current Price.

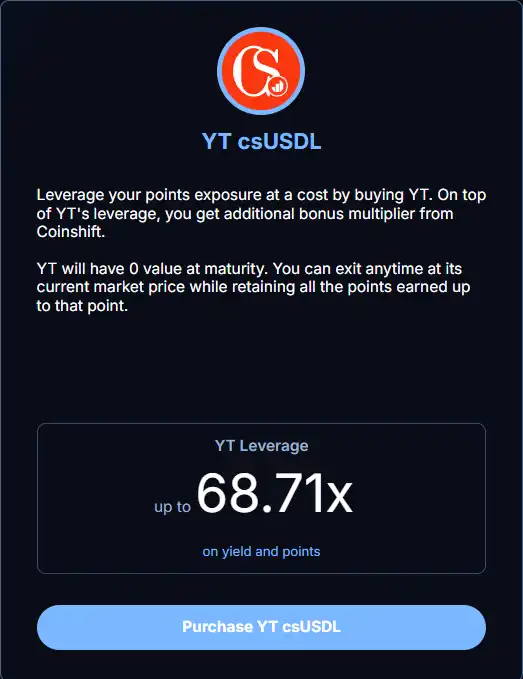

Leverage strategy: 68 times the points income leverage

YT is a highly leveraged asset. You only need to pay 1.5% of csUSDL to buy its future earnings.

This means:

Any increase in earnings will be amplified by leverage;

At the same time, you also get high points rewards (Shift Points);

You can sell or set a limit sell order at any time for flexible exit.

Why is the current market in your favor?

Most DeFi users are scrambling to lock in stable returns on PT, which reduces the implied rate of return on YT and makes it cheaper. For users who know how to analyze mispricing opportunities, the cheaper YT means higher potential returns. Moreover, you can sell YT at any time, or place an order to sell; even if you exit early, you can keep the points you have earned.

Summarize

Use the stablecoin csUSDL to bet on Coinshift airdrops and obtain controllable returns of up to 260% in less than 2 months. It supports withdrawal at any time and is suitable for investors pursuing high-odds opportunities.

YT is not for the "steady yield farmer" who only wants to get 6% return. It is a tool for capital allocators who are willing to take reasonable risks and pursue asymmetric opportunities. If you understand the mechanism of Pendle and have confidence in Coinshift, then this is one of the cleanest arbitrage opportunities in the DeFi market.

Of course, please remember: DYOR, do your own risk simulation, and allocate positions reasonably. Once the market discovers this wave of operations, the price of YT will not go lower.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

TRM Labs Becomes Unicorn with 70M$: BTC Fraud Risk