XRP Price: Jumps 10% as Exchange Outflows and Whale Buying Signal Bullish Momentum

TLDR

- XRP climbed 10% to $1.55 on February 14, marking its largest single-day gain since February 6, 2026.

- Exchange reserves dropped by 700 million XRP since November 2024, indicating investors are moving coins to private wallets.

- Binance and OKX whales purchased over $6.3 million worth of XRP at prices around $1.38.

- Weekly chart analysis shows a fair value gap target at $1.8, representing a potential 20% rally from current levels.

- U.S. spot XRP ETFs recorded net inflows of $4.5 million on February 13, led by Bitwise and Franklin Templeton products.

XRP price jumped 10.10% on February 14, 2026, reaching $1.55. This marked the largest single-day percentage gain for the cryptocurrency since February 6.

XRP Price

XRP Price

The rally pushed XRP’s market cap to $94.18 billion. This represents 3.90% of the total cryptocurrency market cap.

Trading data showed XRP moved between $1.50 and $1.55 during the 24-hour period. Volume reached $3.36 billion, accounting for 3.49% of total crypto trading volume.

Over the past week, XRP gained 8.95%. The cryptocurrency traded in a range of $1.34 to $1.55 during this seven-day period.

XRP remains 57.45% below its all-time high of $3.66. The token reached that peak on July 18, 2025.

Exchange Reserves Drop as Holders Move Coins

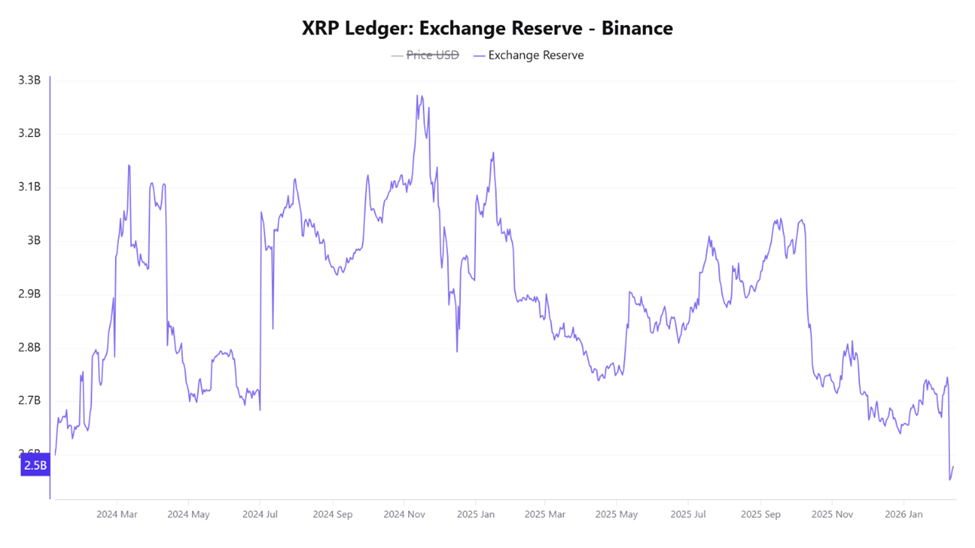

Binance XRP reserves have declined sharply since late 2024. Data shows reserves peaked at over 3.2 billion XRP in November 2024.

Source: CryptoQuant

Source: CryptoQuant

Since then, approximately 700 million XRP have left the exchange over 15 months. This outflow pattern typically signals accumulation behavior.

When investors move coins from exchanges to private wallets, it reduces available supply for selling. Lower exchange reserves can support upward price movement by tightening the market.

Net outflows from exchanges have slowed recently. This suggests the heavy selling phase following the decline from $3 may be easing.

Whale Activity Shows Strong Buying Interest

Large investors on Binance and OKX have been accumulating XRP. Data from Coinglass shows whales buying at average prices around $1.38.

Binance whales purchased and longed over $6.3 million worth of XRP in a single day. Meanwhile, large investors on Coinbase sold approximately $1.02 million worth of the token.

The buying pressure outweighed the selling. This helped fuel the 6% rally in XRP price over 24 hours.

Chart Analysis Points to $1.8 Target

The weekly chart shows XRP consolidating around $1.40 to $1.45. Price action has calmed after a rally earlier in 2025 that pushed the token above $3.

A fair value gap exists approximately 20% above current levels. This gap aligns with a potential target of $1.8.

The latest weekly candle traded at $1.45, up 1.27% from its opening price. A close above the opening level would indicate building momentum.

The RSI indicator stood at 31.91 on the weekly timeframe. This reading sits just above oversold territory, suggesting selling pressure may be exhausting.

ETF Inflows Remain Steady

U.S. spot XRP ETFs recorded net inflows of $4.5 million on February 13. Bitwise’s XRP ETF led with $2.52 million in inflows.

Franklin Templeton’s XRPZ product added $1.53 million. These inflows remain modest but consistent.

The steady institutional interest through ETF products helps stabilize market sentiment. It provides ongoing support for the price even as individual investors trade more actively.

XRP traded at $1.45 in the most recent 24-hour period analyzed, showing a 6% increase. The combination of declining exchange reserves, whale accumulation, and positive ETF flows continues to shape market dynamics heading into mid-February 2026.

The post XRP Price: Jumps 10% as Exchange Outflows and Whale Buying Signal Bullish Momentum appeared first on CoinCentral.

You May Also Like

XRP koers stijgt 9%, maar analist waarschuwt voor mogelijke daling naar $0,75-$0,65

Vietnam Greenlights Elon Musk’s Starlink in Game-Changing Move to Transform Nationwide Internet Access