NFT market picks up: Multiple leading projects announce coin issuance plans, blue chip projects become the main force of recovery

Author: Nancy, PANews

Recently, with the announcement of major coin issuance plans by leading projects such as Magic Eden and Pudgy Penguins, confidence in the NFT market has been effectively rekindled, driving a strong rebound in prices and trading volumes.

NFT airdrop wave is coming, and many leading projects announced their coin issuance plans

A new round of coin issuance is coming, and the airdrop event of the NFT trading market Magic Eden was the first to ignite this wave of NFT craze.

A few days ago, Magic Eden officially launched TGE (Token Generation Event) and quickly landed on major exchanges. The sunshine-like airdrop became a hot topic in the community. While attracting attention with the airdrop activities, Magic Eden also took the opportunity to frequently announce a series of product trends, including allowing users to use ME tokens to trade Solana NFTs, the next version allows users to trade all assets on all chains, and launch community-first features. According to Jack Lu, co-founder of Magic Eden, the launch of ME tokens is just the beginning, and there are more plans to follow. These measures have also further increased the attention of Magic Eden and the entire NFT market.

At the same time, as another major trading platform, OpenSea has also sparked airdrop speculation. According to a recent post on social media by Mike Dudas, co-founder of The Block, OpenSea has registered a foundation in the Cayman Islands. Since foundations are usually non-profit organizations, they can effectively prevent tokens from being considered securities, so this registration behavior is widely regarded as a preparation for token issuance. It is worth mentioning that OpenSea announced last month that it will launch a new version in December, and the internal test version shows that it may launch a loyalty program and retroactive rewards.

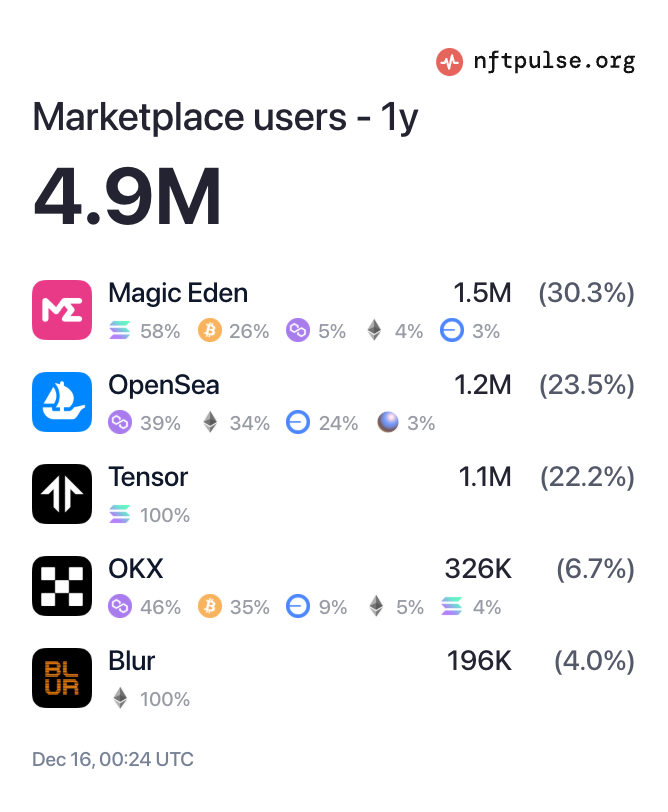

According to the latest data from nftpluse, in the past year, OpenSea ranked second in the NFT trading market with about 1.2 million users and a market share of 23.5%, second only to Magic Eden. Once OpenSea starts airdropping, its huge user base may ignite enthusiasm in the NFT market again.

In addition, the leading NFT project Pudgy Penguins also announced its TGE plan during this period, allocating about a quarter of the total tokens to the community. According to the analysis of X user @BTCThinker88, Pudgy Penguins' PENGU token airdrop may become one of the largest wealth creation events in 2024, and the average airdrop income per holder is expected to reach 31,000-61,000 US dollars. Given that Pudgy Penguins CEO Luca Netz previously revealed that the PENGU token has not yet been snapshotted, the NFT has quickly become one of the hottest targets in the market.

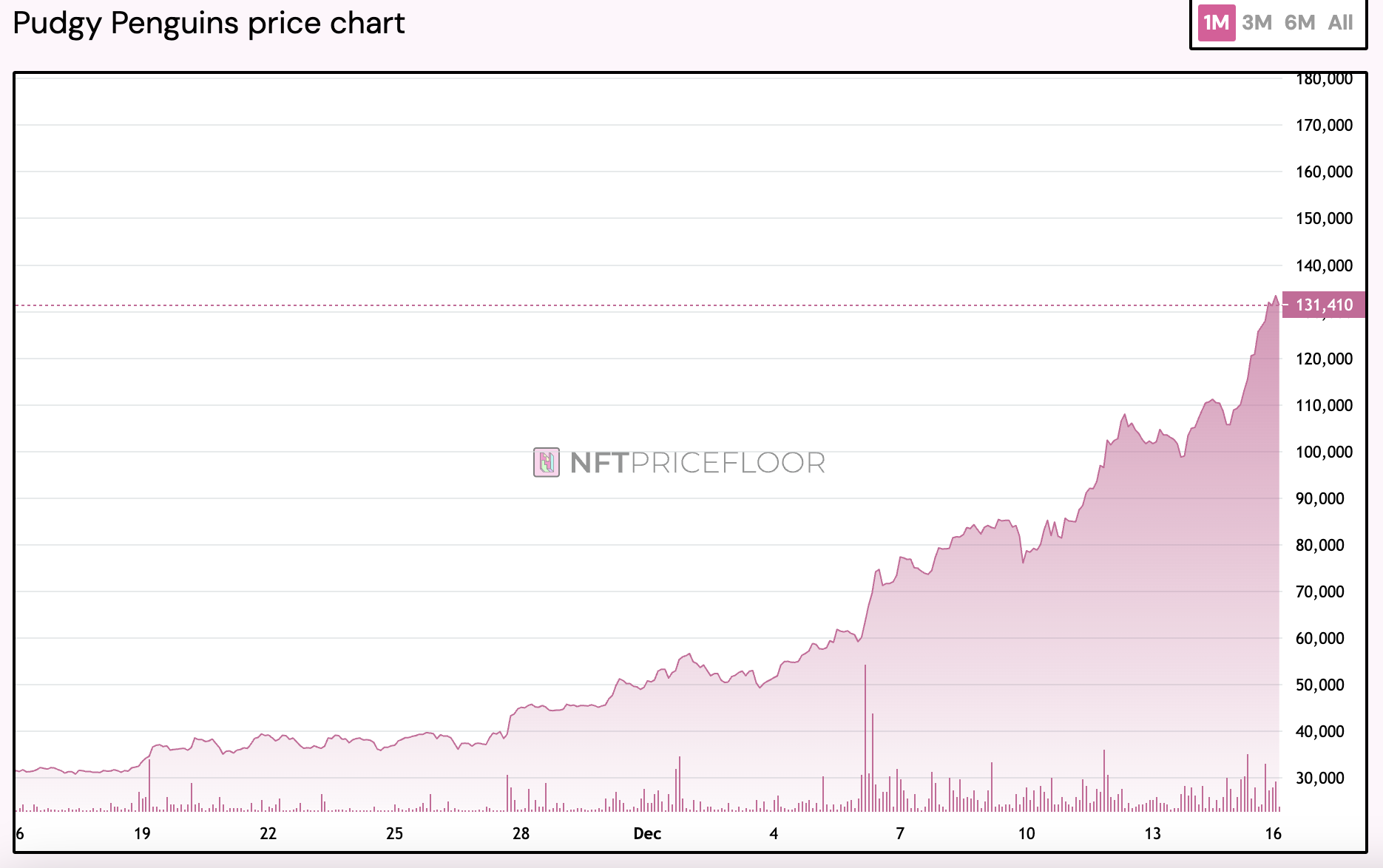

According to NFT Price Floor data, as of December 16, the floor price of Pudgy Penguins has soared to 33.7 ETH, an increase of more than 236.9% in the past 30 days, and the monthly trading volume is as high as 160 million US dollars. At present, the market value of Pudgy Penguins is close to 1.2 billion US dollars, surpassing BAYC, the boring ape, and second only to CryptoPunks, which has the highest market value.

Blue chip projects become the main force of NFT's strong rebound

At present, blue-chip NFT projects are showing strong growth and trading volume, becoming the main driving force for market recovery.

CryptoSlam data shows that in the past 30 days, the total transaction volume of the NFT market was approximately US$720 million, among which transactions on Ethereum, Bitcoin and Immutable all achieved double-digit growth, showing a strong market recovery momentum.

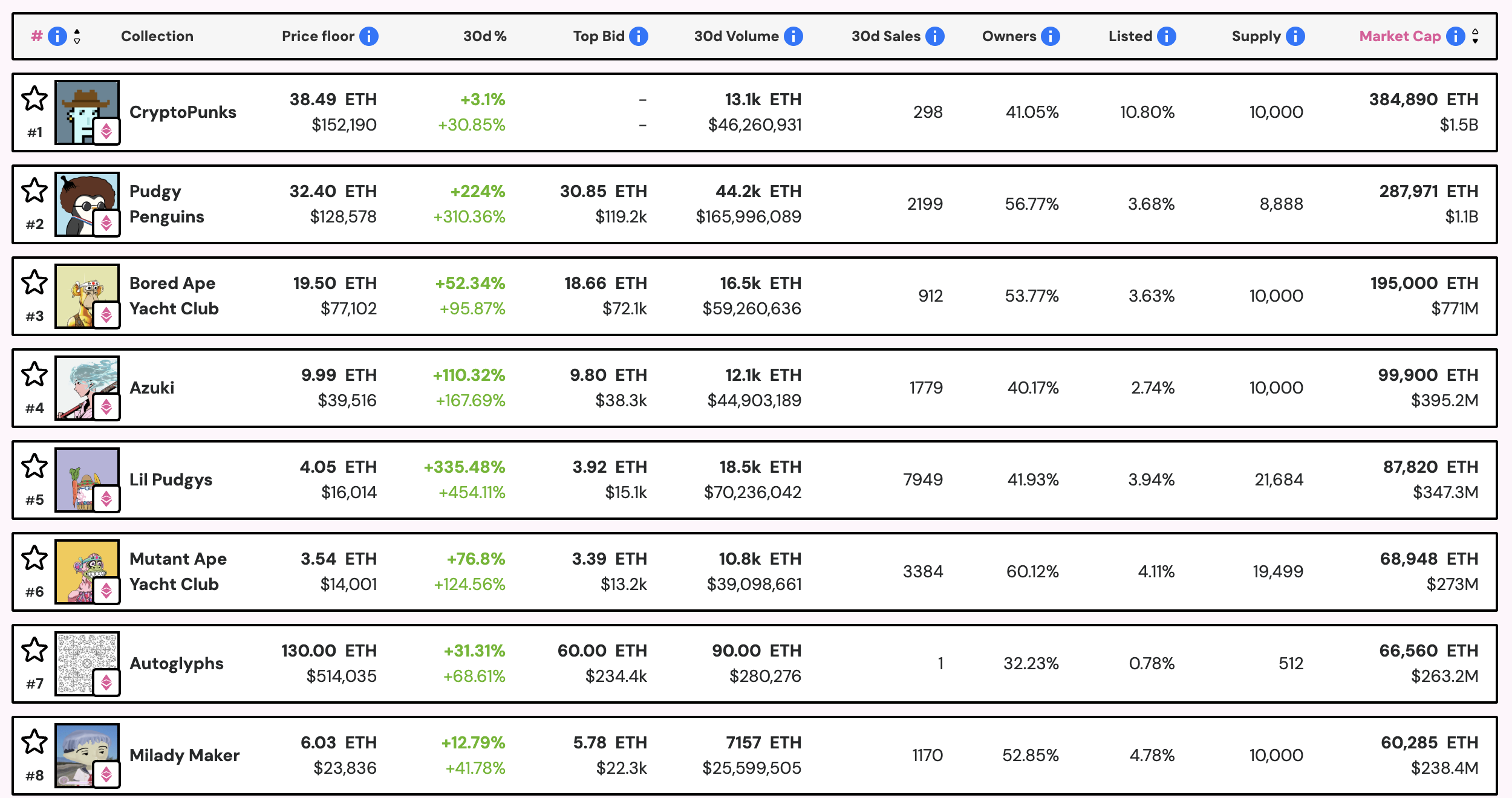

During the market recovery, the main contribution to transaction volume came from blue-chip NFT projects. According to statistics from NFT Price Floor, in the past 30 days, the top ten NFT projects by market value have completed a total transaction volume of US$470 million, accounting for about 64.9% of the overall market, among which Pudgy Penguins, Lil Pudgys and Bored Ape Yacht Club ranked at the top in terms of transaction volume.

At the same time, the market recovery is also reflected in the price performance of blue-chip NFTs. NFT Price Floor data shows that in the past 30 days, the floor price of the top 10 NFTs has increased by an average of 91.7% (calculated in currency terms), among which Pudgy Penguins, Lil Pudgys and Azuki have increased particularly well. This further verifies the huge driving effect of airdrop activities on trading volume and floor prices, and also demonstrates the strong resilience of blue-chip projects.

From the perspective of market performance in more subdivided sectors, the rising momentum of utility NFT and PFP/Avatar is the most obvious. According to NFT Price Floor data, the market value of these two sectors has increased by more than 85%. In contrast, the performance of game NFT and ancient NFT is relatively flat and has not yet kept up with the pace of market recovery.

"The market is about to usher in the most prosperous NFT bull market in history. AI will become extremely rich, and since it cannot buy physical luxury goods, AI will turn to buying NFTs." Andrew Kang, partner of Mechanism Capital, predicted in an article not long ago.

Animoca Brands co-founder Yat Siu also said recently that the NFT market will usher in a strong rebound. Although there have been some failures in the field, NFT will continue to rise as a status commodity.

VanEck pointed out in its "Top Ten Cryptocurrency Predictions for 2025" that despite the challenges faced by NFT, some outstanding projects have surpassed speculative value through strong community ties and successfully resisted the downward trend. For example, Pudgy Penguins has successfully transformed into a consumer product through collectible toys, Miladys has gained cultural status in the field of satirical online culture, and Bored Ape Yacht Club has developed into a leading force in global culture. VanEck believes that new wealthy users will invest in NFTs not just as speculative investments, but as assets with lasting cultural and historical significance, and predicts that the annual transaction volume of NFTs is expected to reach US$30 billion, accounting for about 55% of the peak in 2021.

Overall, blue-chip projects are undoubtedly the core force in the recovery of the NFT market. Although the overall market recovery still faces uncertainties, the arrival of the airdrop wave has effectively stimulated market sentiment in the short term.

You May Also Like

Regulatory Clarity Could Drive 40% of Americans to Adopt DeFi Protocols, Survey Shows

Michael Burry’s Bitcoin Warning: Crypto Crash Could Drag Down Gold and Silver Markets