HBAR Price Faces $0.150 Survival Test as Bearish Sentiment Deepens

The post HBAR Price Faces $0.150 Survival Test as Bearish Sentiment Deepens appeared first on Coinpedia Fintech News

The HBAR price is trying to look resilient at $0.100, but the derivatives market isn’t buying the optimism. Beneath the surface, funding data and futures positioning suggest traders are still leaning bearish even after last week’s headline boost.

Funding Flips, Bears Take Control

Let’s start with the mood check. According to Coinglass OI-weighted funding rate data, the metric still turned negative on Monday and stands at -0.0048% on Tuesday. That may look minor, but it tells a clear story that short sellers are paying longs. In other words, more traders are betting on downside than upside.

That shift matters. As negative funding rate often reflects sustained bearish positioning, and right now it suggests that confidence in a rebound is thin. The broader HBAR price chart mirrors this hesitation, with upside attempts struggling to gain traction beyond short-term bounces.

Meanwhile, futures open interest has slid to $108.82 million, continuing a steady decline. Falling OI typically signals waning participation. Traders are stepping back. Liquidity is thinning. And that’s rarely a sign of aggressive accumulation.

FedEx Boost, Short-Term Spark

Now here’s where it gets interesting. After the announcement that FedEx would join the Hedera Council, the HBAR price caught a short-term bid and pushed back toward the $0.100 level. That kind of corporate association tends to generate headlines and, briefly, demand.

But let’s be real: price reaction alone doesn’t erase broader sentiment.

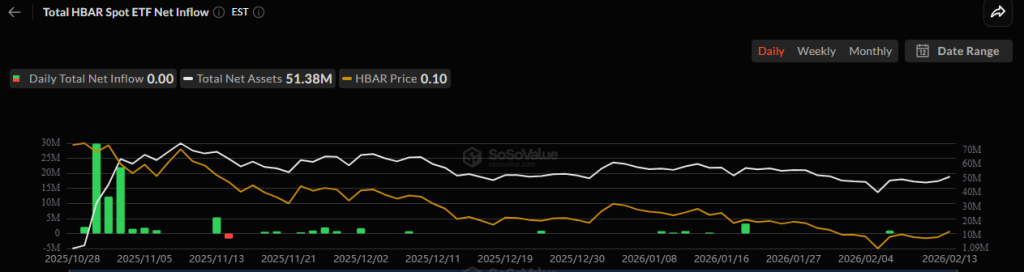

ETF flows aren’t providing much backup either. The last recorded inflows were close to $1 million on February 6. Since then? Nothing. In fact, most trading days since launch have seen zero inflows, with only a handful posting positive numbers. That’s hardly the kind of consistent institutional appetite that shifts a trend.

So while the FedEx development last week added a spark, it hasn’t translated into sustained capital rotation into HBAR/USD markets.

The $0.150 Survival Zone

Technically, $0.150 is shaping up as the line in the sand. If HBAR price prediction manages to climb back toward that zone from CMP of $0.100, it could act as a short-term magnet. But indicators suggest the move may face exhaustion there. RSI currently sits at 52.07 neutral territory, but with room to stretch. A push toward $0.150 could drive it into overbought conditions.

At the same time, CMF at -0.02 shows tentative recovery, yet similar setups in July and October stalled between $0.14 and $0.18 before price rolled over again. That historical context weighs on any aggressive HBAR price prediction.

Interestingly, AO and MACD are showing growing bullish momentum, though both remain below the zero line. That suggests upside potential may continue at least until major resistance is tested.

So what’s next? If the HBAR price breaks and sustains above $0.150 in Q1 2026, the structure could shift. But if it remains suppressed beneath that ceiling, the probability of further lows stays firmly on the table.

You May Also Like

Your 24/7 Market Watchdog: Sleep Soundly While Technology Tracks the Charts

This U.S. politician’s suspicious stock trade just returned over 200% in weeks