Pippin (PIPPIN) Dips 20% Daily: Brutal Collapse on the Way?

The meme coin pippin (PIPPIN) is deep in red territory today (February 17) after posting substantial gains over the past few weeks.

The question now is whether this will be a temporary correction or the beginning of a major collapse.

What Comes Next?

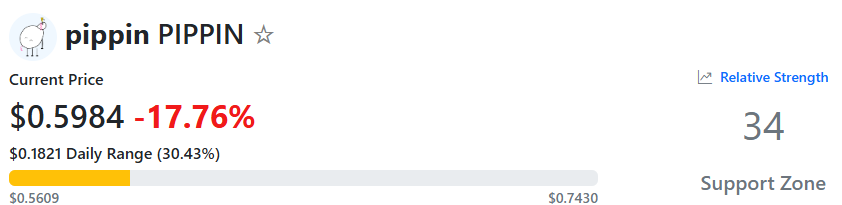

The asset’s price has retraced by nearly 20% on a daily scale and now trades at around $0.59 (per CoinGecko’s data). PIPPIN’s market capitalization has tumbled below $600 million, putting it at risk of losing its prestigious spot among the 100 largest cryptocurrencies.

Several analysts have recently warned that the meme coin could be a high-stakes gamble, advising traders to stay away from it. Earlier this week, X user Ted said he doesn’t know a single person who holds PIPPIN and wondered what might have driven the rally.

He thinks the whole thing is “a CEX cabal play,” similar to Mantra (OM). In crypto slang, “cabal” refers to a small, coordinated group of insiders who are believed to manipulate a token’s price with their actions. Recall that just a year ago, OM was worth almost $9, whereas its market cap briefly exceeded $8 billion. Since then, the asset has crashed by staggering 99%.

Crypto Rug Muncher shared a similar thesis. The X user argued that the only people still active in the PIPPIN ecosystem are “the cabal members who crimed it to $700 million MC in the first place.”

Crypto GVR and ALTSTEIN TRADE also gave their two cents. The former spotted the price reversal that occurred in the past hours to forecast that a major collapse to $0.10 may be coming next. The latter argued that PIPPIN’s “top is in,” predicting that all the gains will be lost and that the valuation will tumble below $0.10.

Something for the Bulls

Despite the grim forecasts from the aforementioned analysts, the meme coin’s Relative Strength Index (RSI) suggests a short-term rebound could be on the horizon.

The technical analysis tool tracks the speed and magnitude of recent price changes and helps traders spot potential turning points. It runs on a scale from 0 to 100, and ratios below 30 indicate that PIPPIN is oversold and might be on the verge of a resurgence. On the contrary, readings above 70 are considered precursors of a correction. Currently, the RSI stands just north of the bullish zone.

PIPPIN RSI, Source: RSI Hunter

PIPPIN RSI, Source: RSI Hunter

The post Pippin (PIPPIN) Dips 20% Daily: Brutal Collapse on the Way? appeared first on CryptoPotato.

You May Also Like

Your 24/7 Market Watchdog: Sleep Soundly While Technology Tracks the Charts

This U.S. politician’s suspicious stock trade just returned over 200% in weeks