Charles Schwab Investment Management, Schwab’s asset management unit, boosted its stake in Strategy (MSTR), the largest Bitcoin treasury company, in the fourth quarter of 2025, according to a recent SEC filing.

The wealth management arm added 91,859 MSTR shares during the quarter, bringing its total position to nearly 1.3 million shares valued at $193 million at the time of reporting.

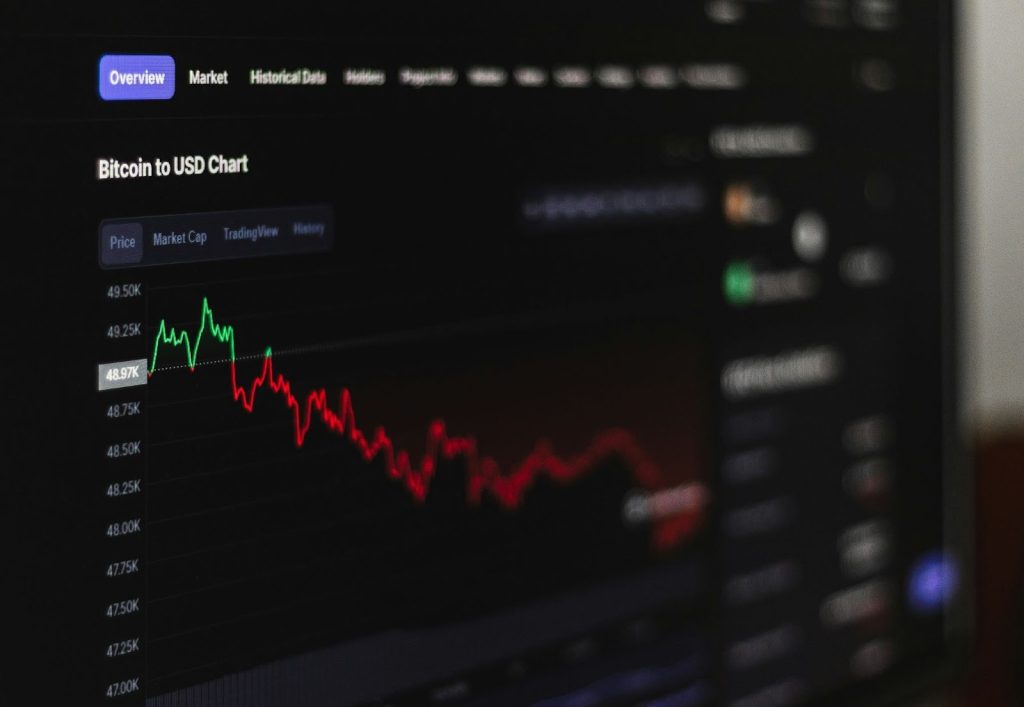

MSTR ended 2025 at approximately $152, representing a 65% decline from its peak. The stock edged lower after the market opened on Tuesday, trading at about $127 at press time, per Yahoo Finance.

Strategy, the enterprise software company that has established itself as a vehicle for Bitcoin accumulation, has drawn significant backing from traditional finance. The firm holds approximately 717,131 BTC worth roughly $48 billion.

The fund manager’s crypto-related holdings included 229,000 shares of TON Strategy, down from 286,000 in Q3, and 6,713 shares of BlackRock’s iShares Bitcoin Trust (IBIT), slightly higher than in the prior quarter.

Schwab also reported a $5,3 million share position in American Bitcoin Corp., the Bitcoin-focused company founded by Donald Trump Jr. and Eric Trump.

Source: https://cryptobriefing.com/charles-schwab-increases-stake-bitcoin-treasury-strategy/