Aave Launches Horizon, Letting Firms Borrow USDC, RLUSD, and GHO Against Tokenized Assets

TLDR:

- Aave Horizon allows stablecoin borrowing against tokenized Treasurys and collateralized loans.

- Chainlink powers Horizon with Onchain NAV, offering real-time net asset values for collateral.

- Horizon supports USDC, RLUSD, and GHO, providing predictable liquidity for institutions.

- Aave’s treasury hit $132.7M, reflecting 130% growth, showing protocol revenue strength.

Aave Labs has rolled out Horizon, a new platform aimed at institutional borrowing. The system allows stablecoins to be borrowed using tokenized real-world assets, including U.S. Treasurys and collateralized loan obligations.

Horizon is built on a permissioned version of Aave V3, designed to meet compliance requirements. Institutions can now post tokenized securities as collateral to access USDC, RLUSD, and GHO with consistent liquidity. The platform combines permissioned collateral with permissionless stablecoin markets to preserve DeFi composability.

Stani Kulechov, Aave founder, described Horizon as a foundation for large-scale lending markets, offering the liquidity institutions need to operate onchain. The launch marks the next phase in Aave Labs’ institutional RWA strategy, first unveiled in March under its parent entity, Avara.

With over $25 billion in tokenized real-world assets already onchain, Horizon seeks to unlock their utility.

Aave’s Horizon Platform: Institutional Borrowing With Stablecoins

Horizon targets qualified institutions, allowing them to borrow stablecoins while using tokenized assets as backing. Borrowers gain access to markets 24/7, supported by predictable liquidity.

Collateral types at launch include tokenized Treasury and yield funds from Circle, Superstate, Centrifuge, and VanEck. By separating permissioned collateral from open stablecoin markets, Horizon maintains DeFi interoperability while meeting regulatory expectations.

The platform integrates partners such as Centrifuge, Superstate, Circle, RLUSD, Ant Digital Technologies, Ethena, KAIO, OpenEden, Securitize, VanEck, Hamilton Lane, WisdomTree, and Chainlink.

Each partner contributes to creating a compliant, functional ecosystem that supports institutional requirements. The platform’s roadmap includes future features like Proof of Reserves and SmartAUM integrations to increase transparency and trust.

Chainlink-Powered Collateral Data and Treasury Growth

Chainlink provides Horizon’s core data layer through its Onchain NAV feed. This feed delivers real-time net asset values of tokenized funds, enabling automated, overcollateralized lending.

The integration ensures institutions can monitor the value of collateral accurately at all times.

Meanwhile, Aave’s treasury excluding AAVE tokens reached an all-time high of $132.7 million, reflecting a 130% increase in reserves.

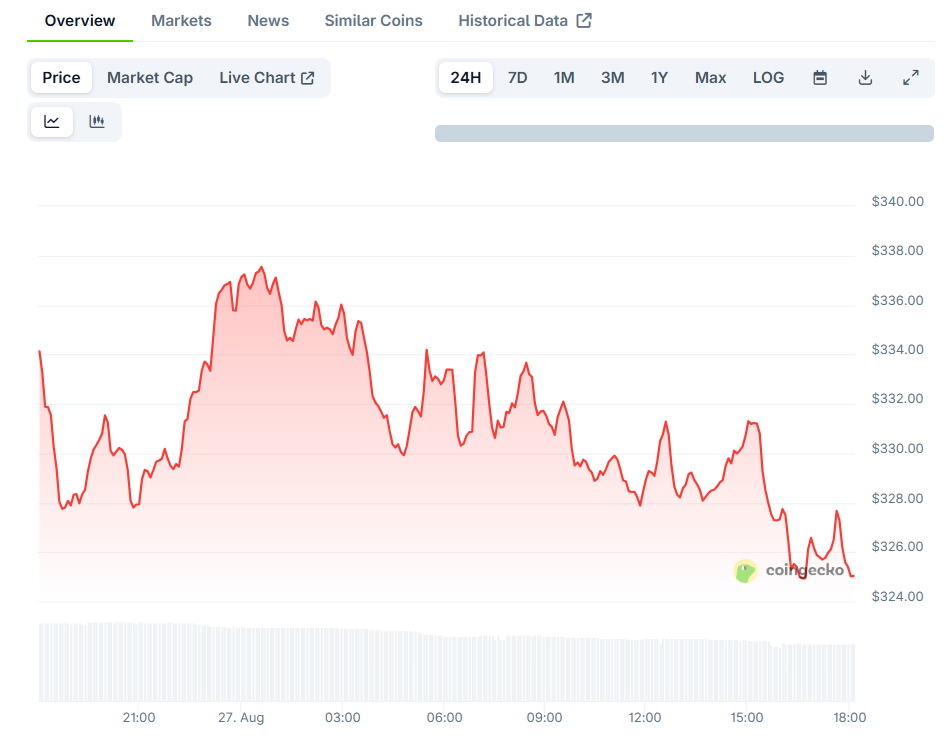

BlockchainBaller tweeted that this demonstrates how DeFi blue chips are building revenue-driven ecosystems. Price data from CoinGecko shows Aave (AAVE) trading at $327.56, down 1.16% in 24 hours but up 13.82% over seven days.

AAVE price on CoinGecko

AAVE price on CoinGecko

Horizon represents a structured move by Aave Labs to bring compliance-ready, onchain lending solutions to institutions. By combining tokenized RWAs, stablecoin liquidity, and Chainlink’s real-time data, it establishes a clear path for borrowing at scale.

The post Aave Launches Horizon, Letting Firms Borrow USDC, RLUSD, and GHO Against Tokenized Assets appeared first on Blockonomi.

You May Also Like

nLIGHT to Announce Fourth Quarter and Full Year 2025 Financial Results on February 26th

When silver became a meme stock, retail investors ultimately caught the falling knife.