The largest airdrop of the year? Hyperliquid airdropped $28,500 per person, and the popularity of HYPE brought new gold rush

Author: Frank, PANews

The long-awaited event finally came. On November 29, the decentralized derivatives exchange Hyperliquid announced the creation of its native token HYPE. After the token went online, the price of HYPE continued to rise, from the opening price of $2 on November 29 to the highest price of $9.8 on December 1, an increase of nearly 5 times in less than 3 days.

Compared with other large airdrop projects this year, HYPE's market performance is really amazing. In this airdrop, Hyperliquid distributed a total of 310 million tokens. Even if calculated at the opening price of $2, the airdrop scale reached $620 million. Among the airdrops this year, it is definitely one of the largest airdrop projects.

But strangely, in the early stage of Hyperliquid's airdrop, few Chinese KOLs discussed it on social media, and not many Chinese bloggers "showed off their orders" afterwards. It seems that those KOLs who focused on making money collectively missed this wave of real big money.

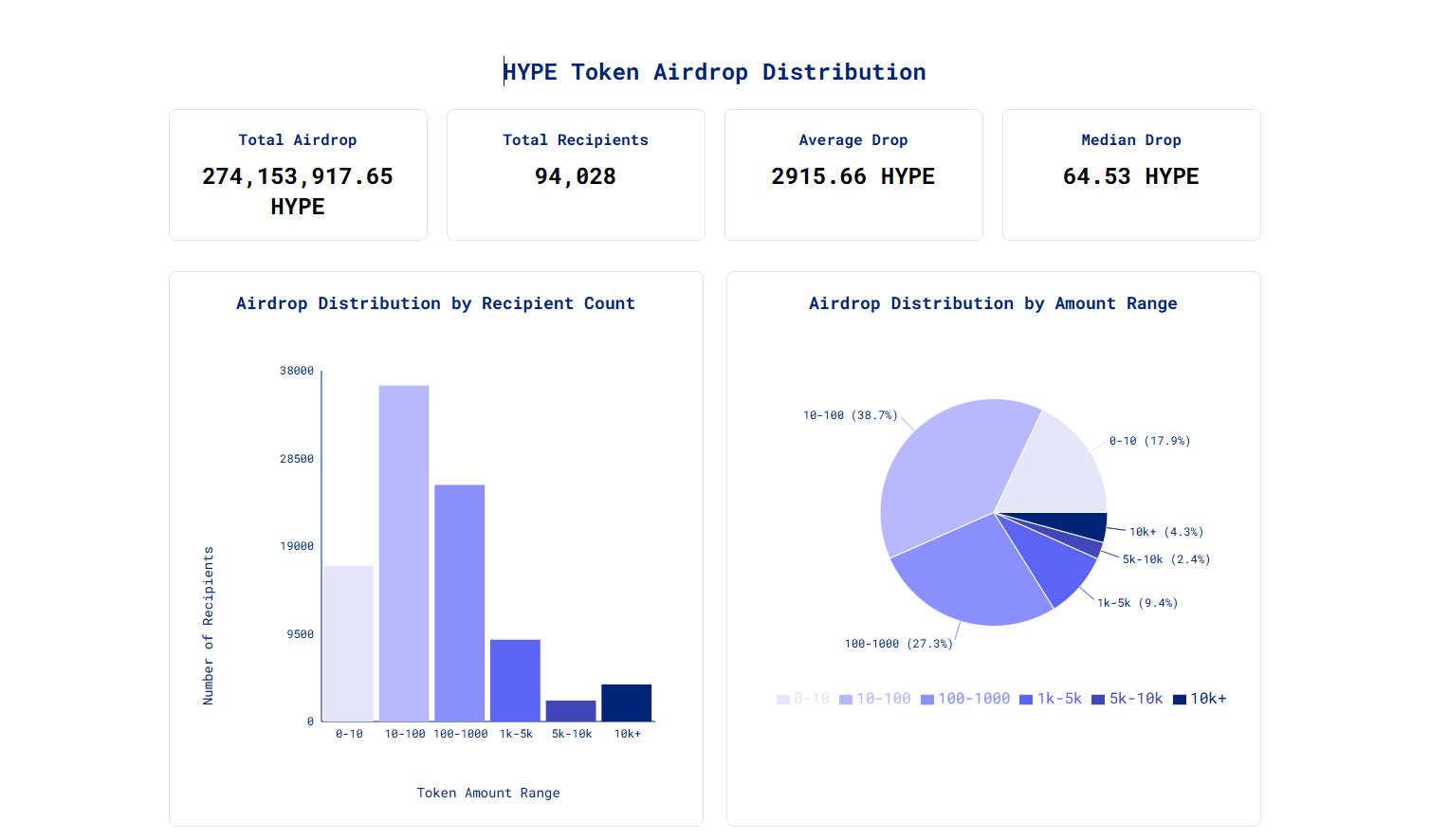

Airdrops were sent to 94,000 addresses, with the highest airdrop reaching nearly 10 million US dollars

According to ASXN Data, the actual number of Hyperliquid airdrops was about 274 million tokens (some users missed the opportunity to receive them because they did not sign the Genesis Event terms). A total of 94,000 addresses received airdrops, with an average of 2,915 HYPE per address, which is equivalent to $28,500 based on $9.8 on December 1. From this perspective, Hyperliquid is indeed one of the largest airdrops this year.

But behind the average of 2,915 tokens is the 80/20 rule. The average is pulled up by the big airdrop holders, and the median airdrop is only 64.53 tokens. From the overall proportion, about 38.7% of users received between 10 and 100 tokens, and 17.9% of users received less than 10 tokens. Therefore, about 56.6% of users received no more than 100 tokens. And the proportion of accounts that received less than 1,000 tokens was 83.9%. From this point of view, most people did not reach the average level of 2,915 tokens, but even if calculated in hundreds of dollars, Hyperliquid's airdrop can be exchanged for an Apple phone.

The highest number of coins claimed by a single address is 970,000. Based on the price of $9.8, the airdrop scale of this address can reach $9.56 million. It should become the single address with the highest claim value in the 2024 airdrop project (the largest single address of Starknet is $360,000, and the largest single address of Jupiter is $130,000).

Bringing in 10,000 new users 2 days after the airdrop

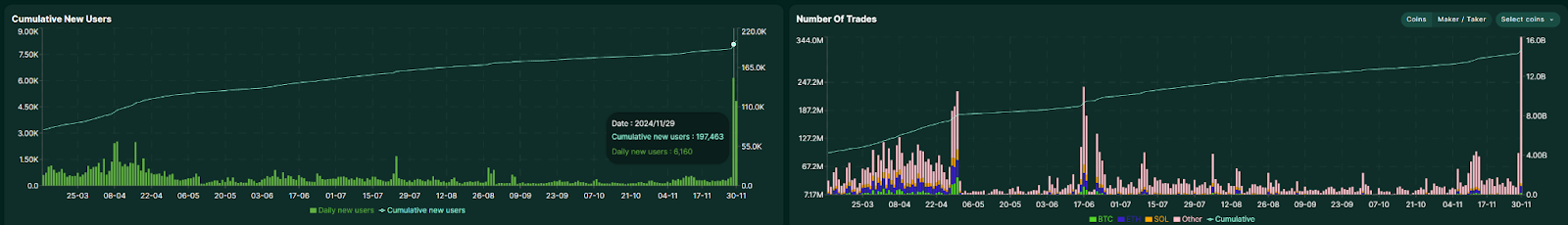

Although there was not much publicity on social media, the result of the luxury airdrop still brought a lot of new users to Hyperliquid. According to historical data, before the airdrop, Hyperliquid's daily new users basically remained below 500, and in most cases only around 150 new users. On November 29 and 30, 10,993 new users were added in two days, even exceeding the number of new users in the past month. On November 30, the total number of transactions exceeded 3.44 million, an increase of more than 10 times compared to before the airdrop.

However, the surge in user activity did not seem to bring much change in trading volume. The total trading volume on November 29 and November 30 was about US$1.8 billion and US$1.9 billion, which did not form a significant increase. However, compared with the precipitous decline in the number of users of other projects after the airdrop, Hyperliquid's performance is indeed somewhat unique.

The growth trend of Hyperliquid has already been formed. According to data from defillama, Hyperliquid Perp ranks second among all derivatives protocols, slightly lower than Jupiter Perpetual. On November 17, Hyperliquid briefly surpassed Jupiter to become the first. In July of this year, Hyperliquid ranked fourth, after GMX and DYDX. As a rising star in decentralized derivatives exchanges, Hyperliquid's rise has already begun.

Hyperliquid ecosystem tokens collectively surged

As of December 1, HYPE’s market value peaked at over $3.3 billion, ranking around 44th among all tokens, on par with OKB. ARB’s market value is currently around $4 billion, and if HYPE’s price continues to rise, it is possible that it will directly surpass ARB.

For those who received the airdrop, the sharp rise of HYPE is undoubtedly the best booster. On social media, many KOLs said that Hyperliquid is the conscience of the year compared to those airdrops that raised a lot of money but designed complex rules and user games. Some users also said that HYPE is currently just a stand-alone coin and can only be traded on Hyperliquid.

With the popularity of HYPE, Hyperliquid seems to have become a new gold mine. In addition to HYPE, other tokens on Hyperliquid have also risen rapidly with this wave of popularity. From November 29 to December 1, the native trading currencies on Hyperliquid, such as PURR, JEFF, and HFUN, have seen a sharp rise. In particular, JEFF (a MEME coin based on Hyperliquid founder Jeff) has seen the highest increase of nearly 10 times in three days. OMNIX, OMNIX, and OMNIX have also doubled in recent days.

However, it remains unknown how long this strong upward trend can last.

So far, Hyperliquid's on-chain deposits and withdrawals still need to be bridged through Arbitrum. More than 60% of the USDC tokens on the Arbitrum chain are held by Hyperliquid addresses. This seems to be a mutually beneficial process. Hyperliquid brings sufficient active addresses and active funds to Arbitrum, and Arbitrum provides Hyperliquid with stable and cheap infrastructure before the mainnet is launched.

As of now, Hyperliquid has not accepted any investment. The Hyperliquid Foundation stated in the announcement of the Genesis event that in the token distribution: "There is no allocation to private investors, centralized exchanges or market makers." Previously, PANews had conducted in-depth research on Hyperliquid's development concept and other contents. (Related reading: The market value of the top MEME coin is over 100 million US dollars. Will the L1 public chain Hyperliquid, which focuses on derivatives trading, be the new MEME gold mine? )

According to Hyperliquid's official information, Hyperliquid EVM has been launched on the test network, but the integration with other L1 states has not been completed. In the short term, it seems that it will not be possible to use cross-chain bridges for asset transfers like other L1s. In addition, as an L1, Hyperliquid's ecosystem is not sound, and everything from browsers to DEX is Hyperliquid's self-operated model. This route seems to have both advantages and disadvantages. The advantage is that all technological innovations and development focuses on the performance improvement of decentralized derivatives exchanges, serving to build a decentralized Binance. The disadvantage is that it may be difficult to expand brand influence by expanding the ecosystem.

From the perspective of Hyperliquid's official social media operations, it is clear that it publishes almost no content except announcements. This is a kind of persistent simplicity, but in the crypto field that is keen on hype and hype, it is indeed unique.

However, the popularity of Hyperliquid in recent days has once again confirmed that any marketing tricks are insignificant in the face of price increases.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

Trump foe devises plan to starve him of what he 'craves' most