Particle Network’s modular L1 to launch on Avalanche

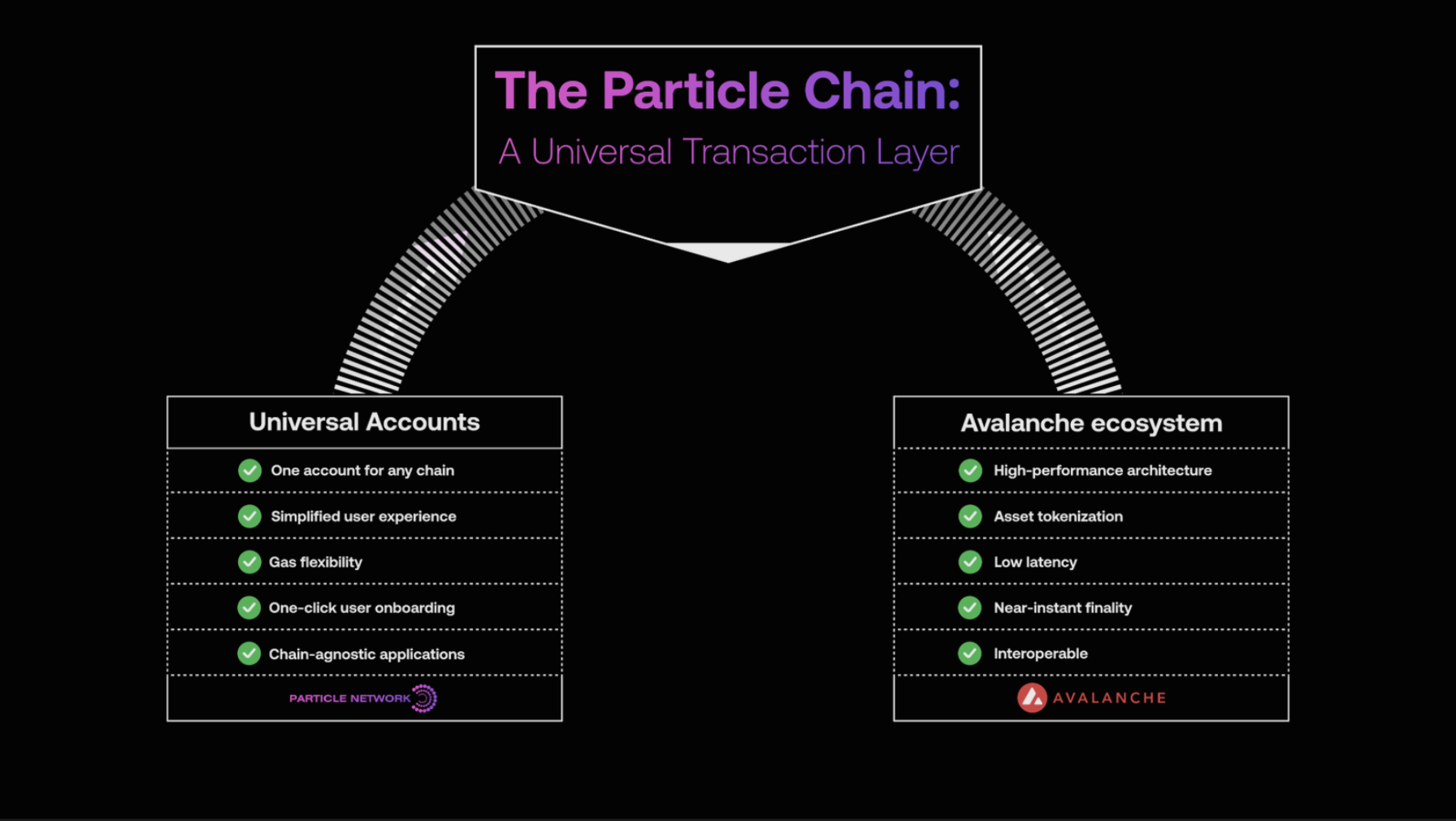

Particle Network will launch its modular layer 1, Particle Chain, on Avalanche, enabling seamless cross-chain transactions with sub-second finality.

- Particle Network will launch its modular Layer-1 blockchain, Particle Chain, on Avalanche.

- By anchoring settlement and coordination on Avalanche, Particle Chain gains sub-second finality, high reliability for institutional assets, and scalable infrastructure.

Particle Network (PARTI) will launch Particle Chain, its modular Layer-1 blockchain designed to coordinate and settle transactions across multiple blockchains, on Avalanche.

Previously, Particle Network’s Universal Accounts relied on underlying chains for settlement, which varied in speed and reliability. By anchoring settlement on Avalanche, Particle Chain ensures sub-second finality and proven stability for high-value environments.

Particle Network’s journey to Avalanche launch

Before launching on Avalanche, Particle Network built the foundation for its cross-chain solution through a series of deliberate steps. The company first developed a modular Layer-1 blockchain using the Cosmos SDK and CometBFT, designed to coordinate and settle transactions across multiple chains rather than host general-purpose smart contracts. This blockchain supports three core features: Universal Accounts, Universal Gas, and Universal Liquidity.

In May last year, Particle Network released a public testnet, allowing users to create Universal Accounts and explore cross-chain functionality. Simultaneously, the company forged partnerships with blockchain ecosystems including Berachain, Arbitrum, and zkSync, extending interoperability and preparing its chain abstraction technology for broader adoption. According to the company’s website, Particle Network now supports over 80 chains and more than 5,000 dApps.

Particle Network’s mainnet first went live in Q3 last year, marking its initial full deployment of Universal Accounts, Universal Liquidity, and Universal Gas on mainnet.

Furthermore, the company launched its first chain-abstracted application—UniversalX—on mainnet in December last year. This dApp was the first real-world implementation enabling chain-agnostic trading using Universal Accounts.

You May Also Like

Marathon Digital BTC Transfers Highlight Miner Stress

This U.S. politician’s suspicious stock trade just returned over 200% in weeks