Cardano Price Prediction Points To Slow Growth As Analysts Back Rollblock As The Altcoin With 25x Potential

Cardano and Rollblock (RBLK) are capturing huge levels of investor attention in 2025, but the story here isn’t just about price action.

Cardano continues to see steady movements, appealing to conservative investors who prefer incremental gains. Meanwhile, Rollblock is being positioned as a high-potential staking powerhouse, with projections suggesting it could deliver 25x returns this year.

Rollblock (RBLK): A Staking Powerhouse Ready To Explode

Rollblock (RBLK) is emerging as one of the most compelling platforms in Web3 gaming, combining blockchain transparency, DeFi principles, and revenue-sharing mechanics that directly reward token holders.

Thousands of active users are engaging daily with over 12,000 AI powered games including live poker, blackjack, and a thriving sports prediction league.

The RBLK token integrates staking, high APYs, and a deflationary buyback-and-burn model to enhance long-term value.

Key highlights of the Rollblock ecosystem:

- Rollblock (RBLK) has been fully operational for over 12 months with millions wagered across its GameFi ecosystem

- RBLK holders earn weekly rewards via a robust revenue share model

- 30% of platform revenue is allocated to buybacks, 60% of which are burned to reduce the supply

- Staking yields of up to 30% APY attract long-term holders

- Rollblock combines security, transparency, and licensed operations for trust and reliability

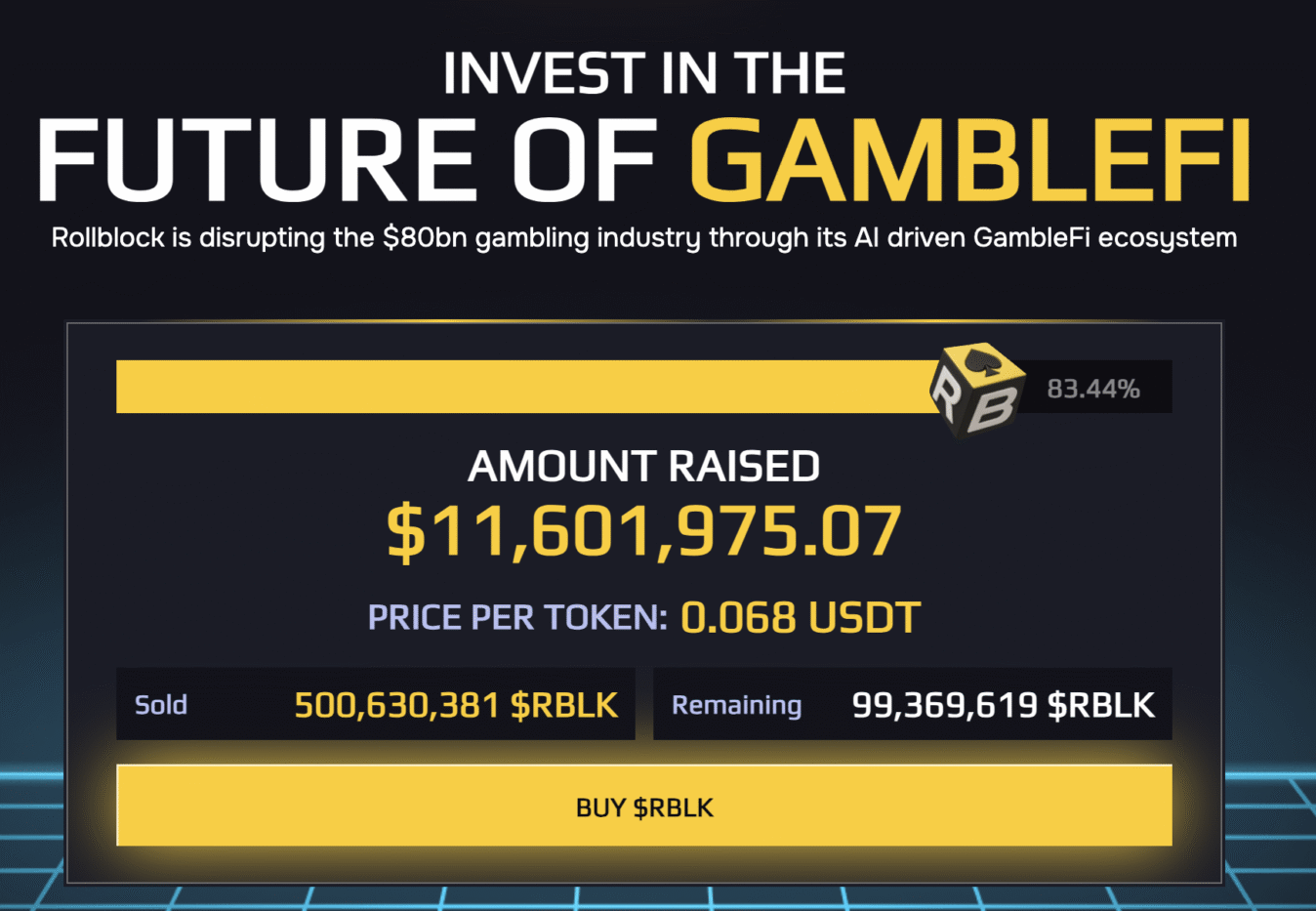

Tokens are selling fast, with over 83% of RBLK presale coins sold at $0.068. This price is expected to surge as major exchange listings approach later this year, rewarding early adopters who are already seeing gains of more than 500%.

The presale has raised over $11.5 million so far, with a 20% bonus available for limited-time purchases, giving early buyers an extra edge before exchange listings drive wider demand.

Watch Crypto Octo’s latest YouTube breakdown to understand why Rollblock (RBLK) is capturing the imagination of Web3 investors: https://youtu.be/ONh5c192f3o?si=fsTNSby5C_mcEELG

| Token | Price | Market Cap | Circulating Supply | Revenue Share | Potential Multiples |

| Rollblock (RBLK) | $0.068 | $2.1B | 1B | Weekly | 25x+ |

| Cardano (ADA) | $0.8454 | $30.23B | 35.76B | N/A | 2-3x |

Cardano (ADA): Steady Uptrend, Slow But Consistent

Cardano (ADA) is trading at $0.86 today, up 2.03% on a steady buying wave. “Buyers are keeping ADA in a steady uptrend as it prepares for another attempt toward the $0.85 resistance zone” according to Amina Chattha

Cardano is also drawing attention from institutions. Grayscale recently filed for a Cardano ETF (ticker GADA) alongside a Polkadot ETF, signaling that traditional finance continues to explore exposure to top altcoins through regulated products.

With ETFs for Bitcoin and Ethereum already proving highly successful among institutions, this filing demonstrates growing interest in Cardano as part of the top crypto projects list.

The combination of whale exits and institutional ETF filings shows two sides of Cardano’s current narrative. Short-term volatility may persist, but the long-term picture remains tied to its blockchain interoperability, staking crypto opportunities, and potential institutional inflows.

A reclaim of the $1.20 level could take place during the next leg up in the markets.

Why Rollblock Will Likely Outperform Top Altcoins in 2025

The 2025 landscape favors Rollblock as the altcoin with the highest upside potential. Cardano (ADA) provides stability but lacks the aggressive growth narrative of Rollblock.

With exchange listings approaching and adoption accelerating by the day, Rollblock is set to outshine traditional top altcoins and could be the breakout 25x opportunity of the year.

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

The post Cardano Price Prediction Points To Slow Growth As Analysts Back Rollblock As The Altcoin With 25x Potential appeared first on Blockonomi.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse