Oracle co-founder becomes world’s richest person after company’s stock surge

- Oracle reported revenue growth in its quarterly report.

- The company’s stock jumped 36%.

- This led to company co-founder Larry Ellison briefly overtaking Musk in the Bloomberg ranking.

- His stake is more than 40% of the stock.

Co-founder of Oracle, one of the largest software developers in the United States, Larry Ellison briefly overtook billionaire Elon Musk to become the richest man in the world. This is reported by Bloomberg.

This happened against the background of the publication of the financial report of the firm for the first quarter of fiscal year 2026. According to him, the company’s revenue amounted to $14.9 billion, earnings per share excluding GAAP increased by 6% – to $1.47.

In addition, RPO (Remaining Performance Obligations) grew 359% to $455 billion, which is the sum of all contractual obligations that have been signed but not yet fulfilled.

One of the reasons for this explosive growth is a $300 billion agreement between Oracle and OpenAI, the developer of ChatGPT. The Washington Post reported on this earlier.

The contract is for five years. Under it, Oracle is obliged to supply OpenAI computing power for data centers. The publication noted that this is the largest industry agreement in history.

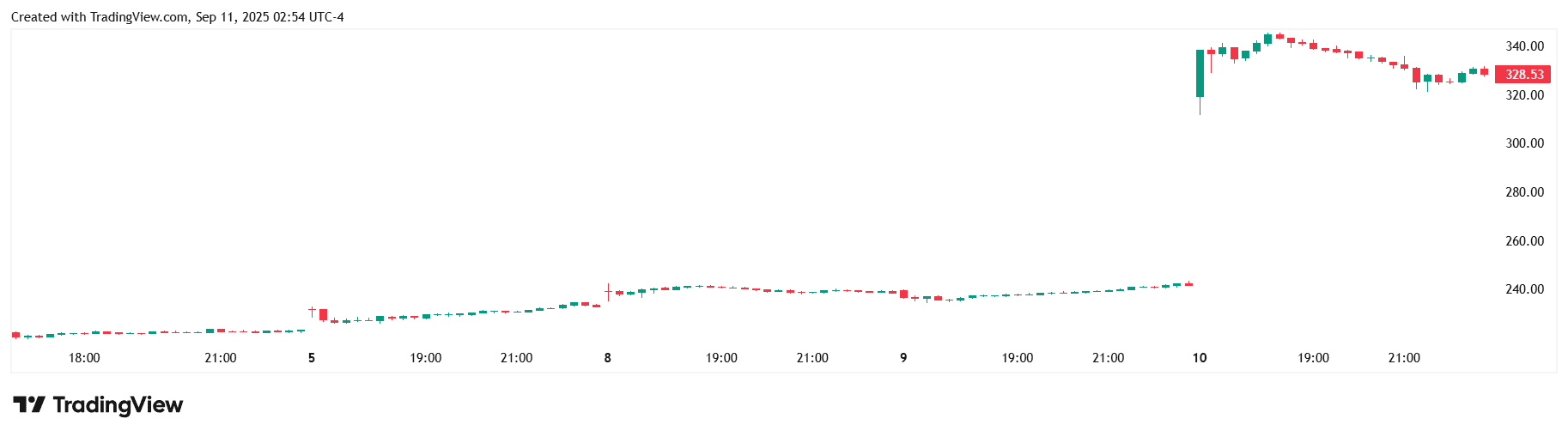

The release of the financial report led to the biggest one-day rise in the company’s shares since 1992, up more than 36% in 24 hours:

ORCL stock price on the NYSE exchange. Source: TradingView.

ORCL stock price on the NYSE exchange. Source: TradingView.

As for Ellison, his stake in Oracle is estimated at 42.9%, according to Oracle’s 2022 SEC filing. Other reports put it at 41.24%.

As of mid-September 2025, the firm’s circulating supply of shares is 2.81 billion, of which Ellison controls 1.15 billion.

The jump in quotes from $241.5 to $338.5 has seen his fortune rise by $89 billion to $383.2 billion, according to Bloomberg data.

In the ranking of the richest people of the publication, he briefly surpassed billionaire Elon Musk, but by the end of the day on September 10, the latter regained the position of leader. The latter’s fortune is estimated at $384.2 billion.

According to Forbes, in turn, the gap between Musk and Ellison is much larger:

Volume 3 of the world’s richest people. Source: Forbes.

Volume 3 of the world’s richest people. Source: Forbes.

He also highlighted the 1529% growth in cloud infrastructure revenue (OCI), which was made possible by big customers like Amazon, Google and Microsoft.

Earlier, we reported on Oracle’s involvement in the ambitious Stargate project. This is a joint venture between OpenAI, Softbank and Oracle aimed at developing AI infrastructure in the US with an investment of $500 billion.

You May Also Like

‘Big Short’ Michael Burry flags key levels on the Bitcoin chart

BlackRock Increases U.S. Stock Exposure Amid AI Surge