Meme Coin Wars: Can Pump.Fun Hold On?

Key Takeaways:

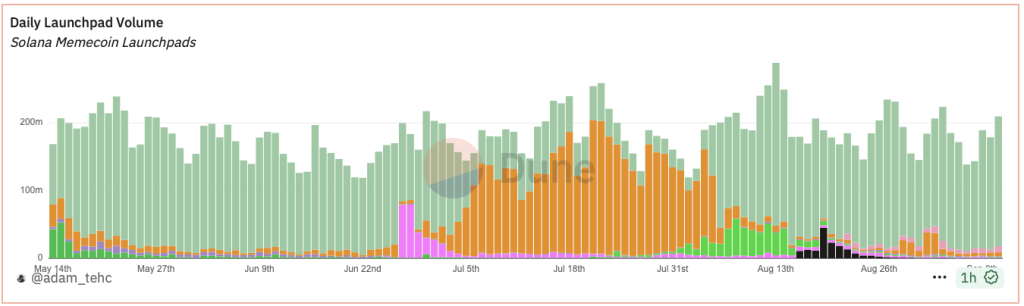

- Pump.Fun briefly lost momentum in July as LetsBonk.Fun gained traction, peaking at over $197 million in daily volume — nearly 4x higher than Pump.Fun at the time.

- By August, Pump.Fun reclaimed dominance, with volume surging to $191 million compared to $6 million on LetsBonk.Fun.

- Platform changes such as paybacks and dynamic fees helped attract new meme coin creators back to Pump.Fun.

- The native PUMP token rose nearly 80% over two weeks, though it still trades about 15% below its all-time high.

- New contenders like Believe.me, Heaven, and Sugar.me briefly challenged Pump.Fun, but most failed to maintain long-term momentum.

In July, rumors started swirling across the crypto community that Pump.Fun was “over” and a new king had emerged: LetsBonk.Fun. The narrative wasn’t entirely baseless.

If you looked at trading volumes on meme coin launchpads, LetsBonk clearly started gaining ground throughout the month. At its peak on July 21, LetsBonk.Fun recorded just over $197 million in trading volume, while Pump.Fun sat at around $50 million — a nearly 75% drop by comparison.

Source: Dune

Source: Dune

Doubts about Pump.Fun were amplified by the silence of its official X account and co-founder Alon, especially in the wake of the PUMP token launch. With no major updates or news about the promised airdrop, many in the community began to assume the worst. But the sentiment shift didn’t last long.

However, LetsBonk.Fun’s popularity was short-lived. In August, Pump.Fun reclaimed its position as the “king of meme coins.” For comparison, as of Sep. 10, the platform recorded a trading volume of $191 million, while its competitor managed only around $6 million.

Did Paybacks Make the Difference?

There could be several reasons behind the drop in interest toward LetsBonk.Fun. First, the hype around the platform may have simply faded, which is common in crypto markets. But more importantly, Pump.Fun adjusted its strategy and started offering better incentives to both traders and meme coin creators.

One major update was the introduction of payback mechanics. Additionally, the platform added dynamic fees that reward meme coin creators directly. This change made Pump.Fun more appealing for new projects looking to launch their tokens, as creators now have the chance to earn a share of the launch fees. In other words, the platform started sharing its revenue with the community.

Another important factor is the weekly paybacks in PUMP tokens. These distributions reward token holders regularly, helping boost demand for PUMP and increasing user engagement across the ecosystem.

The impact is already visible in the token’s price. According to CoinGecko, PUMP has gained nearly 80% over the past two weeks. At the time of writing, it is just about 15% away from its all-time high (ATH). While many in the community still criticize the token after its initial crash, the recent recovery suggests growing confidence in the project.

More Meme Coins and Launchpads Enter the Scene

LetsBonk.Fun wasn’t the only one trying to knock Pump.Fun off the throne. Earlier in the summer, there was a wave of hype around Believe.me, a platform built on the concept of Internet Capital Markets (ICM). In simple terms, users can launch meme coins based on an idea or narrative. Some startups joined the platform, including Fitcoin (FITCOIN) — an app focused on wardrobe and outfit suggestions.

At the height of its popularity, Believe.me nearly matched Pump.Fun in terms of token launch trading volume.

Despite the short-term success of these challengers, new platforms continue to emerge. In August, a new launchpad called Heaven went live. Learning from previous platforms, it immediately introduced a full 100% payback model.

Shortly after launch, Heaven became the second-largest token launchpad after Pump.Fun. On Aug. 9, it accounted for nearly 28% of all new meme coin launches, while Pump.Fun held 63%. LetsBonk.Fun and Believe.me faded into the background with only 1.7% and 0.4%, respectively.

Competition That Shapes the Meme Coin Space

The growing competition between meme coins is leading to a more dynamic and responsive environment for both creators and traders. As platforms work to attract attention and liquidity, they are adjusting their models, offering new features, and becoming more creator-focused. Even Pump.Fun has made changes, such as introducing paybacks and flexible fee models, to stay ahead.

At the same time, the fast pace of new token launches carries risk. Many meme coins are now created with the aim of becoming symbols of their respective platforms. One example is Useless Coin (USELESS) from LetsBonk, which gained rapid popularity earlier in the summer. Its market capitalization exceeded $400 million, with some calling it a possible successor to Fartcoin (FARTCOIN).

Since July, USELESS has entered a correction and has not yet returned to its previous highs.

A new launchpad, Sugar.me, has also emerged, currently ranking third in terms of launched tokens after Pump.Fun and LetsBonk. LetsBonk, in turn, has managed to reclaim second place, showing that market share in this space can shift quickly.

In this environment, attention and capital tend to move fast. New projects appear regularly, and user preferences change with them. While this creates more options, it also highlights the need for careful evaluation of new platforms and tokens.

You May Also Like

The Channel Factories We’ve Been Waiting For

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets