Crypto Presale with Zero Team Allocation: Why AgoraLend’s Revenue-Sharing Model Is Different

The post Crypto Presale with Zero Team Allocation: Why AgoraLend’s Revenue-Sharing Model Is Different appeared first on Coinpedia Fintech News

Most DeFi presales benefit team members and VCs who dump tokens post-launch. AgoraLend breaks this pattern as potentially the last major DeFi presale with 100% community distribution and zero insider allocations.

Early investors get exclusive access to a deflationary token model where 40% of protocol revenue automatically buys back and burns tokens.

With dual lending markets generating multiple revenue streams and current presale pricing at $0.0005, participants position themselves in a protocol that returns value to holders.

Why This Could Be DeFi’s Last Fair Launch Presale

The DeFi presale market has become dominated by venture capital firms and team allocations that create immediate selling pressure upon launch.

Projects routinely allocate 15-30% to teams and 20-40% to private investors who receive massive discounts, leaving retail participants holding bags after coordinated dumps.

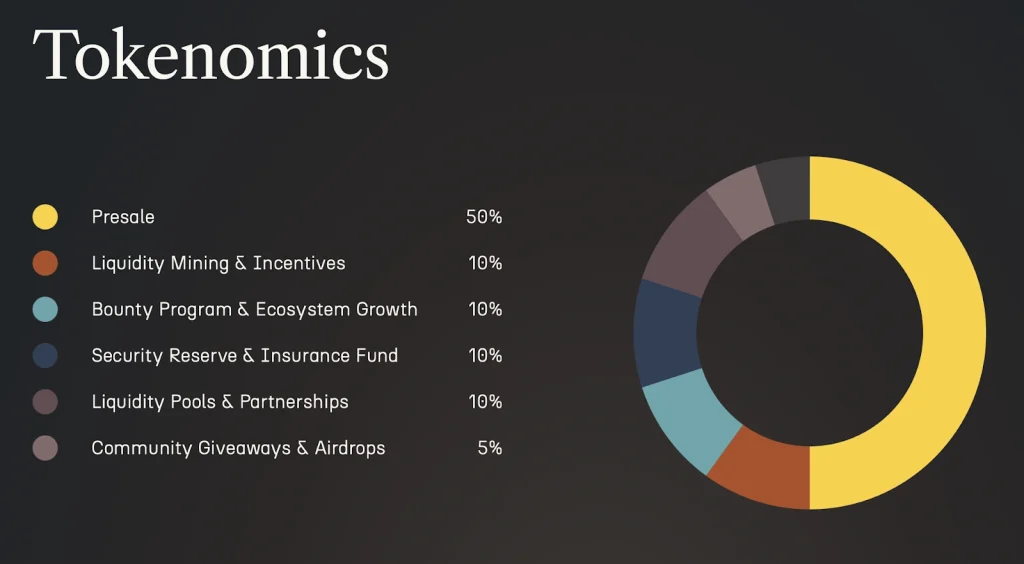

AgoraLend represents a return to DeFi’s original ethos with zero team allocation and zero VC participation. The entire 4 billion token supply goes directly to community participants, liquidity provision, ecosystem development, and protocol security.

No founders can dump tokens, no VCs received preferential pricing, and no insider unlock schedules threaten price stability.

This community-first approach is becoming extinct in modern DeFi. Major protocols like Uniswap, Compound, and Aave all featured significant insider allocations. New projects increasingly favor private funding rounds over public participation.

AgoraLend’s decision to forgo team tokens and VC investment creates a rare opportunity for genuine community ownership.

The 50% presale allocation gives early supporters direct ownership stakes without competing against insider dumping. Unsold presale tokens will be permanently burned, reducing total supply below the initial 4 billion cap.

AgoraLend’s Revenue Flywheel: From Lending Fees to Token Burns

AgoraLend generates revenue through multiple streams that directly benefit token holders via the 40% buyback mechanism. This creates a flywheel effect where protocol growth automatically increases token demand and reduces supply through burns.

Primary revenue sources include borrowing interest rate spreads between what borrowers pay and lenders receive. The Peer-to-Contract (P2C) pools generate consistent fees from automated lending activity, yielding predictable revenue flows.

Liquidation events provide another revenue stream when borrowers fail to maintain adequate collateralization ratios.

These forced asset sales generate protocol fees that feed the buyback system. Market volatility increases liquidation frequency, creating higher revenue during active trading periods.

Premium features and cross-chain bridge usage contribute supplementary income. As AgoraLend expands to Optimism, Arbitrum, Base, and other EVM networks, bridge fees multiply revenue opportunities across multiple blockchain ecosystems.

The 40% buyback mechanism operates transparently through smart contracts. Revenue accumulates in protocol treasuries, automatically triggering AGORA purchases from decentralized exchanges.

Presale Pricing vs Long-Term Value: The Investment Case

The current presale price of $0.0005 per AGORA token shows early-stage pricing before protocol launch and revenue generation. This creates upside potential as lending volume grows across multiple blockchain networks.

Compare this to established DeFi lending protocols. Aave’s market cap peaked to billions despite having team and VC allocations that dilute community value. Compound reached similar valuations with traditional tokenomics that don’t directly return protocol revenue to holders.

AgoraLend’s revenue-sharing model could command premium valuations once the market recognizes its superior value accrual mechanics.

The deflationary tokenomics create mathematical price appreciation as protocol usage increases. Every lending transaction, liquidation event, and cross-chain bridge usage contributes to token burns.

Permissionless asset listing differentiates AgoraLend from competitors by capturing the “long tail” of ERC-20 tokens excluded from major platforms.

This expands the total addressable market beyond blue-chip assets, potentially generating higher fees from specialized lending markets.

How to Secure Your Position Before Public Launch

AgoraLend’s presale operates across multiple blockchain networks with straightforward participation processes.

Visit the official AgoraLend website and locate the presale widget. Connect your preferred wallet and authorize the connection following security prompts.

Enter your desired investment amount in ETH, BNB, or other supported cryptocurrencies. The widget automatically calculates equivalent AGORA tokens at the current $0.0005 price point.

Review transaction details carefully before confirming purchases. Gas fees vary by network congestion, so consider timing purchases during lower activity periods to minimize costs.

After successful purchases, visit the allocation page using your EVM wallet address to verify reserved token amounts. This transparency allows tracking your position and preparing for eventual token distribution and protocol launch.

The presale window creates urgency for positioning before public markets price in AgoraLend’s revenue-sharing advantages.

Early participants secure tokens at a significantly discounted pricing, locking an excellent purchase price. With the pre-sale price per $AGORA token increasing every seven days, it is advisable to participate as early as possible; ahead of protocol launch, testnet completion, and exchange listings that could drive significant price discovery.

Join The AgoraLend Presale Now

Website | (X) Twitter | Telegram

You May Also Like

Galaxy Digital Authorizes $200M Share Buyback as Stock Rebounds

Whales Dump 200 Million XRP in Just 2 Weeks – Is XRP’s Price on the Verge of Collapse?