UK and US Move to Align Crypto Regulations as the Best Crypto Presales Heat Up

With Donald Trump in the United Kingdom for a state visit, the UK and the US are poised to forge closer regulatory ties on key issues.

One of those issues is crypto regulations – in particular, stablecoins. The move could reshape the landscape for stablecoins, investor protection, and cross-border financial innovation. Along the way, it could also send a handful of the best crypto to buy into the stratosphere as markets heat up.

A Shift Towards Cooperation

High-level talks between UK Chancellor Rachel Reeves and US Treasury Secretary Scott Bessent formed the starting point for the whole discussion. Trump himself may get involved later in the week.

Major crypto firms like Coinbase, Circle, and Ripple, as well as leading banks, were part of discussions aimed at synchronizing oversight of the digital-asset sector.

What’s driving the sudden shared interest?

In a word, stablecoins.

Stablecoins, pegged to traditional currencies, have emerged as popular payment instruments and stores of value. For now, they currently exist under varying regulatory regimes in different countries– and that’s why the UK is keen to align more closely with US regulation.

What Alignment Might Look Like

Several areas are expected to be part of the UK-US regulatory alignment:

- Stablecoin regulation: Clearer rules governing issuance, backing, and oversight.

- Combatting financial crime: Unifying anti-money laundering (AML) and know-your-customer (KYC) standards.

- Market conduct: Strengthened supervision of digital asset markets to ensure fair practices and consumer protection.

- Joint innovation sandboxes: Regulatory test environments where firms can trial blockchain-based solutions or new financial products in both jurisdictions under regulatory oversight.

Why It Matters

The UK has publicly acknowledged a risk of being left behind in global crypto regulatory advance. Former Conservative Chancellor George Osborne warned in an op-ed that on stablecoins and broader digital asset policy, other countries are passing the UK by.

And there’s a strong desire on the part of both countries to use regulatory clarity to attract business investment, maintain competitiveness, and support innovation in the financial sector.Additionally, the timing of these moves is significant. Talks coincide with heightened diplomatic and trade conversations, including the US-UK relationship under President Trump’s pro-crypto bent and the UK’s efforts to position itself as a global hub in digital finance.

With alignment on the horizon, the crypto presales could be among the best projects to buy.

Bitcoin Hyper ($HYPER) – Fastest and Cheapest Bitcoin Layer 2 Enables Everyday Bitcoin Transactions

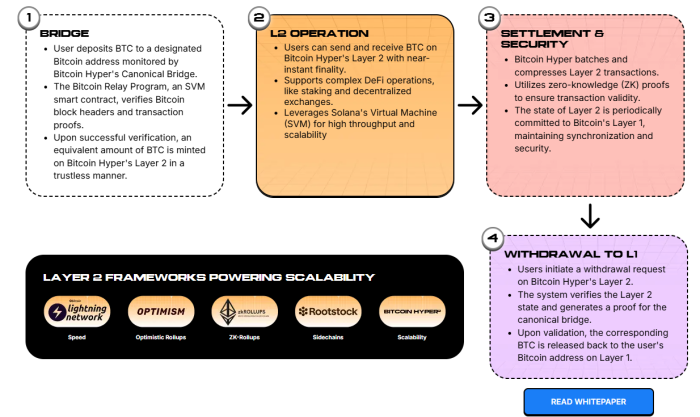

Bitcoin Hyper ($HYPER) aims to solve a couple of long-standing Bitcoin problems. Sure, Bitcoin has a $2.2T market cap, and may not look like it has many weaknesses at all. But the Bitcoin Layer 1 blockchain emphasizes simple smart contracts for security and reliability, rather than speed or scalability.

To achieve the latter, Bitcoin Hyper integrates the Solana Virtual Machine (SVM) through the use of a Canonical Bridge. Deposit $BTC on the canonical bridge, mint wrapped $BTC on the Hyper Layer 2.

On Hyper, investors can leverage the SVM’s speed to transact $BTC at Solana’s speeds – several thousand transactions per second. That utility explains why our $HYPER price prediction shows the token price reaching $0.32 by the end of this year.

Learn more about what Bitcoin Hyper is and jump into the presale at the official website.

PepeNode ($PEPENODE) – Mine-to-Earn Gamifies Meme Coin Yield

What if you could meme and game at the same time?

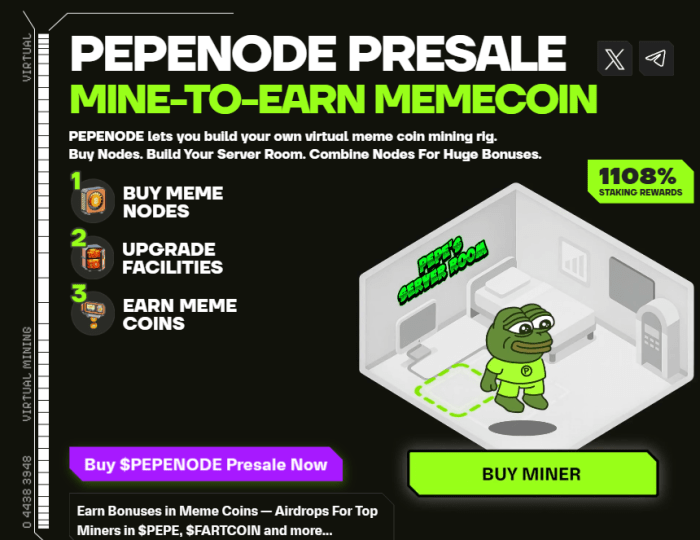

PepeNode ($PEPENODE) makes it possible with an innovative Mine-to-Earn mechanic. Buy $PEPENODE and use the token to upgrade your virtual mining server room. The more nodes you purchase and the more you upgrade your rig, the more $PEPENODE you’ll earn.

You can earn rewards in other tokens, including $PEPE, $FARTCOIN, and more. There’s also a leaderboard where miners can see whose rig is performing the best.

The $PEPENODE presale has passed $1.2M, with tokens priced at $0.0010617 — but our price prediction sees the token climbing to $0.0023 by the end of the year.

Check out the presale page for the latest info.

BlockDag ($BDAG) – Massive Crypto Presale Offers Endless Blockchain Interconnectivity

BlockDag has an incredibly ambitious vision – a proof-of-work consensus with Directed Acrylic Graph (DAG) technology.

If BlockDag finds the success it hopes for, it could be the foundation for an entirely new standard for blockchain networks. BlockDag wants to build a more transparent blockchain with full DeFi capabilities, including:

- Stablecoins

- Staking

- Lending & borrowing

- Swaps

- Cross-chain bridging

The solidity and reliability of a proof-of-work blockchain would back all of those features. And with over $400M raised in a massive presale so far, BlockDag is well-positioned to succeed.

While US-UK regulatory alignment promises benefits, there are obstacles to overcome. Regulatory systems differ in structure, legal tradition, and risk tolerance. The UK and US may diverge in consumer protection standards, enforcement priorities, or industry oversight.Ensuring alignment without stifling innovation will be a delicate balancing act.

But if negotiators can pull it off, look for hot crypto presales like $HYPER, $PEPENODE, and $BDAG to explode into the newly defined space.

Authored by Bogdan Patru for Bitcoinist — https://bitcoinist.com/best-crypto-presales-to-buy-as-uk-and-us-start-crypto-cooperation

You May Also Like

XRP Buyers Defend Most Major 200-Week Price Average: Can It Be Bottom of 2026?

Expert Tags Ethereum’s ERC-8004 Mainnet Launch An “iPhone Moment”, Here’s What It Means