Application Token Theory in the Vibe Coding Era: Why Will It Give Birth to a Huge Wave of Wealth?

Author: Grant Blocmates

Compiled by: Tim, PANews

In the latest Y Combinator startup camp, members were asked: "What percentage of your code base is generated by AI?" A quarter of the entrepreneurs said that 95% of their code was generated by AI.

For better or worse, Andrej Karpathy (former director of Tesla AI and founding member of OpenAI) coined the term “Vibe Coding”.

In short, this means that even tech-savvy people like you and me can generate code by typing in text (prompt words). Today, this has prompted many "dreamers" to postpone their job searches and instead try to build the next Facebook.

Highly successful independent entrepreneur Pieter Levels recently demonstrated how this is possible with Cursor, Grok, and Claude in his almost entirely AI-generated flight simulation game, which is now generating $85,000 in recurring revenue per month through embedded advertising.

There are still quite a few bugs in this mode that require a basic understanding of the actual situation to solve, especially when you are madly typing on the keyboard, trying to get it to generate an application.

Naturally, some real developers emerged to provide consulting and debugging services to the new generation of pure AI programmers (yes, the front end is done by Vibe Coding).

As these cutting-edge models continue to improve and get better at generating code from natural language (text and speech), their output will become extremely efficient.

Anthropic CEO Dario Amodei recently said that in "three to six months," we will be at a stage where 90% of the code is written by AI. And in twelve months, AI will be able to "write almost all the code."

What would the world be like if this were the case?

Who will be the loser?

The cost of building applications has approached zero. The SaaS subscription services that you were reluctant to pay for before can now be reproduced at a much lower cost.

If a SaaS company doesn’t build a strong enough moat through network effects, hard-to-copy products, or tight legal intellectual property, it’s doomed.

I’m talking about you, Docusign and Typeform.

Additionally, it will be more efficient to build native products in-house through MCP that can connect to team workflows, knowledge bases, and existing databases.

I think that efficient talents who are familiar with building AI may be one of the most urgently needed positions for small and medium-sized enterprises at present.

As some extremely powerful small models come online, companies will be able to run all processes internally through local machines or models, which will greatly benefit privacy protection and operational security.

Teams that still believe that “good wine needs no bush” is an effective marketing strategy will eventually be eliminated by smarter teams who simply copy their products and do a better job of marketing them.

Who will be the winner?

As code generation models evolve, the playing field is leveling from a technical perspective, and the teams that can dominate the battle for user mind share and attention will come out on top.

Good marketing comes from knowing your core audience because you are your core audience. If all products were the same, apps would become (more) a fashion item that people use to show off.

"I use Claude because I know it better than anyone else. I won't use the well-known ChatGPT, which is for newbies who know nothing about it."

For an app to be cool, it has to be really cool. The branding, market positioning, and cultural sensitivity all have to be spot on.

Guess what? Big language models won’t be able to do this in the near future. Why? Because humans are far more complex than AI can imagine.

Subcultures are incomprehensible to those outside their closed circles. What is amazing to one person may be bland to another.

We may see a world where everyone will have a personalized user experience journey and exclusive user interface tailored for them based on their personal preferences without even realizing it.

Graphic designers, creative directors, marketing experts, and UI/UX wizards all play roles in organizations that require excellent taste and an eye for anticipating trends.

These roles will perform well and this will never change. Models cannot know what they don’t know. In their most basic form, they are essentially word prediction machines.

Note: I’m fully aware that the term “app coins” sounds silly; irony really can’t be conveyed through words.

Unless you have extensive connections and have successfully invested in companies such as Anthropic, Cursor, OpenAI, and Perplexity, or have invested in potential stocks such as Lovable, Replit, and LindyAI at the application layer, you can only continue to find joy in misery.

If you’re a high-risk speculator who believes crypto is the future of France, some of the teams I’ve spoken to recently are working on building such projects.

The idea is "app coins." These cryptocurrencies would serve as memecoins, both representing and actually supporting the founders or small teams that build the apps of the future.

Tokens are the best tool to solve the cold start problem, which kills more ideas than any other factor.

Founders and small teams that have difficulty attracting the first 10 to 100 users can effectively break through this dilemma through token mechanisms and speculative properties.

Humans are naturally inclined to speculate. But they also want to speculate fairly. The idea of a young person who can discover the next big idea is a big deal.

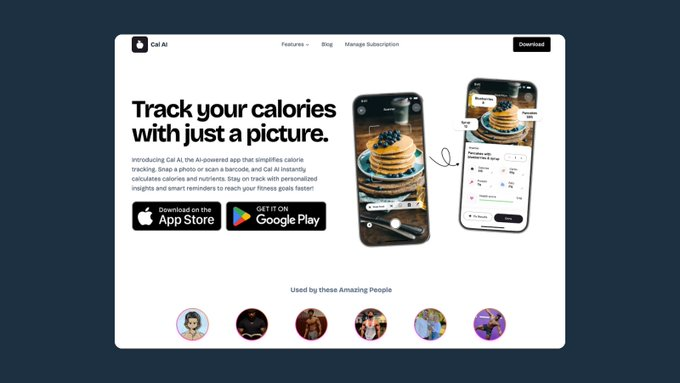

Have you seen this app? Cal AI takes a picture of your food and estimates the calories to within 10%. Sounds like everyone's first startup idea, right?

This is a team of four teenagers who used a product on the MyFitnessPal platform to create a business with an annual revenue of up to $20 million. How did they do it? Through precise market positioning, they locked in the target customer group and carried out targeted marketing.

They heavily reinvest their revenue into influencer marketing every month (which works really well in the fitness industry) and position their product for the average user: its product design is extremely simple, fresh, and fun.

They also make it clear that if you are training for Mr. Olympia, a top bodybuilding event, this product is not for you.

How many times has this product failed? If I had to guess, hundreds of times.

What we’re going to see next are applications that are launched alongside tokens, which, for better or worse, will at least allow them to gain some initial attention.

Will there be loopholes? Definitely.

Will some of them become outright vaporware? Most likely.

(Note: The term vaporware refers to software or products that are highly publicized before their official release, but are delayed for a long time or even fail to be released in the end. It often carries the ironic connotation of false publicity or failure to deliver on promises.)

Was this going to happen no matter what? Of course.

But what excites me is that through the code generation model and the concept of vibe coding (although the name is a bit embarrassing for me), anyone can bring ideas to market anywhere and at any time.

Introverts who don’t like carrots touching peas on their plates can now bring products to market without having to make eye contact or talk to anyone. This is a model worth looking forward to.

Teams I'm watching:

- Kaito: In today’s era, mind share and attention are king, and even a newbie can launch a product.

- dev.fun: Based on Solana's Vibe coding platform, it helps independent founders or small teams realize products from 0 to 1 and supports the tokenization of ideas. Add points to buidl.

- Tryoharaa: Another platform that "turns ideas into projects in one click", developed based on the Base chain, with smooth UI/UX. The team is also hardcore, and Brexton is a big shot.

- SendAI: Initially focused on intelligent agents, it has now transformed into an application ecosystem platform that can be used by anyone.

- TaroBase: Pretty low-key, but Alliance is said to be incubating them.

These are just a few examples that come to mind, but I suspect we will see some amazing independent creators emerge and wow us, and I think we will see a billion dollar project built by a single founder in the next 12 months.

In short: with the help of artificial intelligence, anyone can turn ideas into actual products, even if they don’t know how to program. The tokenization mechanism has given rise to speculation, which greatly increases the possibility of "developers" attracting users in the early stages. An explosive growth in application development is coming.

Finally, if this fantasy I have conjured up in my head comes true, we will witness the largest wealth creation in history, which will not only allow founders to accumulate unimaginable wealth, but also provide ordinary investors who stay sharp with the opportunity to invest before everyone else.

We are seeing a huge demand to level the playing field and treat retail investors more fairly. Pumpfun was an equal and reverse response to low float, high FDV scams, but it is still not an ideal solution.

You May Also Like

Native Markets Wins Hyperliquid’s USDH Stablecoin Bid, Plans to Enter Testing “Within Days”

Amazon posts $500,000 annual salary for 'Head of Crypto Ecosystem' position