Bitcoin Miner TeraWulf (WULF) Stock Rallies 21% Amid $9.5B AI Infrastructure Lease

TeraWulf Inc. (NASDAQ: WULF), a US-based bitcoin BTC $114 028 24h volatility: 0.8% Market cap: $2.27 T Vol. 24h: $56.98 B mining and high-performance computing firm, announced a landmark 25-year lease contract worth approximately $9.5 billion with Fluidstack. To facilitate Terawulf’s AI infrastructure integration, the joint venture will deliver 168 megawatts (MW) of critical IT load at its Texas campus.

According to SEC filings, the partnership structure also gives TeraWulf a 51% majority stake and the exclusive right to participate in future Fluidstack-led projects. The venture will be financed through project debt, with Google backing $1.3 billion of Fluidstack’s long-term lease obligations.

The project will expand TeraWulf’s contracted high-performance computing (HPC) platform to over 510 MW of critical IT load, strengthening its reputation as a low-carbon digital infrastructure provider.

The Abernathy facility is slated for delivery in the second half of 2026, and future expansions are already under consideration as both companies seek to leverage existing infrastructure.

Growth Outlook: From Bitcoin Mining to AI Compute Dominance

The long-term deal reflects TeraWulf’s broader transformation from a traditional bitcoin mining company into a diversified AI infrastructure provider. The company now targets between 250 MW and 500 MW of new contracted IT load annually, demonstrating an aggressive growth strategy to match global demand for GPU-intensive AI computing.

TeraWulf’s strategic partnership with Fluidstack, supported by Google’s financial commitment, signals growing convergence between crypto-native mining infrastructure and institutional AI compute workloads.

With Morgan Stanley acting as financial advisor and Paul, Weiss, Rifkind, Wharton & Garrison LLP providing legal counsel, the transaction marks one of the most significant HPC infrastructure commitments by a US digital asset firm to date.

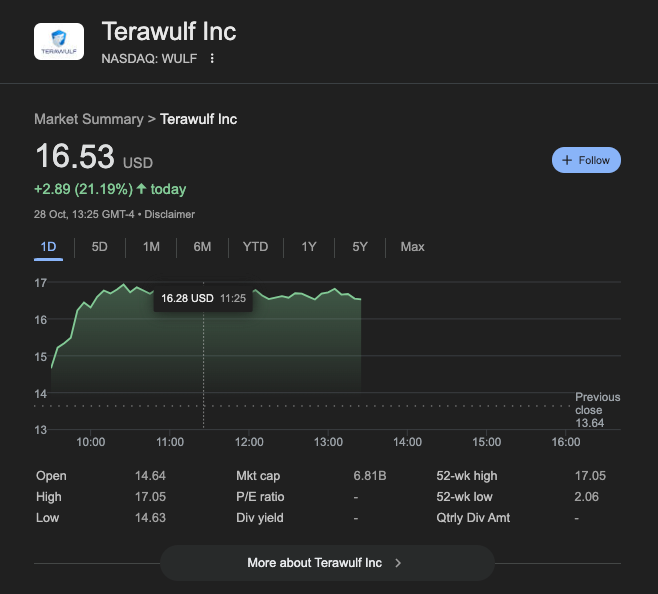

TeraWulf’s (WULF) stock price rose 22.88% on Oct. 28, trading at $16.76 at the time of writing.

Terrawulf (WULF) Stock Price action, Oct. 28, 2025 | Nasdaq

The post Bitcoin Miner TeraWulf (WULF) Stock Rallies 21% Amid $9.5B AI Infrastructure Lease appeared first on Coinspeaker.

You May Also Like

Building a DEXScreener Clone: A Step-by-Step Guide

Hong Kong Secretary for Justice: Any entity issuing stablecoins pegged to the Hong Kong dollar, whether in Hong Kong or outside Hong Kong, must apply for a license.