Coinbase's latest monthly outlook: Liquidity returns in autumn, and the altcoin season is about to explode

By David Duong , Coinbase

Compiled by Tim, PANews

Article Overview

- Coinbase maintains a positive outlook for the third quarter of 2025, but its view on alt season has shifted. Based on current market conditions, it believes the market could shift into a full-blown alt season as September approaches. (A common definition of an alt season is when at least 75% of the top 50 altcoins by market capitalization outperform Bitcoin over the past 90 days.)

- Many have been debating whether a September Fed rate cut would mark a peak for the crypto market. We disagree. Considering the nearly $7 trillion in retail funds currently held in the OTC market, including money market funds and other sectors, we believe the Fed's easing policy could attract even more retail investors in the medium term.

- Focusing on ETH. CoinMarketCap's altcoin seasonal index's sluggish performance, in stark contrast to the 50% surge in altcoin market capitalization since early July, highlights the growing institutional investment enthusiasm for ETH. Growing demand for digital asset treasuries (DATs), coupled with the growing narrative surrounding the integration of stablecoins and RWAs, has fueled this rally.

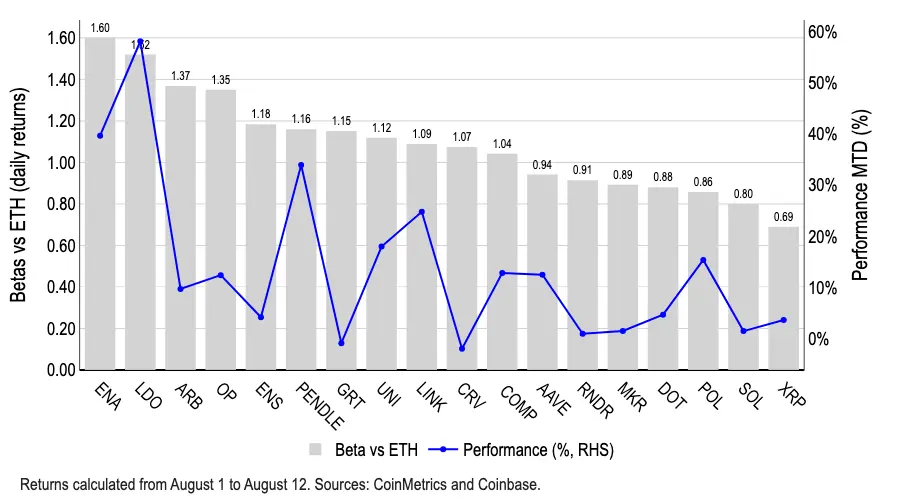

- Tokens like ARB, ENA, LDO, and OP consistently exhibit higher beta returns than ETH, though only LDO leads the pack with its 58% monthly gain. Lido has historically provided relatively direct access to ETH through its liquidity staking feature. Furthermore, we believe the SEC's statement that liquidity staking tokens do not constitute securities under certain conditions has supported LDO's appreciation.

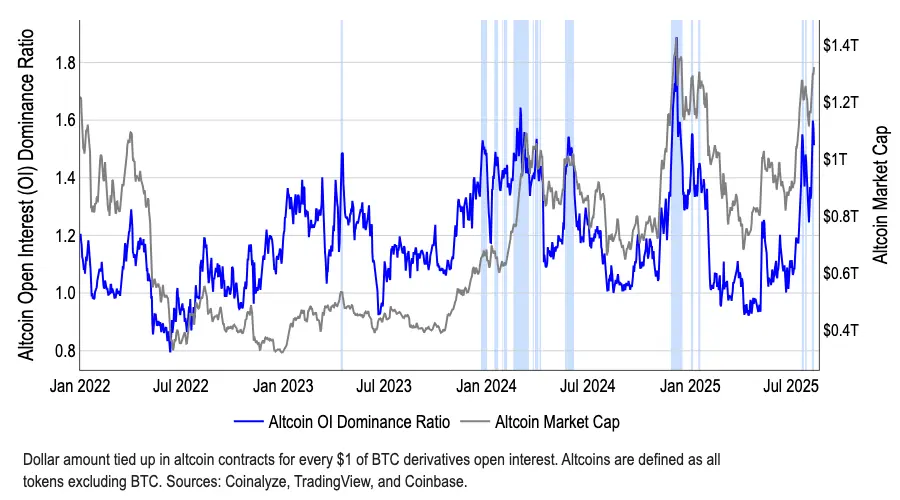

Entering the copycat season

By August 2025, Bitcoin's market share had fallen from 65% in May to approximately 59%, signaling the beginning of a shift in capital towards altcoins. While the total altcoin market capitalization has surged over 50% since early July, reaching $1.4 trillion as of August 12th, CoinMarketCap's Altcoin Season Index remains in the low 40s, well below the 75 threshold historically defining the start of an altcoin season. As we head into September, we believe current market conditions are already showing signs of a full-blown altcoin season.

Our optimistic outlook stems from a comprehensive macroeconomic perspective and anticipation of significant regulatory developments. As we've previously explained, our proprietary global M2 money supply index, which typically leads Bitcoin prices by 110 days, suggests a potential new wave of liquidity could arrive in late Q3 or early Q4 2025. This assessment is particularly crucial, as institutional investment appears to be primarily focused on large-cap cryptocurrencies. In our view, the primary driver of the altcoin season is retail investors.

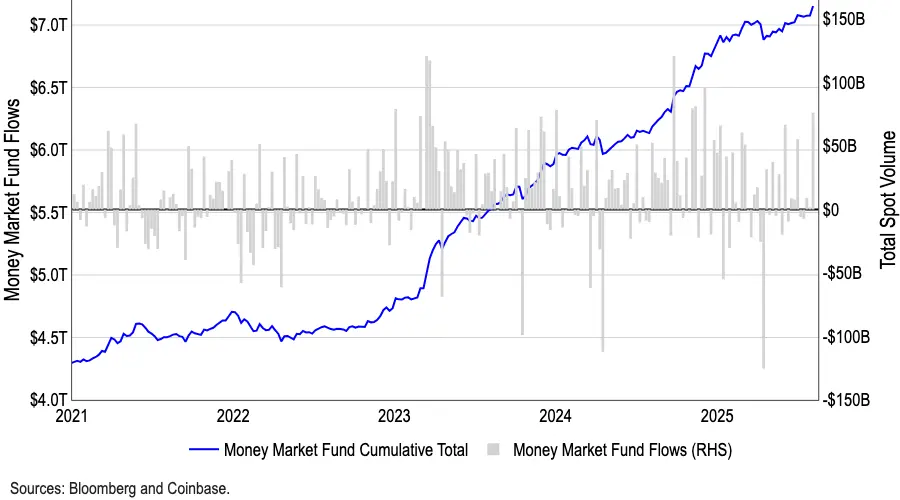

The current $7.2 trillion in U.S. money market funds (the highest level on record) is noteworthy (see Figure 2). Cash reserves declined by $150 billion in April, which we believe contributed to the strong performance of cryptocurrencies and risk assets in the following months. Interestingly, however, cash reserves have rebounded by over $200 billion since June, contrasting sharply with the rise in cryptocurrencies over the same period. Traditionally, cryptocurrency price increases and cash reserves tend to trade off against each other.

We believe these unprecedented levels of cash reserves reflect three key market concerns: (1) heightened uncertainty in traditional markets (due to issues like trade conflicts); (2) overvalued markets; and (3) ongoing concerns about economic growth. However, as the Federal Reserve approaches its September and October rate cuts, we believe the appeal of money market funds will begin to wane, and we anticipate more capital will flow into cryptocurrencies and other riskier asset classes.

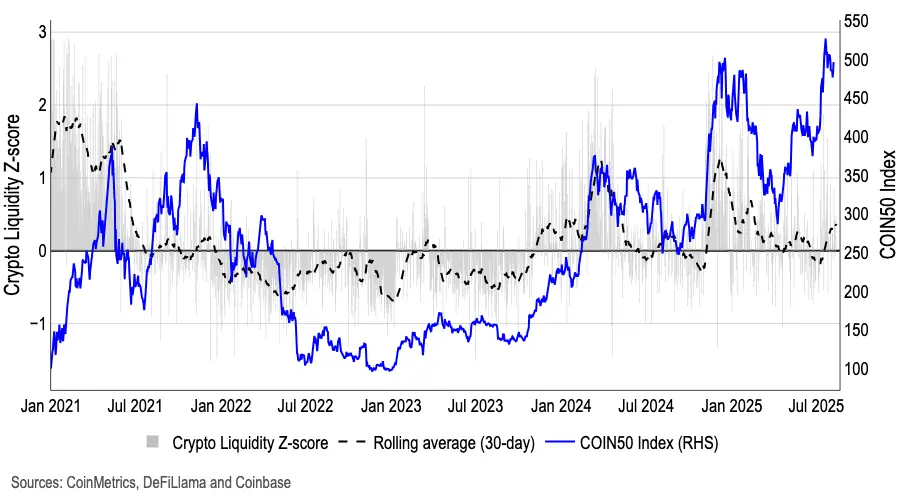

A liquidity-weighted z-score measurement model, based on indicators such as net stablecoin issuance, spot and perpetual swap trading volume, order book depth, and circulating supply, indicates that liquidity has begun to recover in recent weeks, ending a six-month downward trend (see Figure 3). The growth of the stablecoin market is partly due to the increasing clarity of the regulatory framework.

Ethereum Beta Target

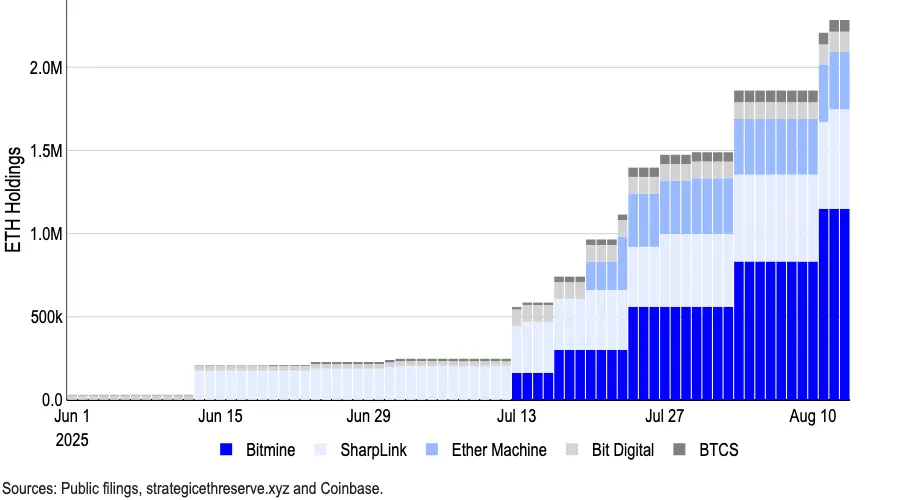

Meanwhile, the divergence between the Altseason Index and the total altcoin market capitalization primarily reflects Ethereum's growing institutional appeal, driven primarily by demand from digital asset treasuries and the rise of stablecoins and the RWA narrative. Bitmine alone increased its holdings by 1.15 million ETH through $20 billion in newly raised funds, bringing its cumulative purchasing power to $24.5 billion. (Sharplink Gaming, previously the largest ETH holder, currently holds approximately 598,800 ETH.)

The latest data shows that as of August 13, the companies with the largest ETH reserves controlled a total of approximately 2.95 million ETH, accounting for over 2% of the total supply of Ethereum (12.07 million). (See Figure 4 for details.)

Tokens such as ARB, ENA, LDO, and OP rank at the top in terms of their higher beta relative to Ethereum returns. However, LDO appears to be the only one to have performed exceptionally well during Ethereum's recent rally, with a monthly gain of 58%. In the past, thanks to its liquidity staking capabilities, Lido provided investors with relatively direct Ethereum exposure. LDO's current beta relative to ETH is 1.5 (a beta greater than 1.0 indicates that the asset is theoretically more volatile than the benchmark, potentially amplifying gains as well as losses).

Furthermore, we believe the US SEC's August 5th announcement regarding liquidity staking has supported the LDO token's price increase. Staff from the SEC's Division of Corporate Finance clarified that when the services provided by a liquidity staking entity are primarily "transaction execution" and staking rewards are transferred directly to users on a pro rata, one-to-one basis through the agreement, their activities do not constitute an offering or sale of securities. However, it should be noted that the involvement of guaranteed returns, discretionary re-staking, or additional reward mechanisms may still trigger a securities designation. This current guidance is merely a departmental opinion, and future changes in the Commission's position or litigation decisions may alter this interpretation.

Summarize

Our Q3 market outlook remains positive, but our assessment of the altcoin market has shifted. The recent decline in Bitcoin's dominance suggests a preliminary rotation into the altcoin sector, rather than a full-blown altcoin season. However, with the total altcoin market capitalization climbing and the Altcoin Season Index showing early positive signals, we believe market conditions are preparing for a rotation, potentially ushering in a more mature altcoin market in September, supported by both the macro environment and anticipated regulatory progress.

You May Also Like

XRP Challenges $5, DOT Miners Help XRP Mining Enthusiasts Benefit From The Spike

Tether Treasury mints 1 billion new USDT on Ethereum