ConsenSys CEO Reveals SWIFT is Leveraging Linea for Payments

- SWIFT will build its new blockchain payment system on Ethereum Layer 2 Linea, confirmed by Consensys CEO Joe Lubin.

- The platform aims to facilitate 24/7 real-time crypto payments, involving over 30 traditional financial institutions.

- Linea, developed by Consensys, offers high transaction throughput at a fraction of Ethereum costs, with over $2.2 billion in total value locked.

- Major banks including Bank of America, Citi, JPMorgan Chase, and Toronto-Dominion Bank are participating in trial phases.

- This initiative could challenge existing blockchain-based payment systems like Ripple’s XRP Ledger, emphasizing widespread crypto adoption in banking.

SWIFT, the global messaging network responsible for overseeing around $150 trillion in international payments annually, is taking a significant step into blockchain technology. The organization plans to develop its new blockchain payment settlement platform on Ethereum’s Layer 2 scaling solution, Linea. This development was confirmed by Consensys CEO Joe Lubin during a recent conference, marking a notable collaboration between traditional finance (TradFi) and blockchain innovators.

Initially, SWIFT announced that over 30 traditional financial institutions would be involved in building infrastructure for a 24/7, real-time crypto payments system, though it did not specify the blockchain chain involved. Lubin clarified during the Token2049 conference in Singapore that Linea was the chosen platform, highlighting the strategic importance of this move. The announcement was deliberately “soft rolled out” to the banking sector, which Lubin said was received positively as a step toward bridging the gap between DeFi and TradFi.

Developed by Consensys, Linea utilizes zk-EVM rollup technology, offering processing speeds of around 1.5 transactions per second at approximately one-fifteenth the cost of Ethereum mainnet transactions. It currently boasts over $2.27 billion in total value locked (TVL), ranking as the fourth-largest Ethereum Layer 2 solution behind Arbitrum One, Base Chain, and OP Mainnet, according to L2BEAT data.

This move could have transformative implications for global finance, particularly because SWIFT manages a vast network of financial messaging that facilitates international transactions. Involving major banks such as Bank of America, Citi, JPMorgan Chase, and Toronto-Dominion Bank, SWIFT’s trial on Linea aims to pioneer near-instant settlement and reduce intermediaries, costs, and errors in cross-border payments. The initiative could emerge as a significant competitor to Ripple’s XRP Ledger, which is already being adopted by some banks for blockchain-based transactions.

Some of the biggest banks involved

Leading financial institutions like Bank of America, Citi, JPMorgan Chase, and Toronto-Dominion Bank are participating in SWIFT’s blockchain trial efforts. Their involvement underscores the industry’s growing acceptance of blockchain technology for secure, efficient payments. This collaboration might accelerate the adoption of decentralized blockchain systems in mainstream banking, challenging existing payment solutions like Ripple’s.

For years, the integration of blockchain into traditional finance has been anticipated, promising benefits such as instant settlement, lower fees, and reduced settlement errors. The collaboration between SWIFT and Linea could also inspire broader adoption of blockchain infrastructure in global payment networks, ushering a new era of financial operations.

Linea’s broader potential

Beyond payments, Lubin described Linea as a platform capable of supporting a “user-generated civilization,” where content and infrastructure can be built collectively. By leveraging Ethereum’s trustless settlement layer, communities could develop decentralized applications, rules, and frameworks from the ground up — a stark contrast to the top-down approach of traditional hierarchies.

Decentralized autonomous organizations (DAOs) are already experimenting with decentralized governance and smart contracts, aiming to operate without centralized control. While few have scaled successfully, the potential for a bottom-up digital society is rapidly evolving, with blockchain technologies like Linea playing a central role.

This article was originally published as ConsenSys CEO Reveals SWIFT is Leveraging Linea for Payments on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Pi Network News: Major Development Announced as Project Enters New Phase

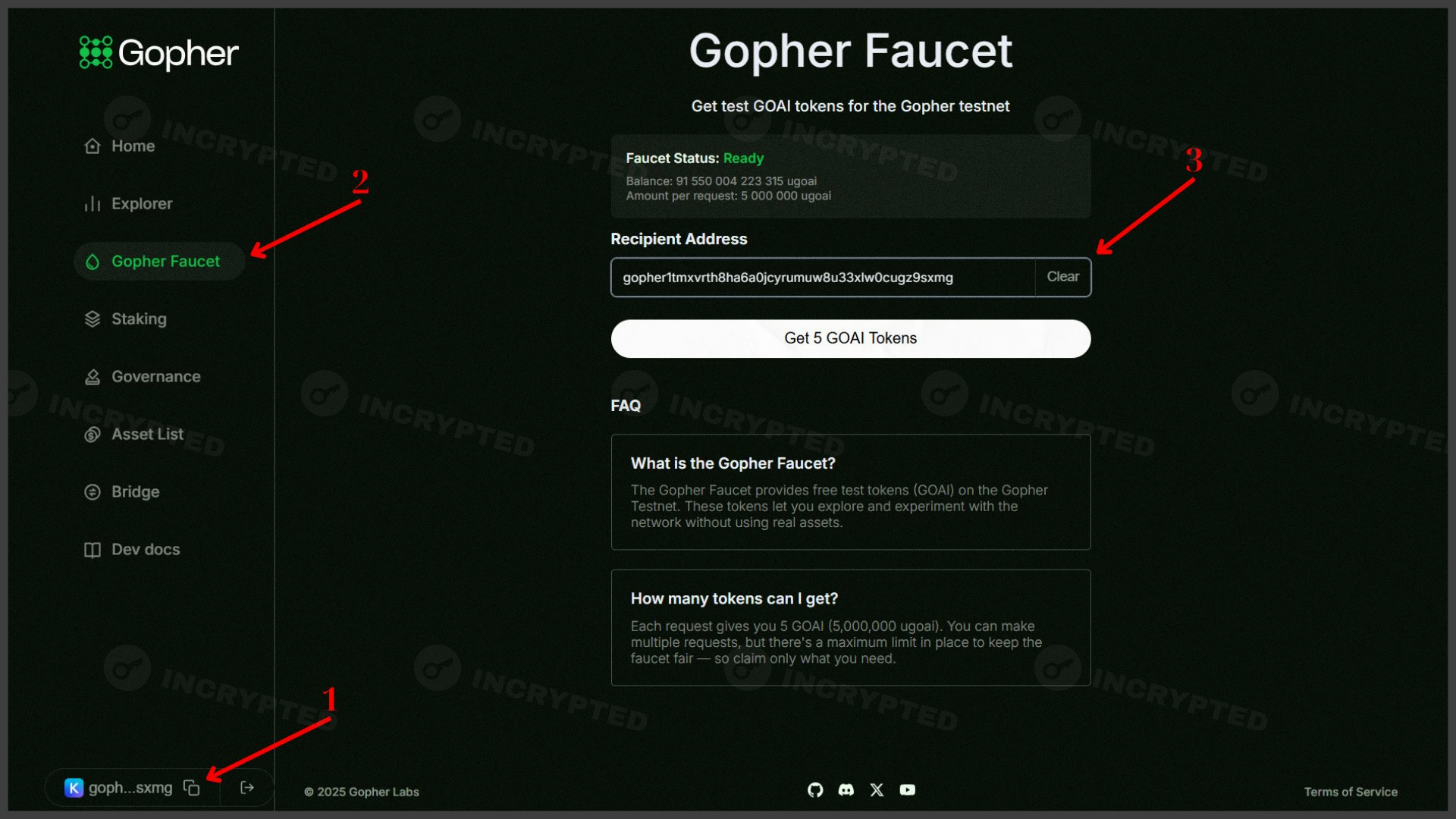

Gopher — active participation in the testnet with the aim of airdrop