Crypto Market in Trouble as U.S. Government Shutdown Fears, $1.65B Liquidations, and Fed Rate Uncertainty

The crypto market has been experiencing a significant downturn since mid-September. Prominent cryptocurrencies, including Bitcoin, Ethereum, DOGE, etc, are all in downward momentum and trading at their lowest market value. According to the recent analysis, there are multiple factors, including a potential U.S. government shutdown, acting as primary catalysts of this unprecedented turmoil.

The current U.S government shutdown fears arise from the political dispute between Republicans and Democrats over spending priorities, and healthcare subsidies arise from the threats of permanent job cuts and broader economic concerns. The economic environment in the United States has already been vulnerable due to the recent tariffs and layoffs implemented by the authorities, and the ongoing crypto market turmoil further pushes the U.S. economy and will creating a risky environment for American businesses and consumers.

Bitcoin, the most valuable digital currency in the world, has been significantly volatile over the past two to three weeks. The token was trading between $108,700 and $113,700 in intraday activity. The latest market analytics suggest that the token is 1% down today with a daily trading volume of $53.16 billion. Ethereum, on the other hand, is slowly regaining the market momentum and is trading at 1.58% higher than yesterday’s price. Even though the top cryptocurrencies are slowly regaining momentum, the total output of the market is still bizarre and could be even worse once the fears of a possible U.S. government shutdown on October 1 and macroeconomic developments intensify.

How does the Government Shutdown Fears Impact the Crypto Market?

A Federal government shutdown will be possible once Congress and the White House fail to agree on a funding plan by September 30. This will make a huge impact on the whole United States, including its financial and economic sectors. As per the crypto expert analysis, the investors are worried about the possible government shutdown because they believe that it will disrupt the regulatory guidance and reduce institutional confidence in cryptocurrencies.

Political instability has always affected the cryptocurrency market; it generally induces selling pressure and price decline. The increased caution related to the political instability will create a downward trend in the crypto market, and the examples of prominent cryptocurrencies like BTC, ETH, and DOGE experiencing significant price drops are also incidents that coincide with government shutdown fears.

The $1.65 Billion Liquidations and Fed Rate Uncertainty are also Fueling Factors!

The recent market downturn has caused enough damage to the whole cryptocurrency sector. This trend triggered the forced closure of $1.65 billion in leveraged long crypto positions and fueled the price drops of major cryptocurrencies, including Bitcoin, Ethereum, and DOGE.

Baba Crypto, one of the prominent crypto educators, tweeted on X that nearly $1 billion in crypto positions had been liquidated within 24 hours as Bitcoin’s decline had sparked a massive long squeeze. According to CoinGlass, over $967 million worth of contracts had been wiped out, with long traders accounting for almost 88% of the total. He noted that Ethereum had led the liquidations with $309 million, followed by Bitcoin at $246 million. He also added that this marked the second major long squeeze of the week after Bitcoin’s earlier plunge to $112,000. He said that analysts stated these wipeouts could reset leverage in the market, but volatility remained high.

The Fed rate uncertainty is a prime factor for this downturn in the crypto market. Some crypto analysts attributed the crypto market’s 1.95% drop in 24 hours and 8.5% decline in 7 days to Fed rate cut uncertainty. Amid the 25-basis-point rate cut by the Fed, crypto markets remained significantly volatile, and the experts believe that this could be due to the unclear forward guidance and mixed asset flows. The uncertain economic outlook and continuing regulatory scrutiny, aligned with the Fed rate cut, could be other factors for the crypto market’s unprecedented turmoil.

88EX, one of the leading digital asset service platforms, claimed that in the past 24 hours, the crypto market had dropped 3.1%, extending its 7-day cumulative decline to 8.3%. Key reasons included macroeconomic uncertainty, as Fed Chair Jerome Powell had issued mixed signals after the rate cut, triggering $1.7 billion in liquidations. There had been a leverage pullback, as derivatives traders increased bearish bets, with open interest surging 10.88%. The Fear & Greed Index had plunged from a neutral 41 the previous day to 32, reflecting growing market panic.

The post Crypto Market in Trouble as U.S. Government Shutdown Fears, $1.65B Liquidations, and Fed Rate Uncertainty appeared first on BiteMyCoin.

You May Also Like

Pi Network News: Major Development Announced as Project Enters New Phase

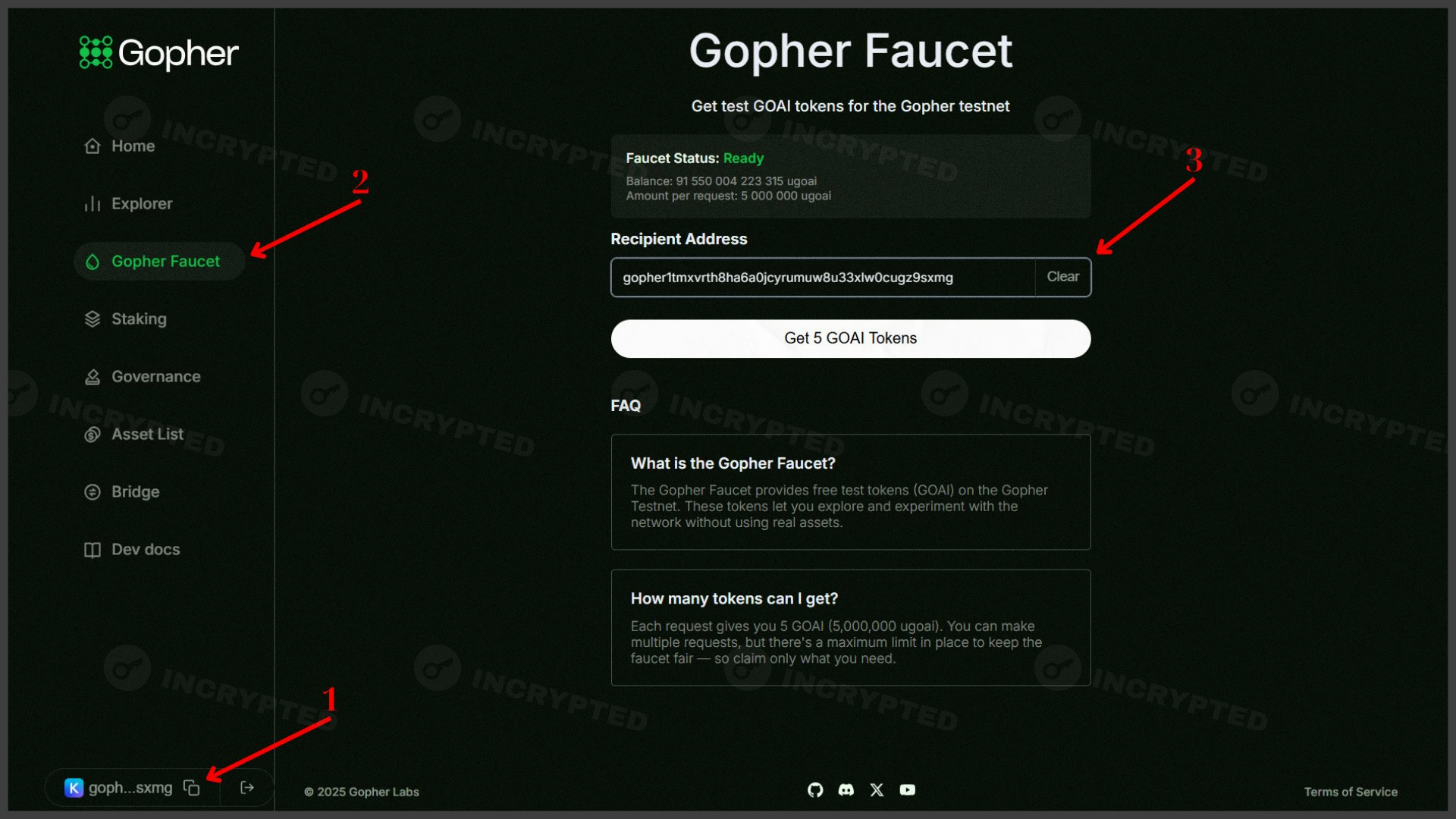

Gopher — active participation in the testnet with the aim of airdrop