Cryptocurrency Market Faces Turbulence Before Fed Rate Decision

2025/09/15 16:27

The cryptocurrency market faces selling pressure before the upcoming Fed rate decision. Significant losses are anticipated for major altcoins like XRP, SOL, and DOGE.

Continue Reading:Cryptocurrency Market Faces Turbulence Before Fed Rate Decision

The post Cryptocurrency Market Faces Turbulence Before Fed Rate Decision appeared first on COINTURK NEWS.

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact [email protected] for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

Share Insights

You May Also Like

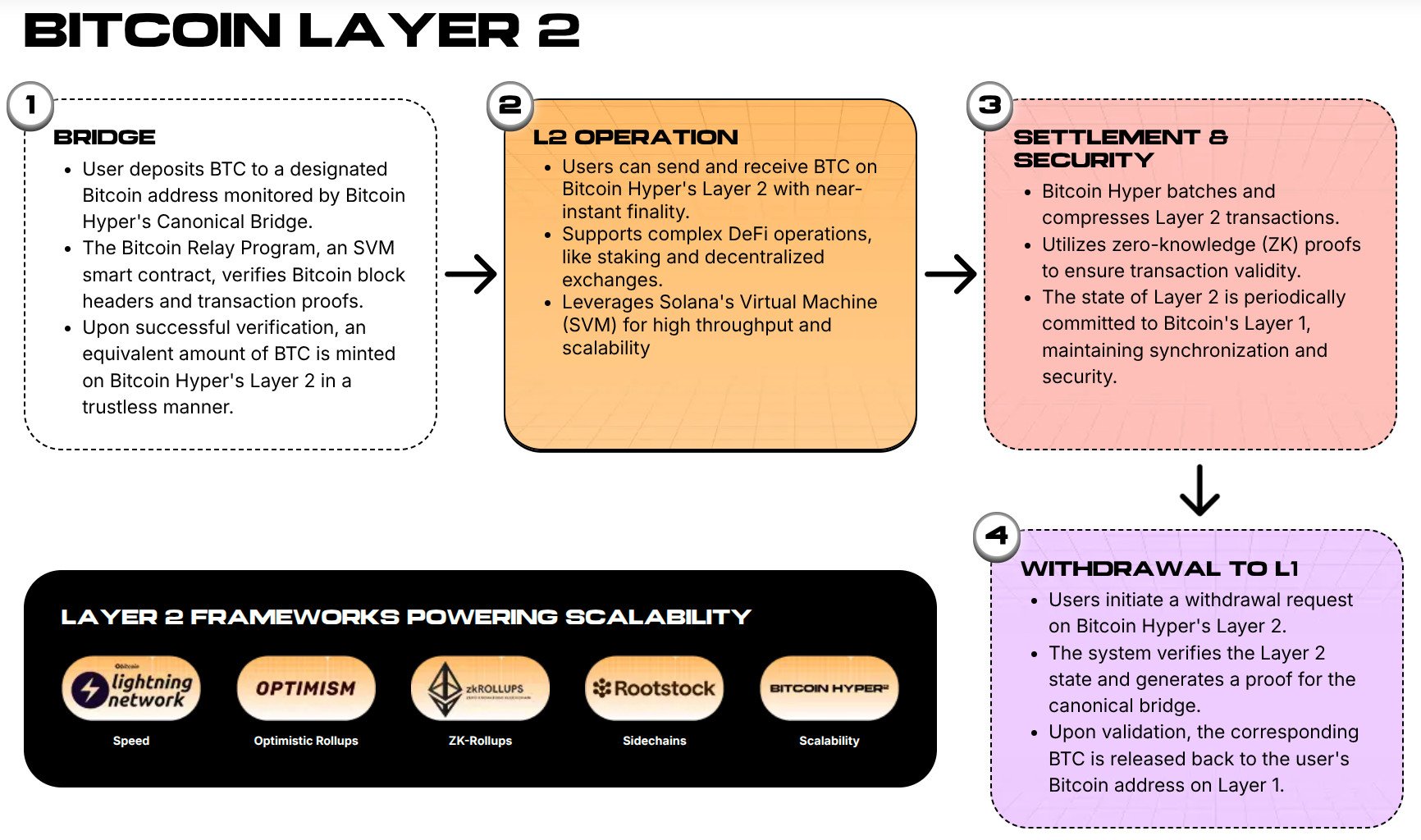

Bitcoin Hyper Presale Hits $16M As Whales Buy $64K, Is This the Next Crypto to Explode?

Bitcoin is slow and expensive, especially at peak times.

Share

Brave Newcoin2025/09/15 18:42

Share

Recession Cancelled? Experts Weigh In

The post Recession Cancelled? Experts Weigh In appeared on BitcoinEthereumNews.com. Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead. Grab a coffee because the debate over the economy’s future is not going away. From warnings of a downturn to bold calls that the recession has been cancelled, the clash of views shapes how investors look at everything from equities to Bitcoin (BTC) and the technologies driving the next cycle. Recession Cancelled? Why Wall Street Is Divided on Bitcoin, AI, and Market Cycles Sponsored Sponsored The US recession drumbeat refuses to fade, but markets are increasingly tuning it out. On one side, Moody’s Analytics Chief Economist Mark Zandi maintains a 48% probability that the US economy will tip into recession within the next 12 months. His outlook suggests lingering fragility despite resilient growth data. Zandi’s warning echoes recent consumer and labor market data showing mixed signals. Retail sales remain strong, jobless claims have ticked higher, and inflation’s path remains uncertain. “Investors who think the recession risk has gone away are mistaken,” Zandi cautioned. The analyst notes that shocks in energy markets or tighter credit conditions could quickly upend growth. On the other hand, Global Macro Investor’s Julien Bittel Visser insists the “recession is cancelled.” In a recent conversation with Anthony Pompliano, he dismissed traditional macro fears. The investor highlighted how narratives of contraction are being replaced by enthusiasm around technology and digital assets. “The only thing that matters now is AI and crypto…Everything else is just noise,” Visser said. Sponsored Sponsored Visser argues that equity markets and Bitcoin are primed for a melt-up as capital reallocates toward the only two trades that matter: artificial intelligence (AI) and crypto. He pointed to fresh technical breakouts across Ethereum, Dogecoin, and Sui as evidence of broadening market participation beyond Bitcoin. He added…

Share

BitcoinEthereumNews2025/09/15 17:53

Share

Nemo Protocol to issue debt token to compensate $2.6m hack victims

Nemo Protocol, the Sui-based DeFi platform recently exploited for $2.6 million, has announced a compensation program that will reimburse affected users. As part of ongoing efforts to reimburse victims, the Nemo protocol team has unveiled a three-step recovery path. The…

Share

Crypto.news2025/09/15 18:36

Share