Ethereum and Solana: Are Institutions Driving the Next Rally?

The post Ethereum and Solana: Are Institutions Driving the Next Rally? appeared first on Coinpedia Fintech News

Citi’s $4,300 ETH forecast and Solana’s $300M treasury pivot highlight big-money moves pushing both tokens into blue-chip status.

Ethereum and Solana have kicked September into gear with headlines that signal institutional strength. Citi raised its ETH target, a $300M treasury pivot put Solana into mainstream finance, and analysts highlighted both as “blue chips” of the digital asset space. But while big caps offer stability, presales like MAGAX are catching retail attention because the outsized gains usually come before assets mature.

The MAGAX presale is live—secure tokens today before the next price jump.

Citi’s $4,300 Ether Target Shows Wall Street Confidence

ETH is being positioned as a yield-bearing institutional asset.

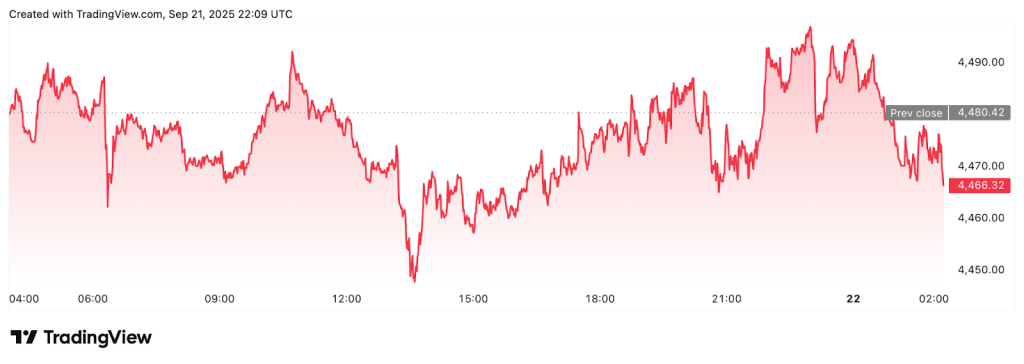

Citi Research issued a forecast on Sept 16 setting a $4,300 year-end target for Ethereum, with a bull-case projection of $6,400. The bank cited staking yields, tokenization, and ETF inflows as the drivers pushing ETH toward long-term credibility in portfolio allocation.

Fundstrat’s Mark Newton also highlighted ETH’s near-term potential, calling dips into the $4,400–$4,375 area buy opportunities and projecting a surge to $5,500 by mid-October.

A $300M Corporate Pivot Puts Solana on Treasury Playbooks

Institutional adoption of SOL is accelerating in 2025.

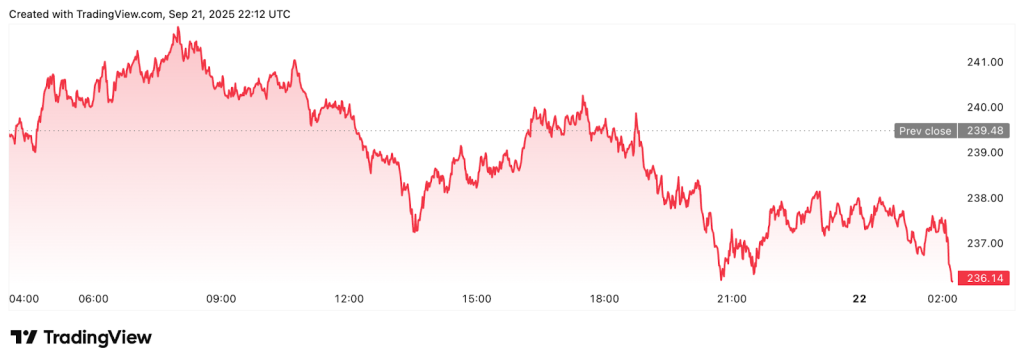

Brera Holdings announced a $300 million private placement led by ARK Invest and UAE’s Pulsar Group, rebranding as Solmate and shifting strategy to accumulate and stake Solana. The stock spiked over 200% intraday before retracing, showing how corporate Solana plays can now move markets far beyond crypto exchanges.

Upgrades and Derivatives Add Fuel to SOL’s Momentum

Network improvements and trader positioning are reinforcing growth.

On Sept 2, Solana’s community voted with 98% approval to pass the Alpenglow upgrade, aimed at strengthening scalability and performance. Analysts say this type of network progress is a signal institutions look for before deploying serious capital.

On the market side, Solana futures open interest hit highs this month, with CME OI at 8.12M SOL on Sept 12 before easing slightly. Even after the pullback, derivatives traders are pricing in volatility and paying premiums above 15% annualized, pointing to continued appetite.

ETH and SOL are blue chips now—MAGAX is still early.

Retail vs. Institutional: Where the Big Gains Really Are

Wall Street seeks steady yield, but retail still hunts for 10x plays.

While institutional flows into ETH and SOL add credibility to the market, they also change the game. Once tokens reach “blue chip” status, they attract ETFs, pension funds, and balance sheet allocations — which in turn dampen volatility and compress ROI. That’s great for risk-adjusted returns, but less exciting for retail investors who remember what it was like to turn $500 into life-changing gains during the DOGE or SHIB runs.

Presales remain the hunting ground for those asymmetric bets. By design, they offer lower entry points, capped allocations, and community-driven momentum before institutions can step in. MAGAX, for instance, has tied presale mechanics to viral culture through its Meme-to-Earn model, ensuring that those who create the hype also share in the upside. This “early-stage advantage” is why retail investors continue to pour into presales even while institutional capital focuses on ETH and SOL.

If ETH and SOL represent the new financial mainstream, presales like MAGAX are where the next breakout stories are being written.

Why Presales Like MAGAX Matter in a Blue-Chip Market

Retail investors chase the asymmetry institutions no longer get.

ETH and SOL’s “blue-chip” status is good news for market stability but caps explosive upside. For retail, the opportunity lies in presales like MAGAX, a project that blends meme virality with AI-powered fairness. By filtering bots and rewarding real creators, MAGAX aims to turn cultural momentum into measurable incentives. Its stage-based presale creates scarcity and urgency, echoing the mechanics that drove early hype cycles minus the manipulation.

The Takeaway: Institutions Build Credibility, Presales Drive Upside

Big money is crowding into ETH and SOL—retail is looking at MAGAX.

Ethereum and Solana now carry liquidity, research coverage, and corporate adoption. For investors seeking stability, they’re logical picks. For those seeking multi-X potential, however, MAGAX offers the chance to capture exponential growth before the crowd arrives.

Explore the MAGAX presale now before the next stage sells out.

You May Also Like

Sonic Holders Accumulate Millions as Price Tests Key Levels

Coinbase Custody Set to Grow with Proposed OCC Charter