Ethereum Targets 4.6K Breakout After Testing Major Liquidity Clusters Near 4K

Ethereum retests key $4K liquidity levels and eyes $4.6K breakout as analysts see potential for new highs in Q4.

Ethereum has regained strength in early October, with price action drawing attention to key resistance levels. After recovering from late September lows, Ethereum is moving closer to the $4,500 zone. Analysts suggest that Ethereum’s next breakout attempt could be decided around this area, with traders closely watching liquidity levels that were previously tested near $4,000.

Ethereum Liquidity Clusters and Key Resistance Levels

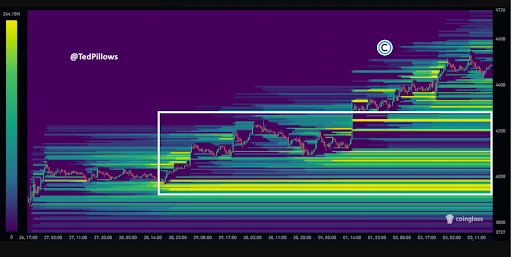

Market analyst Ted Pillows noted that Ethereum had built liquidity clusters around $4,000 to $4,200. These areas became critical after ETH dropped below $3,900 during the September correction. He added that on the upside, liquidity rests between $4,600 and $4,700, which may act as the next target for buyers.

Ethereum Liquidity Clusters| Source: TedPillows/X

Ethereum Liquidity Clusters| Source: TedPillows/X

Ethereum’s recovery above $4,200 suggests that earlier liquidity sweeps have cleared weaker positions. Analysts argue that the $4,500 to $4,700 range now represents an important decision point. If ETH secures a close above this zone, it could create conditions for a larger rally. Conversely, failure to do so may bring renewed pressure toward the mid-$4,000 region.

Recent market data also show that ETH’s open interest has only grown modestly compared to price action. This indicates that the latest move is not heavily driven by leverage. Analysts believe this could limit risk in the near term while still leaving room for additional futures participation should momentum continue.

Ethereum Technical Patterns Pointing to Breakout

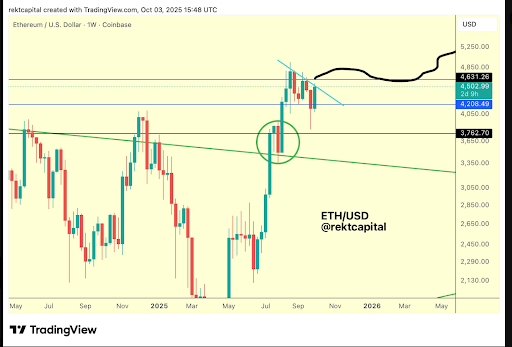

Analyst Rekt Capital shared that Ethereum must break a weekly lower high trendline and then close above $4,600. According to him, such a move, followed by a retest, would set Ethereum for a possible breakout to new highs. He also noted that Ethereum is attempting to move out of a monthly bull flag pattern, a structure often associated with continuation of upward trends.

ETH/USD | Source: Rektcapital/X

ETH/USD | Source: Rektcapital/X

Other analysts have pointed to the “Power of 3” trading setup, also known as the accumulation-manipulation-distribution model. This formation previously supported a strong rally in 2021. The recent drop below $4,000 is viewed by some as part of this setup, clearing liquidity before a larger move. Market participants believe the retest of $4,100 to $4,200 has strengthened this outlook.

Technical indicators such as moving averages have also aligned with resistance levels near $4,500. Analysts agree that a daily or weekly close above this area will be critical. Without this confirmation, Ethereum may face another retracement to its mid-range supports.

Outlook Toward Potential Price Targets

Ethereum is trading near $4,460, advancing about 13% over the past week. Market analysts eye possible continuation if $4,500 is cleared. Projections range from $5,500 to $6,900 depending on breakout confirmation. The higher target comes from the bull flag pattern described by analyst Titan of Crypto, who stated that a breakout from this formation could lead ETH toward $6,900.

Moreover, Cas Abbe suggests that Ethereum may retest the $4,100 to $4,200 level before aiming higher. He pointed to Fibonacci extensions indicating possible targets near $5,994 and $6,200 if support levels hold. Other traders, including CW, highlighted that Ethereum is close to its prior all-time high near $4,800, suggesting that any breakout could place it in new territory.

Institutional demand and steady spot buying continue to support the current rally. However, analysts also warn that failure to maintain $4,200 to $4,400 as support could bring Ethereum back toward $3,800. For now, the market’s focus remains on whether Ethereum can confirm strength above $4,500 and advance toward the next liquidity cluster near $4,700.

The post Ethereum Targets 4.6K Breakout After Testing Major Liquidity Clusters Near 4K appeared first on Live Bitcoin News.

You May Also Like

Wormhole launches reserve tying protocol revenue to token

Nate Geraci: More than 30 cryptocurrency ETFs submitted applications to the US SEC yesterday