Ethereum to Repeat Bitcoin’s 100x Supercycle, Tom Lee Predicts

Key Highlights:

- Tom Lee predicts Ethereum’s explosive growth, matching Bitcoin’s 100x supercycle.

- Despite recent dips, ETH accumulation by long-term holders signals confidence.

- Historical price drops like $2,900 offer major buying opportunities for ETH.

Ethereum will grow 100-fold — that’s the bold prediction made by Tom Lee, CEO of BitMine, a company that manages the world’s leading altcoin reserves. He believes the second-largest cryptocurrency by market capitalization is on the verge of the same supercycle that took Bitcoin to dizzying heights in recent years.

On November 16, Lee reminded the public that he first recommended Bitcoin to clients of his research company Fundstrat back in 2017, when the price of the leading cryptocurrency was around $1,000. Over the years, Bitcoin experienced painful declines of up to 75%, but ultimately demonstrated fantastic results.

“To have gained from that 100x Supercycle, one had to stomach existential moments to HODL,” the analyst noted. “We believe $ETH is embarking on that same Supercycle.”

A lag that could turn into a breakthrough

Indeed, at the beginning of 2025, Ethereum was noticeably lagging behind Bitcoin, which was hitting new all-time highs one after another. While ETH peaked at $4,946 in August, Bitcoin continued to soar, reaching over $126,000 in October.

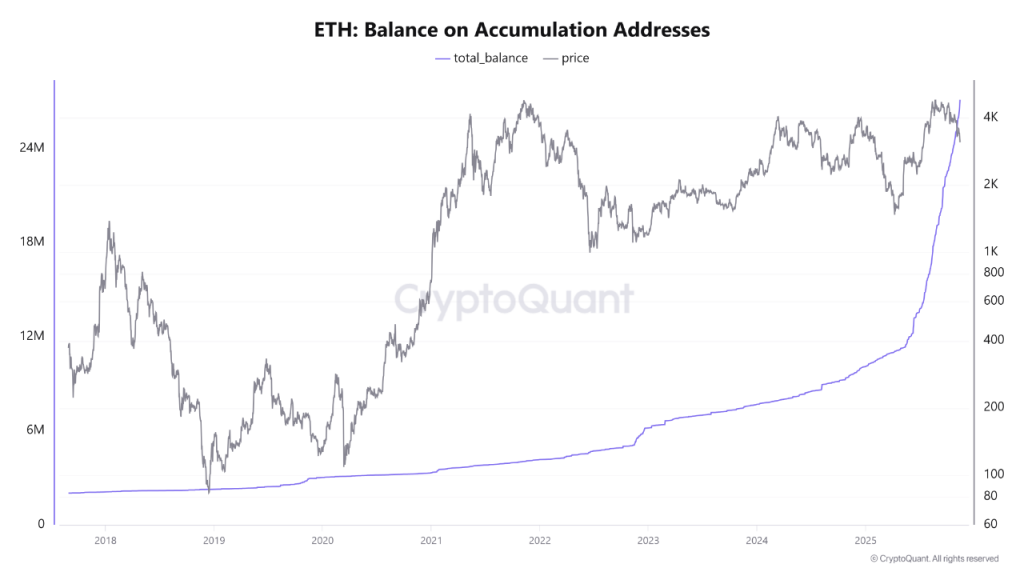

ETH balance on accumulation addresses. Source: CryptoQuant

ETH balance on accumulation addresses. Source: CryptoQuant

Today’s picture looks less rosy: Bitcoin has lost 25% of its peak value, and Ethereum has fallen 35% from its high. Lee noted that such volatility is driven by doubts and “does not reflect the true potential.”

Long-term holders are accumulating Ethereum

Interesting statistics were provided by CryptoQuant analyst Burak Kesmeci: at its current price of around $2,950, Ethereum is just $200 above the average purchase price of long-term holders — those who are “patiently accumulating positions.”

Realized price for accumulation addresses. Source: CryptoQuant

Realized price for accumulation addresses. Source: CryptoQuant

ETH has only fallen below this level once in its history — in April, when President Trump’s global tariffs took effect. According to Kesmeci, approximately 17 million ETH have been received by long-term holders this year, and the total balance of these wallets has grown from 10 million to 27 million ETH.

If ETH falls below $2,900, it is unlikely to stay there for long. Historically, this price has represented “one of the best opportunities for long-term accumulation.”

You May Also Like

Bitcoin mining company Bitfury launches $1 billion investment plan, focusing on companies in AI, quantum computing, and other fields.

BounceBit plans to use platform fees for BB repurchase