Ex PayPal, David Knox CFO of Hyperion DeFi: crypto treasury breakthrough

The race of companies to bring tokens onto their balance sheets takes a leap forward. Hyperion DeFi hires former PayPal head of capital markets, David Knox, as chief financial officer.

The appointment, announced on September 29, 2025, by Bloomberg, marks a more mature phase of corporate crypto treasury, in line with the evolution of the financial function in companies more exposed to digital.

According to data collected by our research desk and conversations with CFOs of digital-first companies, in the period 2023–2025, requests for revisions of treasury policies with exposure to crypto have grown significantly, with an increasing focus on custody, limits, and controls.

Industry analysts observe an increase in formal due diligence and reporting procedures for wallets and service providers.

In the companies we have collaborated with, the adoption of structured governance rules has accelerated the dialogue with external auditors and the board of directors.

Nomination and Context

According to a report by Bloomberg authored by Olga Kharif, Knox has left PayPal Holdings Inc. to lead the finance of Hyperion DeFi, a company focused on managing digital assets held in treasury.

It should be noted that the company is known for accumulating tokens – including the native asset of the Hyperliquid platform – integrating them into its balance sheet in anticipation of a appreciation over time.

The move accentuates an already ongoing trend in the corporate sector, shifting from sporadic experiments to more structured governance, with senior profiles responsible for risk management, accounting, and transparency.

In this context, the entry of a CFO from the capital markets suggests more codified processes and responsibilities.

Why It Matters for Balance Sheets

The crypto treasury transforms a portion of liquidity into potentially profitable but more volatile tokens compared to cash. This results in impacts on liquidity, risk management, reporting, and relationships with auditors and regulators.

According to the IFRS Interpretations Committee, cryptocurrencies are generally treated as intangible assets (IAS 38), except in specific cases – for example, when held as inventory for those engaged in trading.

In the US GAAP context, starting in 2025, many companies will apply the new FASB standard ASU 2023‑08, which requires fair value measurement with recognition of changes in the income statement, improving transparency but also making earnings more sensitive to market volatility.

That said, for investors, reading the results will require greater attention to the market component compared to the core business alone.

Operational Impact: Risks, Measures, Governance

With the arrival of Knox, a strengthening of policies, processes, and internal controls is expected. In practice, the operational framework tends to converge towards institutional standards, with greater discipline on limits and responsibilities.

- Objectives: preserve liquidity, generate yield, and enable operational uses (collateral, payments, incentives).

- Risks: price volatility, token liquidity, counterparty risks, cyber, custodial, and those related to an evolving regulatory framework.

- Measures: definition of exposure limits for assets and issuers, hedging strategies on critical horizons, wallet segregation, on-chain auditing, and emergency plans for conversion into fiat.

Market Trends and Comparisons

The Hyperion case fits into the trend of treasuries integrating crypto alongside traditional assets. Indeed, well-known examples include MicroStrategy, which has integrated its Bitcoin strategy into the company’s positioning (company documentation).

In the European Union, the entry into force of the MiCA regulation, fully applicable starting in 2024, is raising standards for service providers on crypto-assets, with indirect impacts on custody, exchanges, and transparency for corporate users.

In this context, treasury choices are also evaluated in light of regulatory compliance. To delve deeper into the current MiCA regulation and the associated challenges, you can read our detailed analysis on MiCA Crypto Alliance.

How to Set Up a Crypto Treasury

Policy and custody: from perimeter to controls

- Mandate approved by the Board of Directors: definition of objectives, permitted instruments, time horizons, and limits related to volatility and drawdown.

- Custody with segregation: implementation of institutional solutions, multi-sig, key management procedures, and recovery testing. See also our practical guide on custody.

- Reconciliation processes: address whitelisting, four-eye checks, incident logging, and periodic audits.

Accounting and Disclosure: IFRS vs US GAAP

- IFRS: cryptocurrencies are typically classified as intangible assets (IAS 38) with potential impairment tests; if held for sale, they are accounted for as inventories. A supplementary note is required to disclose the risks and the valuation methods used.

- US GAAP: the ASU 2023‑08 standard introduces fair value measurement and more detailed disclosures on asset categories, risks, and the sensitivity of earnings.

- Reporting: companies must provide tables of movements (purchases, sales, impairment/gains), pricing criteria, and internal control mechanisms.

Metrics to Monitor

- Ex-ante: Value-at-Risk, stress test on price and liquidity shock, and analysis of correlations with the core business.

- Ex‑post: Recording of results (realized/unrealized P&L), costs related to slippage, custody expenses, and tracking error compared to benchmarks.

- Compliance: verification of suppliers’ licenses, insurance coverage, and adherence to MiCA/AML and sanction policies.

What changes with Knox in Hyperion

Knox’s profile brings a wealth of experience in capital markets, risk structuring, and dialogue with investors and auditors, indicating a process of financial function institutionalization.

This results in greater rigor on exposure limits, improved transparency in fair value determination, and an integrated approach to managing liquidity, volatility, and tax implications.

Furthermore, the presence of a CFO with a deep fintech background could facilitate the development of strategic partnerships with custodians, market maker, and specialized insurers, helping to reduce the cost of operational risk.

Indeed, the dialogue with qualified counterparts tends to benefit from more solid and predictable internal structures. For more insights into the role of crypto market maker in today’s system, we refer to our specific analysis.

Open Questions and Controversial Angles

- To what extent is the admitted volatility in the balance sheet compatible with the debt covenants?

- Which tokens pass an institutional due diligence on liquidity, on-chain governance, and legal risks?

- Does measuring at fair value make earnings too pro-cyclical? Could it be useful to develop an “underlying performance” metric not influenced by price fluctuations?

- How to balance security on-chain with daily operations, avoiding an excessive increase in risks related to signatures and transfers?

You May Also Like

Pi Network News: Major Development Announced as Project Enters New Phase

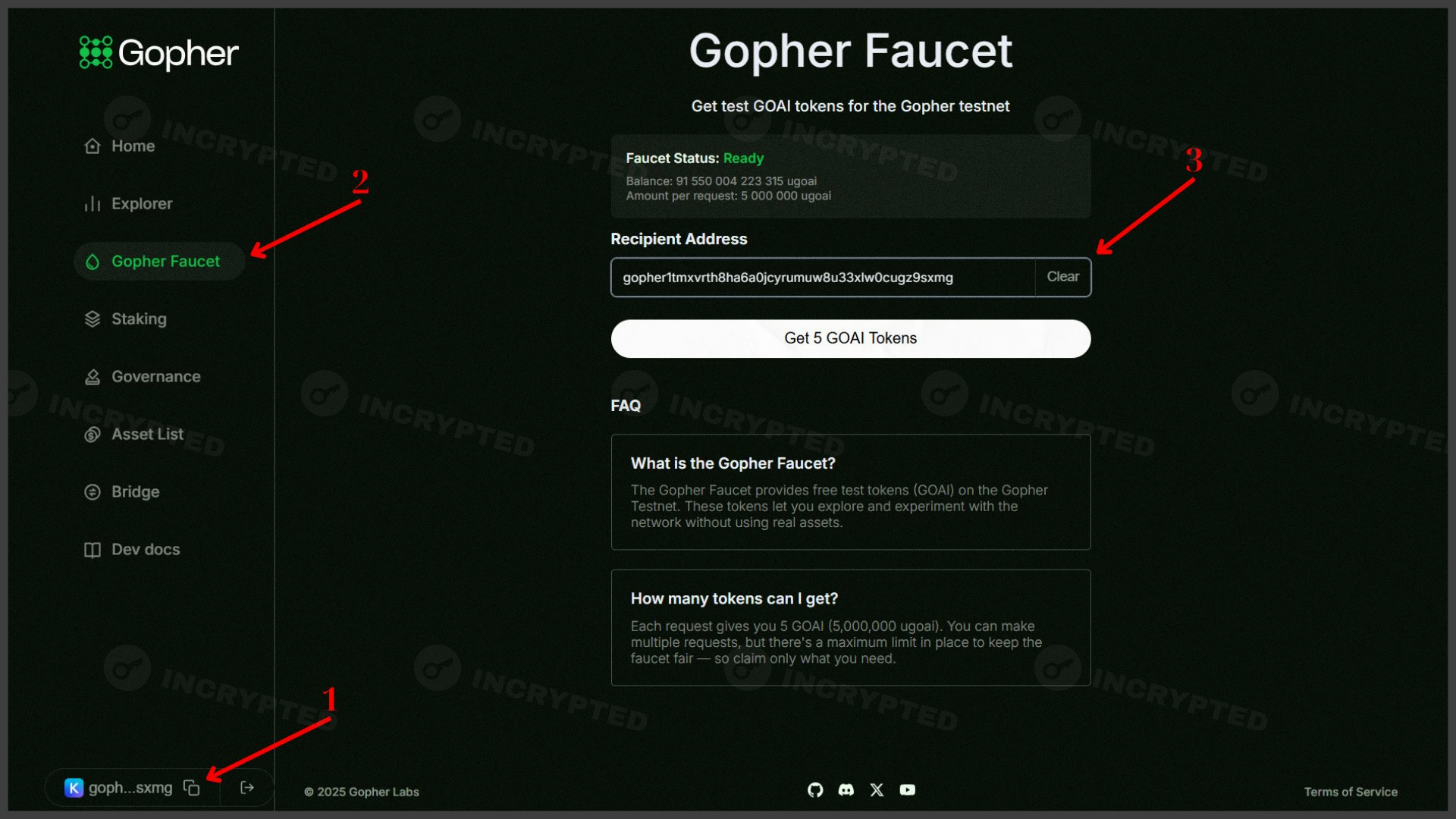

Gopher — active participation in the testnet with the aim of airdrop