How did "Penguin Chain" Abstract achieve over 1.3 million users and over 50 million transaction volume in just three months?

By Stacy Muur

Compiled by: Tim, PANews

In a field full of infrastructure-first blockchains, Abstract made a strong debut on January 27, 2025, with a bold adjustment to its core strategy: it will focus on end-user rather than developer testnets first, aiming to promote the real large-scale implementation of applications.

Overview

- Start date: January 27, 2025

- Development history: Abstract is the first consumer-oriented Layer 2 scaling solution in the Ethereum ecosystem, developed by the Igloo team that created the well-known NFT series "Pudgy Penguins".

- Core Value Proposition: Designed for mass adoption, Abstract eliminates key barriers such as wallets, mnemonics, and gas fees

- Application areas: games, social networking, NFT and prediction markets

- Technical architecture: built on zkSync ZK Stack

Data as of April 22, 2025:

- 1.31 million+ independent wallets

- Total transaction volume exceeded 51.3 million

- The number of contracts created reached 2.26 million

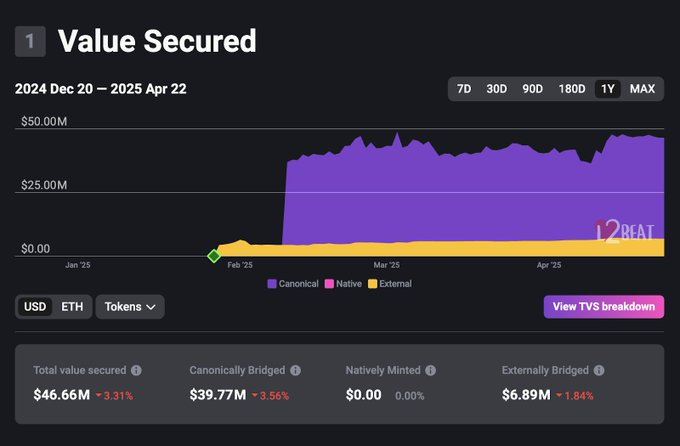

- Total guaranteed value (TVS): US$46.66 million

- DeFi TVL: $16.86 million

- Average daily trading volume: 500,000 to 700,000

- Daily active wallets: 50,000 to 100,000

User Experience Revolution: Real Consumer Chain Practice

Unlike most L2 models that first launch development tools and wait for the ecosystem to develop, Abstract reconstructs the user's full life cycle experience:

- Registration process: Built-in smart contract wallet (AGW), no need to rely on external tools such as MetaMask

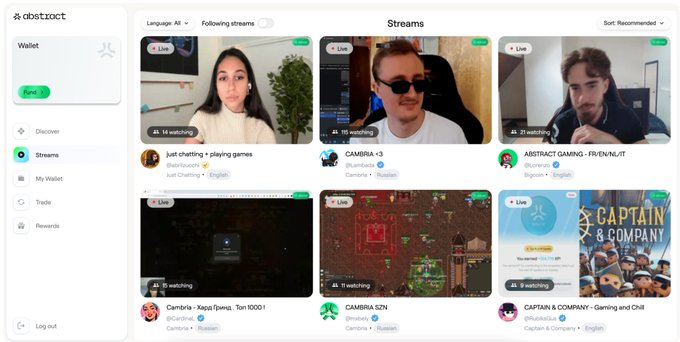

- Discovery mechanism: Through the embedded consumer portal aggregation application, integrated live viewing and XP task system, to achieve closed-loop interaction within the site

- Retention system: a combination of streaming content + dynamic tasks + incentive mechanism

The “Pudgy Effect”: IP-driven large-scale distribution

Abstract’s onboarding process is not designed around incentives or airdrops, but rather around native IP distribution and real-world consumer traffic channels.

Pudgy’s consumer IP and product distribution system are the core strategies for Abstract to achieve autonomous user growth before launching any tokens:

- Sequencer Release: The first node accurately matched the Pudgy Penguins marketing cycle, and achieved more than 700,000 transactions on the first day

- On-chain reward system: Bind to Pudgy offline experience rights, NFT holders can enjoy bonus rewards

- Native application matrix: Pudgy World, Pudgy Party and other core DApps are launched simultaneously

- Virtual-real linkage innovation: physical toys come with QR codes that lead directly to the on-chain world, realizing the transformation of consumer goods to on-chain users

- Channel leverage effect: Pudgy IP has over 1 million toy sales, $10 million in revenue, and 1.7 million Instagram followers

- Optimize customer acquisition costs: Rely on IP assets to achieve low-cost cold start and quickly form network effects

App Usage: Where do users spend their time?

Unlike most emerging blockchains, whose usage is often concentrated in a single field such as cross-chain bridging, token exchange or test decentralized applications, Abstract Blockchain has demonstrated a broad and multi-level application ecosystem vitality, with application scenarios covering digital wallets, application frameworks, gaming and entertainment, transaction services and social networks.

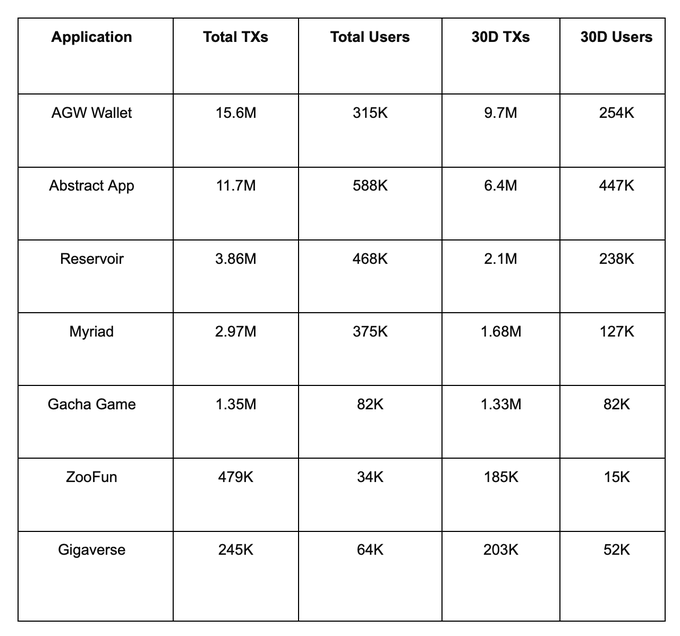

Top 7 apps

The wallet and core interface have driven over 27 million transactions and 700,000 users with infrastructure alone. In addition to infrastructure, applications such as Gachapon, Myriad, and Reservoir also continue to show user return behavior.

On-chain activity: insights from the data

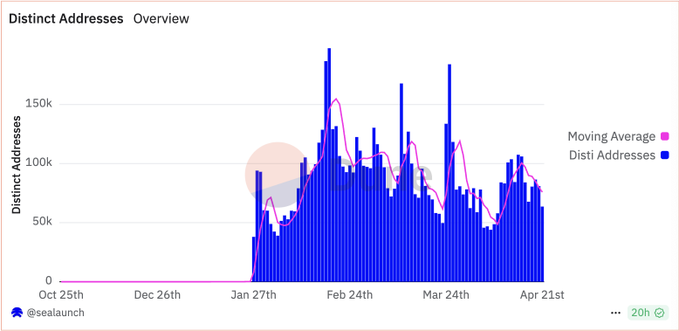

- Number of active wallets: peaked at over 150,000 per day in February, then gradually stabilized, remaining between 50,000 and 100,000

- Engagement drivers: The surge in activity is closely related to application releases, community activities, and on-chain incentives.

- Retention signal: A brief dip in March followed by a rebound - this suggests that users are truly sticky, rather than just engaging in utilitarian behavior.

Total Locked Value (TVL) Trend Analysis

Currently, the locked amount of the Abstract protocol has reached 46.66 million US dollars. Since the rapid growth at the beginning of its launch, TVS has always remained above 45 million US dollars, and a significant growth peak appeared in early February. Although it experienced a slight decline in early April (about 3%), the scale of funds has rebounded rapidly, indicating that the protocol has a stable fund retention capacity and a low risk of short-term volatility.

Trading trend analysis

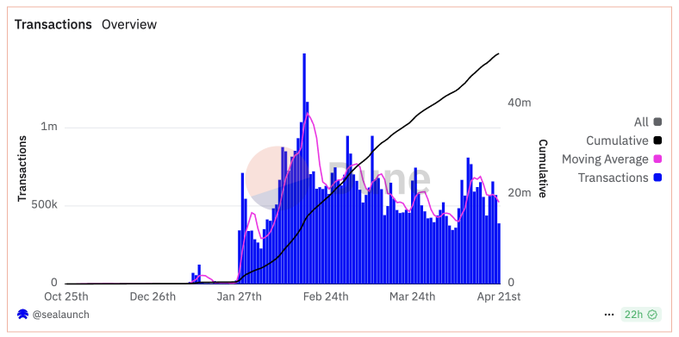

- Initial growth period: trading volume gradually increased after launch → peaked in February with an average daily trading volume of over one million

- Operational stability period: From March to April, the average daily transaction volume remained between 500,000 and 700,000

- Cumulative processing volume: The total transaction volume of the platform has exceeded 40 million and is showing a trend of continuous growth

Infrastructure Technology Stack

Abstract is a vertically integrated blockchain built for a consumer-grade user experience. Its infrastructure architecture combines zero-knowledge proof (ZK) scalability technology with embedded client tools.

Product stack overview:

Four-layer architecture:

1. Abstract ZK-rollup

2.Abstract Global Wallet

3. Panoramic Governance (PG)

4. Consumer Portal

Based on the framework of architecture design and performance, each level is deconstructed and analyzed.

AGW: No MetaMask required, no mnemonics, no pop-ups

AGW will be issued as a basic function by default to all Abstract platform users. The product replaces traditional browser plug-ins, external accounts (EOAs) and complex login interaction processes through a smart contract wallet layer native to the blockchain.

Application scale:

Cumulatively processed more than 15.6 million transactions

The total number of registered users reached 315,000, of which 254,000 were active users in the past 30 days

Core features:

- Quick registration with email/social account/passkey (using Privy)

- Gas-free transactions (via paymasters)

- Allow background silent execution of operations after session key authorization

- Support batch transaction submission, eliminating multi-step interactive processes

- Socialized account recovery mechanism based on the guardian module completely avoids the risk of losing traditional mnemonics

Consumer Portal

The Consumer Portal is the default user interface for all Abstract wallets. It integrates application discovery, asset exchange, streaming services, XP task system, and wallet management. It is the main entry point for users to use and retain applications.

Abstract App alone has processed more than 11.7 million transactions from 588,000 users, including 6.4 million transactions in the last 30 days, and has 447,000 active users.

Portal features:

- Discover apps through curated app marketplaces

- Live streaming center embedded directly in the application

- Experience points and task systems improve application activity

- Native support for token swaps and NFT minting

- One-stop integration of AGW wallet management, identity authentication and activity records

Panoramic Governance (PG)

PG is a value redistribution mechanism based on actual usage. The sorter fee + token release amount flows to:

- Active Users

- High flow applications

- Voters who participate in governance through staking and usage

Unlike most chains that adopt "passive governance" (weight is determined solely by the amount of coins held), PG requires participants to actually contribute to network activities in order to unlock benefits.

Developers can offer "vote bribes" to compete for token release based on voting weight (similar to the Aerodrome model), but the scale of the system is driven by activity rather than simply relying on the amount of coins held.

Encourage positive cycle:

- User: Benefit from use

- Application: Benefit from increased engagement

- Governance: Benefit from promoting ecological activity

This is a radical innovation of the traditional "lock + idle" token model.

Live streaming as a growth engine

Most blockchain projects treat live streaming and creator content as a marketing layer outside the protocol. Abstract embeds it directly into the on-chain protocol through the consumer portal, making live streaming a native component of user registration, ecosystem discovery, and user growth.

What makes the Abstract platform unique:

- The platform natively integrates live streaming capabilities similar to Twitch, rather than through external access.

- The anchor's income adopts an on-chain payment mechanism, and its distribution is mainly based on the following indicators:

- Views

- Promotion effect on applications within the Abstract ecosystem

- User subsequent behavior (recorded by AGW tracking system)

The platform will actively recommend popular video clips and live broadcast content, thereby building a complete traffic closed loop between creators, application developers and users.

The flywheel effect in action

Streamers showcase new applications on the Abstract platform;

Viewers log in through AGW (Abstract Gateway) and experience these applications instantly;

The increase in app usage has attracted more creators to join and promoted funding for developer-streamer collaboration projects;

Abstract promotes high-quality content clips to inject more potential users' attention traffic into the platform.

This closed loop internalizes the entire chain of content → usage → growth within the platform, rather than dispersing it across multiple platforms.

Conclusion: Abstract’s current position

Abstract has demonstrated what a user-centric blockchain infrastructure looks like in real-world applications:

- Wallet functions are built-in: not an external plug-in, but a deep integration

- Discovery and interaction are native: functions are native to the platform, not fragmented

- Content embedded ecosystem: content grows autonomously on the platform without relying on external channels such as Twitter

- Behavior incentive orientation: rewarding user behavior contributions rather than simply token holders

You May Also Like

Telegram Shuts Down Huione’s Largest Crypto Scam Market Ever, But Rivals Take Over with 400% Volume Surge

Block to issue $1.5 billion in senior bonds for corporate operations and strategic investments