JPMorgan Chase Experts Predict Bitcoin Will Rise to $170,000

- JPMorgan Chase believes that bitcoin can grow to $170,000 in the next 6-12 months.

- Experts called the asset undervalued relative to gold.

- Bitcoin absorbs more risk capital, therefore, its capitalization and price should be higher.

In the next 6-12 months, the bitcoin rate may reach the $170,000 mark. This follows from an analysis by experts at JPMorgan Chase, as cited by CoinDesk.

Senior analyst Nikolaos Panigirtzoglou and his team explained the correction on October 10-11 and November 4-5, 2025 by the “unhealthy background” of the derivatives market. Experts believe that the deleveraging phase in the sector is over and the open interest to capitalization ratio has returned to normal.

As in the previous analysis, the bank was guided by a model comparing bitcoin and gold. JPMorgan Chase experts believe that the first cryptocurrency absorbs 1.8 times more risk capital compared to the precious metal, therefore, the capitalization of the asset should be higher.

This implies a 60-70% increase in the indicator from the current value of $2 trillion. This level of capitalization, in turn, implies an increase in the price to $170,000, according to the organization.

Also experts pointed to the increase in the volatility of gold, which in the long term can make bitcoin a more attractive hedge asset.

Note that the Gold Volatility Index of the Cboe exchange is at a level of 20 points. This is low compared to the mid-October 2025 peak, but it is higher than the values recorded from May through September inclusive.

A 20-point annualized reading means that the gold price can rise or fall by that value. In mid-October, volatility jumped to 30 points and above as demand escalated amid the escalating trade war between the US and China.

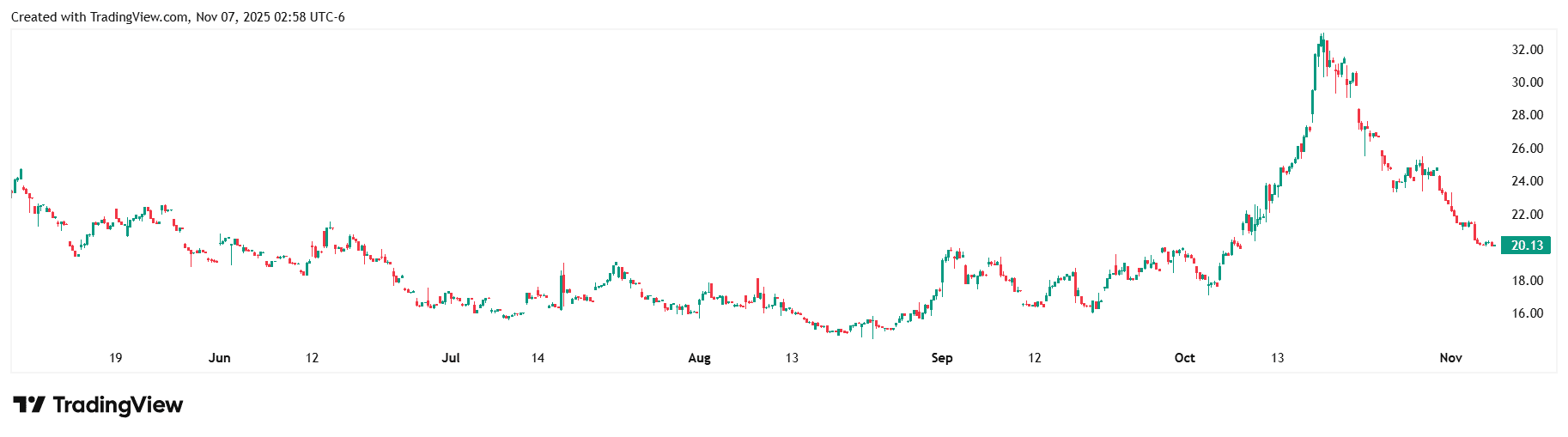

Change in the value of the Gold Volatility Index on the Cboe exchange. Source: TradingView.

Change in the value of the Gold Volatility Index on the Cboe exchange. Source: TradingView.

At the same time, the bank’s experts believe that the completion of the quantitative reduction (QT) program by the US Federal Reserve will hardly be reflected in the global markets due to the limited liquidity of banks.

You May Also Like

Kazakhstan's crypto asset fund aims to reach a scale of $500 million to $1 billion by seizing wallets.

Coinbase Issues Cryptocurrency Call to US Justice Department: “Solve Urgent Problems!”